-

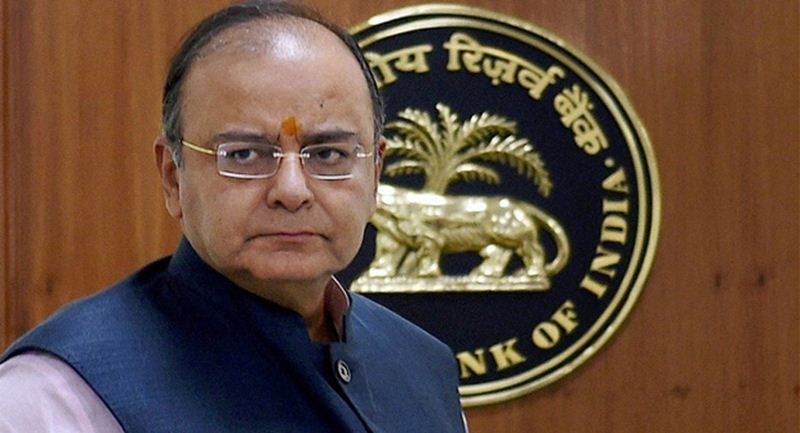

EPF tax: Budget 2016 row has just got worse with Arun Jaitley's Finance Ministry stepping in with its explanation. It added further to the confusion over tax treatment of employees provident fund (EPF) contributions proposed in the Union Budget, by saying a final view was yet to be taken on the subject. (Reuters)

-

EPF tax: Budget 2016 – In a statement, the ministry said on members of the provident fund who invest their withdrawals in annuity funds, no tax will be levied. If not, 60 percent of the money withdrawn will be taxed. Thus far, it is clear.

-

EPF tax: Budget 2016 – But what has created confusion is over whether only the interest component will be taxed upon withdrawal or the whole corpus itself built after April 1, 2016. Revenue Secretary Hasmukh Adhia had alluded that only interest will be taxed and not the corpus. But a statement thereafter suggests no firm decision has been taken as yet. The earlier clarification from Adhia seems to have come due to the uproar against the government's proposal. But the ministry statement has clearly said the matter was not closed as yet. (PTI)

-

5. Arun Jaitley on EPF tax row: There is also a change in the law that when inheritance comes in there is no tax payable. This was intended to incentivise people in the private sector also to use it as a kind of pension fund and to disincentive those who otherwise would indulge in consumption of that fund this move was made.

-

EPF tax: Budget 2016 – "We have also received representations asking for not having any monetary limit on employer contribution under EPF because such limit is not there in NPS. The Finance Minister would be considering these suggestions and taking a view on it in due course." (PTI)

-

EPF tax: Budget 2016 – The salaried class was shocked by Monday's budget proposal presented by Finance Minister Arun Jaitley that seemed to suggest that 60 percent of withdrawals from the provident fund accounts will be taxed — that, too, with retrospective effect. (PTI)

-

EPF tax: Budget 2016 – Jaitley said 40 percent of the National Pension Scheme (NPS) corpus would be tax-exempt at the time of withdrawal to make it attractive for the savers. He said the annuity fund, which goes to legal heirs, also won't be taxable. In case of superannuation funds and recognised provident funds, the same norm of 40 percent of corpus to be tax-free will apply in respect of corpus created out of the contributions made on or from April 1, the minister added.

US announces new rules for selection of H-1B visa for foreign workers