-

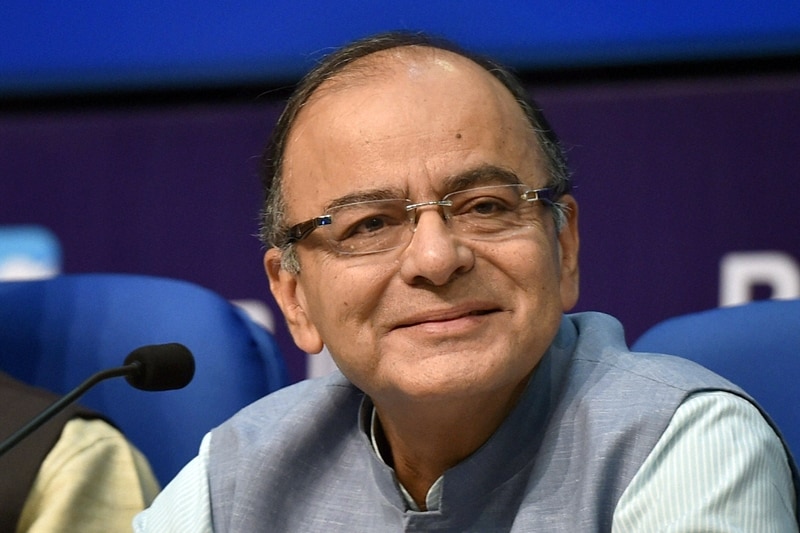

Budget 2016: Arun Jaitley has given relief to individual income tax payers and increased the tax deduction limit to Rs 60,000 per annum from the current Rs 24,000 on the housing rent. "I propose to increase the limit of deduction of rent paid under 80 GG from Rs 24,000 per annum to Rs 60,000 to provide relief to those who live in rented houses," he said while presenting the Budget for 2016-17 in the Lok Sabha. (AP)

-

Budget 2016 summary: Arun Jaitley said his budget will look at three pillars in right earnest: A prudent fiscal policy, raise domestic demand and carry out reforms. He also said farm, rural sector, infrastructure and social sector will be allotted more money. "Recapitalization of banks also to be done during next fiscal year," he said, as much concern have emerged over the quantum of exposure of Indian scheduled banks in terms of gross non-productive assets, re-cast loans and write-offs, which amounts to Rs 9.5 lakh crore. (AP)

-

Budget 2016 summary: He said the nine pillars of this year's budget will be: agriculture, social programmes, rural development, education with skill development, infrastructure, financial reforms, policy reforms in terms of ease of doing business, fiscal discipline and tax reforms. "A unified agriculture platform to be dedicated to the nation on the birth anniversary of Dr.B.R. Amebdkar," the finance minister said, amid applause from the benches. (AP)

-

EPF tax in Budget 2016: With PF withdrawal tax proposal in Arun Jaitley's Budget 2016 causing a controversy to break out across the country and the social media erupting in fury plus the trade unions threatening a strike, the Narendra Modi govt rushed to clear the air. An official said as far as taxing provident fund (PF) withdrawals was concerned, PPF withdrawals will continue to be fully exempt from income tax and that only the interest accruing after April 1, 2016 on 60 per cent of the contributions made to Employee PF (EPF) will be taxed. Here are the top 5 reasons why the govt has proposed this move that has shaken the world of employees:

-

Budget 2016 summary: At the same time Rs.35,984 crore was being allocated for agriculture in the next fiscal. This apart, the outlay under the job guarantee programme was being enhanced to get Rs.38,500 crore. These enhanced allocations are capable of transforming villages and towns, Jaitley said. (AP)

-

Budget 2016 summary: Arun Jaitley said there was also the need to spread digital literacy in rural areas. In addition, he added, Rs.8,500 crore was being allotted towards rural electrification, targeting 100 percent rural electrification by May 1, 2018. FM also assured that the government intended to double the income of farmers in five years, besides allotting Rs.35,984 crore towards welfare of farmers. The proposals also included universal coverage of cooking gas in the country, with a massive mission towards this aimed at the poor people. In this regard, he said, the government appreciated the 75 lakh middle class and lower middle class families for willingly giving up cooking gas subsidy. On health, he said, a new scheme will provide cover upto 1.lakh per family. (AP)

Indian woman leaves US after layoff during F-1 OPT, calls goodbye ‘hardest step’