-

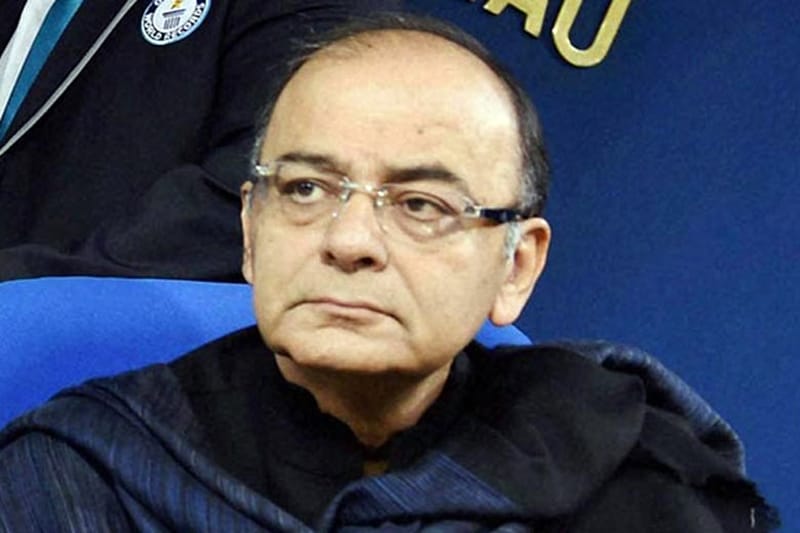

Budget 2016: Real estate industry is looking for clarity and favourable changes from FM Arun Jaitley in the upcoming Union Budget for the next fiscal, notably on issues such as independent regulator, single window clearance and enhanced income tax deduction limits. Here is what is topmost on the minds of the property merchants:

-

In a first, Income Tax Dept launches e-appeal filing system: In yet another step aimed at reducing human interface between taxman and the taxpayer, the Income Tax department operationalised a facility for e-filing of the first appeal before a tax officer. The department said the facility of filing the appeal form, like filing Income Tax Returns (ITRs), can be done using a digital signature from now on, while the Electronic Verification (EVC) facility for the same using the Aadhaar, mobile number and email id will be activated soon on the official web portal of the tax department -http://incometaxindiaefiling.gov.in/ (Reuters)

-

Budget 2016: Instead of allowing home buyers to receive income tax benefits after possessing the property, real estate industry wishes the Budget incorporates a provision which enables customers to receive tax benefits from the time they start paying interest on home loans. "The budget should consider to increase tax deduction limit for housing loans making it easier for people to own homes. Real Estate Investment Trusts (REITS) should be exempted from taxes on rent, stamp duty, transfer of assets and distribution of dividends so that theses trusts become efficiently functional," said Experion Developers chairman Hemant Tikoo. (AP)

-

Budget 2016: Another major issue with taxes for home buyers is the multiplicity of taxes. Buying an under construction property requires buyers to pay service tax, VAT, excise tax, customs and others to form about 22 to 25 percent of the total cost of the property. However, the industry feels passing the Goods and Services Tax (GST) bill in the Rajya Sabha can help reduce the multiplicity of taxes. "We look forward to the implementation of GST Bill in a definite time period, which will replace all other levies by Central and State governments and help the real estate sector in many ways. A single tax will eliminate the need of paying various taxes and provide a big relief to developers as well as customers," said Jindal. (Reuters)

-

The builder was also directed the company to provide adequate car parking spaces in the project and refund the excess amount, if any. (PTI)

-

Budget 2016: The industry is looking forward to a single window clearance to save time, cut costs and benefit the customers. Depending on the project size, developers have to meet about 6-8 conditions now after the environment ministry reduced the number of conditions from 30. "Introducing Single window clearance for speedy approvals of projects to reduce cost over-runs, tax sops and more funding for green projects are some of the measures which can put back the sector on the growth trajectory," said T. Chitty Babu, chairman and CEO of Akshaya. (Reuters)

-

Budget 2016: Confederation of Real Estate Developers Association of India (CREDAI) president Getamber Anand said the Union Budget should give a robust and uniform definition of affordable housing. "Restricting the definition of affordable housing to 25 square meters or 40 square meters amounts to scuttling of the vision. The Budget would do well to adopt a uniform definition of affordable housing comprising dwelling units with carpet area up to 90 square meters in non-metros and up to 60 square meters in metros," said Anand. He said capital gains exempt from tax under Section 54F invested in the construction of house has to be increased to five years from the current three years due to the long approval processes involved. (Reuters)

-

Budget 2016: House of Hiranandani chairman Surendra Hiranandani called for the promotion of REITS and the removal of Dividend Distribution Tax (DDT) which he termed as a roadblock. “There hasn’t been a single REIT listing in India since its inception and we attribute this to the existence of DDT (currently 15 percent). Removal of DDT (tax levied on the dividend paid to investors) will result in a rush of investment in REITs and this could prove to be decisive for the sector,” said Hiranandani.

Indian woman leaves US after layoff during F-1 OPT, calls goodbye ‘hardest step’