-

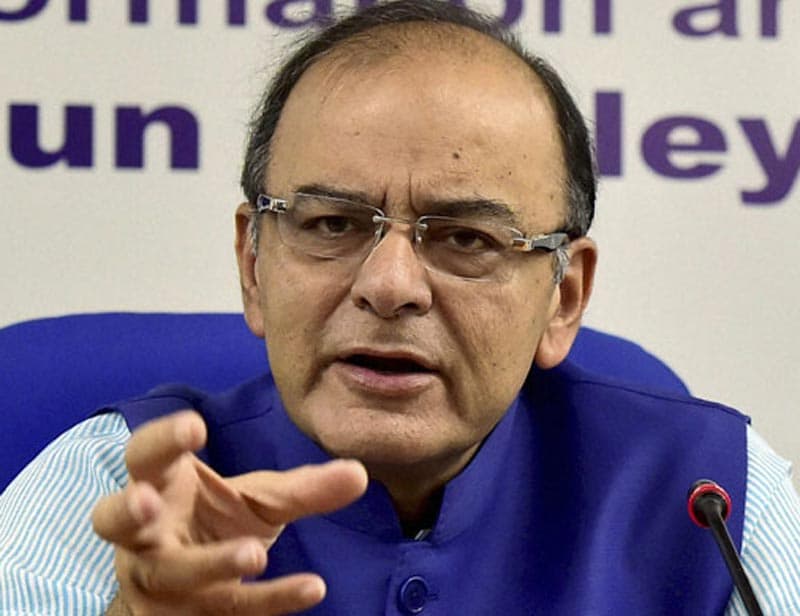

EPF tax rollback: "Salaried people depend on their salaries for their living and on retirement they depend on their EPF savings for their daughter's marriage and for housing, and if tax is levied on EPF, it would be a big blow to salaried class," Maken said. (PTI photo)<br><a href="https://www.financialexpress.com/article/budget-2016/fm-arun-jaitley-withdraws-controversial-budget-2016-epf-tax-proposal-nps-tax-exemption-to-remain/220780/"><strong>Budget 2016 EPF tax proposal withdrawn; NPS tax exemption to remain</strong></a></br>

-

EPF tax: Due to some amount of lack of understanding about the changes made in the General Budget 2016-17 in the tax treatment for recognised EPF and National Pension System (NPS), the government has issued clarifications in this matter. (Express)

-

4. Aadhaar Bill: The Bill "will empower the states to distribute resources of the State to deserving people and save the resources that undeserving people get," the Arun Jaitley said while replying to short debate on the Aadhaar (Target Delivery of Financial and Other Subsidies, Benefits and Services) Bill, 2016'. The FM said that till a few months ago, he himself was a beneficiary of LPG subsidy which he should not be entitled to. So the Bill will help weed out undeserving beneficiary from government subsidy scheme. "The purpose of the Bill is not for collateral purpose but to ensure that benefit of public revenue reach the targeted beneficiary," he added. (PTI)

-

EPF tax: The purpose of this reform of making the change in tax regime is to encourage more number of private sector employees to go for pension security after retirement instead of withdrawing the entire money from the Provident Fund Account. (Reuters)

-

EPF tax: Towards this objective, the government has announced that 40 percent of the total corpus withdrawn at the time of retirement will be tax exempt both under recognised EPF and NPS.

-

8. Aadhaar Bill: Aadhaar Bill: Arun Jaitley said discussion on the institution of Aadhaar has been going on for over seven years after the then UPA government approved a bill in September, 2010 and introduced in Parliament that December. "Entire discussion in seven years has now culminated," he said, noting that it was discussed in standing committee and extensive public suggestions were also received, as he stressed that the government had taken note of all this. (PTI)

-

THERE ARE LIMITATIONS ON WITHDRAWAL WHEN YOU RESIGN<br> If you have left a job where you maintained your EPF account, you cannot immediately withdraw the accumulated money. You need to be without a job for two months at the least to claim your accumulated money. You have to give a declaration on the same. In case you take a new job, the EPF account can be transferred and fresh contributions be made in them from your salary.</br>

-

EPF tax: The government in this Budget has also made another change which says, that when the person investing in Annuity dies and when the original Corpus goes in the hands of his heirs, then again there will be no tax. The idea behind this mechanism is to encourage people to invest in pension products rather than withdraw and use the entire Corpus after retirement. (Express)

-

PROVISION FOR PARTIAL WITHDRAWAL: It, however, introduced a provision that allowed members to withdraw their own share of PF contributions along with interest earned on their own contribution on the cessation of employment on the condition that they are not re-employed with an establishment which is covered under the EPF Act. (PTI)

-

EPF tax: However, in EPFO, there are about 60 lakh contributing members who have accepted EPF voluntarily and they are highly – paid employees of private sector companies. For this category of people, amount at present can be withdrawn without any tax liability. Such employee can withdraw without tax liability provided he contributes 60 percent in annuity product so that pension security can be created for him according to his earning level. However, if he chooses not to put any amount in Annuity product the tax would not be charged on 40 percent.

-

EPF tax: There is no change in the existing tax treatment of Public Provident Fund (PPF). Currently, there is no monetary ceilings on the employer contribution under EPF with only ceiling being that it would be 12 percent of the salary of the employee member. Similarly, there is no monetary ceiling on the employer contribution under NPS, except that it would be 10 percent of salary.

Aadhaar Card update October 2025: Here’s how to change name, address, date of birth and phone number online in simple steps