-

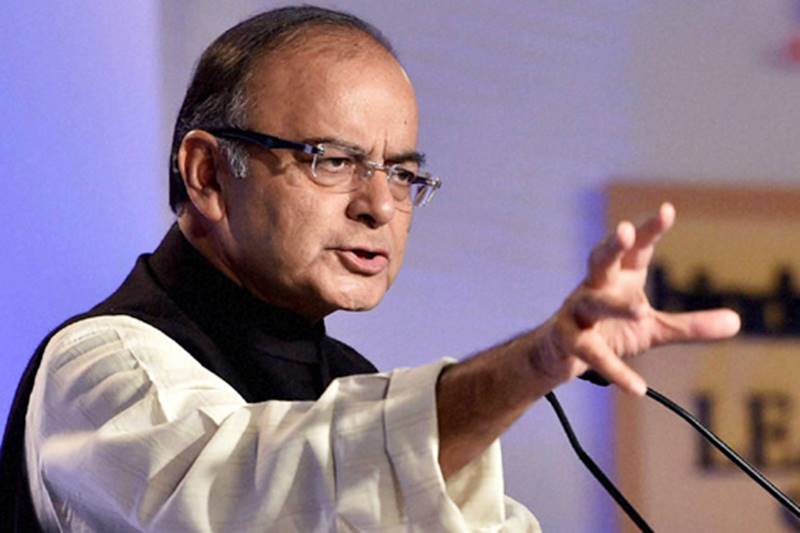

Budget 2016: FM Arun Jaitley's Union Budget 2016 has proposed to widen the scope of presumptive taxation scheme to include professionals from fields such as legal, medical and engineering, having annual income of up to Rs 50 lakh. The existing scheme of taxation provides for a simplified presumptive taxation scheme for only certain eligible persons engaged in select businesses only and not for persons earning professional income. (Reuters)

-

Budget 2016: In order to rationalise the presumptive taxation scheme and to reduce the compliance burden of the small tax payers having income from profession and to facilitate the ease of doing business, it is proposed to provide for presumptive taxation regime for professionals, the Finance Bill 2016 said. (PTI)

-

Small savings schemes interest rate: Asked whether the government had taken an unpopular decision, Finance Minister said, "It would be most unpopular decision if India's lending rates were 14 to 15 per cent. To destroy India's economy would be the most unpopular thing to do. Low interest rate in the long run will help everybody. When a borrower goes to bank for availing home loan, he should get it at 9 per cent or 15 per cent? Which decision will be unpopular"?(PTI)

-

Budget 2016: Government has also proposed to enhance the threshold limit for audit of accounts from Rs 25 lakh to Rs 50 lakh for persons having income from such professions. Jaitley has also proposed to increase the turnover limit under the presumptive taxation scheme under section 44AD of the Income Tax Act to Rs 2 crore "which will bring big relief to a large number of assesses in the MSME category". (Reuters)

-

Budget 2016: Jaitley said it if the taxpayer opts for the presumptive taxation scheme, he has to remain in that scheme for 5 years. "Further, if he does not offer the income as per the said scheme in any of the five years, he shall not be eligible to claim the benefit under the scheme for next 5 years," he added. (PTI)

-

Budget 2016: The scheme is currently available for small and medium enterprises (non corporate businesses) with turnover or gross receipts not exceeding Rs 1 crore. At present about 33 lakh small business people avail of this benefit, which frees them from the burden of maintaining detailed books of account and getting audit done. (Reuters)

-

Jewellers strike: That apart, Arun Jaitley has made it mandatory for providing PAN card details for jewellery purchases of Rs 2 lakh or above. While jewellers may argue on the increased burden on them, it is a sensible move to bring in a lot more clarity on gold purchases in the country. It will also bring in a fair degree of checks and balances on jewellery purchases. (Image Source: PTI)

e-Aadhaar app launch in India: Easily update your date of birth, address and phone number instantly with the upcoming all-in-one app