-

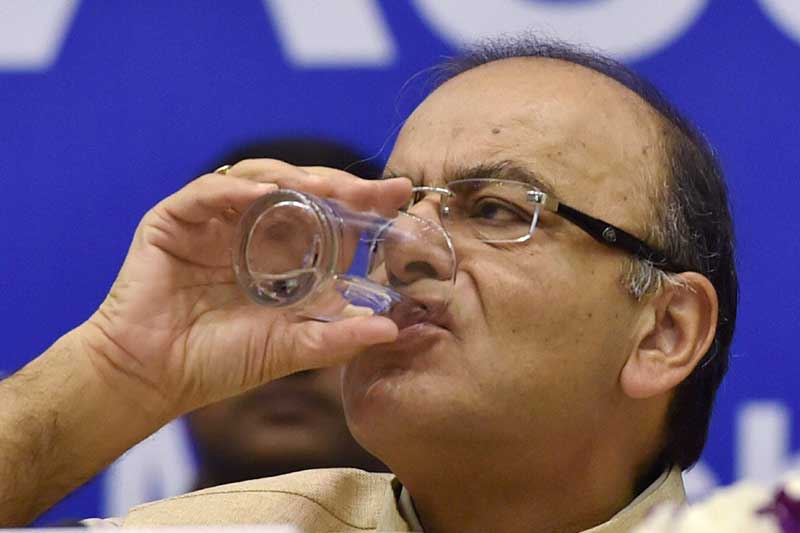

As the Budget 2016 driven EPF tax controversy rages on streets and social media, Arun Jaitley signalled that he would roll back the proposal to tax pension withdrawals by private sector employees after a backlash from salaried workers. Arun Jaitley's pensions tax plan sparked fury among India's small but vocal professional class – only around 36 million of the country's 1.3 billion people contribute to the EPF. Newspapers led front pages on the pensions tax, with the Hindustan Times splashing 'Govt Blinks' and the Times of India saying 'Salaried Class Rages' after a wave of outrage broke across social media (Image Source: AP)

-

EPF tax controversy: In Budget 2016, Arun Jaitley proposed taxing lump-sum withdrawals exceeding 40 percent of an individual's retirement pot in the Employees' Provident Fund (EPF), unless the sum is reinvested in a pension product such as an annuity. "This is a draconian act and will be a killer blow to the already tax burdened salaried class," said Vaibhav Aggarwal, a financial analyst who launched an online petition against the changes. (Image Source: AP)

-

EPF tax controversy: More than 100,000 people signed the petition, leading the finance ministry to partly withdraw its plans on Tuesday. The original proposals included restricting EPF contributions from April. (Image Source: Express photo)

-

EPF tax row: Facing flak for proposing a tax on employees' provident fund withdrawals, Finance Minister Arun Jaitley said he will spell out the final decision on the matter when he replies to the debate on Budget in Parliament. After Budget 2016-17 proposed taxing 60 per cent of the withdrawal from Employees' Provident Fund (EPF) on contributions to be made after April 1, the government has hinted at a partial rollback. Here is what Arun Jaitley had to say about the EPF tax row:

-

EPF tax controversy: A senior finance ministry official familiar with the matter said the tax on returns from the social security fund could be partly or fully waived. People on lower pay, making up to 15,000 rupees ($220) per month, would be exempted. (Image Source: PTI)

-

EPF tax rollback: The proposal would not have impacted 3.26 crore EPFO subscribers drawing statutory wage of up to Rs 15,000 per month. Employees Provident Fund Organisation (EPFO) has a total subscriber base of 3.7 crore. (Express photo)

-

EPF tax controversy: If implemented, the EPF tax plan could hit millions of employees who pay up to 33 percent tax on income, forcing them to explore other options to save for their old age. "It will eat up their retirement savings which could be a double whammy especially in light of high inflation," said Amit Maheshwari, managing partner at consultancy Ashok Maheshwary & Associates. (Image Source: PTI)

-

EPF tax controversy: The EPF, overseen by the Ministry of Labour, invests 95 percent of its $100 billion under management in state and corporate bonds. It plans a return of 8.8 percent on investments this year, in line with the long-term average, and pays out monthly pensions to retirees. ($1 = 67.635 rupees) (Image Source: PTI)

Zoho Arattai introduces a feature that WhatsApp still hasn’t rolled out in 2025: Details inside