-

Jewellers strike: It's taken the shine out of many a wedding across the country over the past few days. Jewellery shops all over India have been closed since March 2. They are opposing finance minister Arun Jaitley’s budgetary proposal for a 1% excise duty without input tax credit or 12.5% with input tax credit on non-silver jewellery. (Image Source: Reuters)

-

1. Budget 2016: Arun Jaitley has reimposed 1 per cent excise duty on gold jewellery after a gap of four years in a bid to curb demand, which the industry said would make objects costlier and impact their business. In Budget 2016-17, Finance Minister Arun Jaitley imposed 1 per cent excise duty (without CENVAT credit) or 12.5 per cent (with CENVAT credit) on articles of gold jewellery. (Image Source: Reuters)

-

2. Budget 2016: Silver jewellery, other than studded with diamonds or other precious stones namely, ruby, emerald and sapphire have been excluded from the excise duty. Reacting to the development, World Gold Council (WGC) India MD Somasundaram PR said, "Reintroduction of a 1 per cent excise duty on the manufacture of jewellery is inconsistent. It will make jewellery buying more expensive and could lead to irregular business practices." (Image Source: PTI)

-

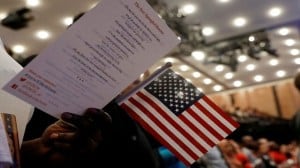

Jewellers strike: The big plus in this Budget 2016 proposal is that it will also help the government identify people who need to pay taxes, but have been avoiding simply because there was no way to monitor heavy-duty jewellery purchases.(Image Source: PTI)

-

4. Budget 2016: Similarly, excise duty on refined silver manufactured from silver ore or concentrate, silver dore bar, or gold ore bar — has been increased to 8.5 per cent from 8 per cent. (Image Source: Reuters)

-

5. Budget 2016: Prospectively, the excise duty exemption under the existing area based exemptions on refined gold silver is being withdrawn, the budget document said. (Image Source: Reuters)

-

6. Budget 2016: The government has also increased countervailing duty (CVD) on gold dore bars to 8.75 per cent from 8 per cent. CVD on silver dore raised to 7.75 per cent from 7 per cent. (Image Source: Reuters)

-

7. Budget 2016: The import duty on imitation jewellery has also increased to 15 per cent from the existing 10 per cent. (Image Source: Express Photo)

-

8. Budget 2016: Jewellers are also against the proposed mandatory quoting of PAN by customers for transactions of Rs 2 lakh and above. (Image Source: Reuters)

-

9. Budget 2016: The finance ministry has clarified last week that only jewellers with a turnover of more than Rs 12 crore will be liable to pay 1 per cent excise duty on non-silver jewellery items. (Image Source: PTI)

-

10. Budget 2016: So far, the government has not dropped any indication to meet the demand of bullion traders and merchants. According to a statement issued by Jeetender Agarwal, spokesperson of the All India Gems and Jewellery Trade Federation (Telangana chapter), members from as many 30 associations based in Hyderabad and Secunderabad joined the indefinite relay hunger strike and many jewellers shut their outlets. (Image Source: Reuters)

India vs Sri Lanka Live Cricket Score, Asia Cup 2025 Super Four: Arshdeep takes two wickets, SL 2/2 (0.5)