Crores of people in India have saved their hard-earned money in LIC insurance policies for future needs and other important purposes. But, some fraudsters by means of cheating and other fraudulent and corrupt practices are trying to snatch your money saved in LIC. Yes, you read it right; this is happening and that is why LIC has cautioned policy holders. A detailed notification has been issued by LIC so as to save their customers from falling prey to fraudulent activities. This fraud is taking place by means of SMS. Fraudsters are cheating customers in the name of linking Aadhaar number with LIC insurance policies. Noteworthy, LIC is India’s largest insurance company and it has millions of customers.

NO SUCH MESSAGE BY LIC

LIC has clearly said, “Our attention is drawn to some messages circulated in social media with our Emblem and logo asking policy holders to link their Aadhaar number by sending SMS to designated number.” Further, LIC says,”LIC of India informs the public and policy holders that no such message has been sent by LIC.” “Also, no facility to link Aadhaar number to policies is available through SMS in LIC,” the notification added.

DON’T SHARE PERSONAL INFORMATION

LIC says, “As and when LIC will enable linking of Aadhaar number with policies through SMS, our website will be duly updated of this option. LIC policy holders are cautioned to check with LIC offices before sharing personal information.”

So, what is the information and guidelines which have been issued by LIC of India for its policy holders? Here are the full details of the notice shared by LIC of India:-

FULL TEXT OF NOTIFICATION ISSUED BY LIC

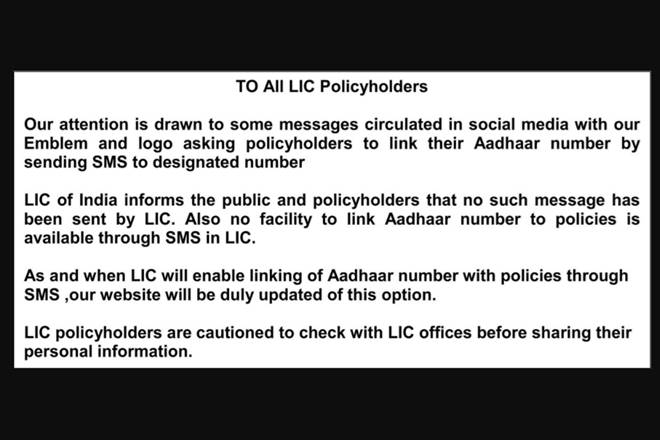

“Notice – Regarding linking of Aadhaar Number through SMS

Our attention is drawn to some messages circulated in social media with our Emblem and logo asking policy holders to link their Aadhaar number by sending SMS to designated number.

LIC of India informs the public and policy holders that no such message has been sent by LIC. Also, no facility to link Aadhaar number to policies is available through SMS in LIC.

As and when LIC will enable linking of Aadhaar number with policies through SMS, our website will be duly updated of this option

LIC policy holders are cautioned to check with LIC offices before sharing personal information.”

‘Linkage of Aadhaar number to insurance policies is mandatory’

Insurance Regulatory and Development Authority of India (IRDA) has already said that linkage of Aadhaar number with insurance policies is mandatory. Also, IRDA asked insurers to comply with the statutory norms. According to IRDA, “The Authority clarifies that, linkage of Aadhaar number to insurance policies is mandatory under the Prevention of Money Laundering (Maintenance of Records) Second Amendment Rules, 2017.” In a communication to all life and general insurance companies, IRDA had said that the rules have statutory force and as such, they have to implement them without awaiting further instructions. The government had in June had notified the Prevention of Money Laundering (Maintenance of Records) Second Amendment Rules, 2017, making Aaadhar and PAN/Form 60 mandatory for availing financial services including insurance and also for linking the existing policies with the same.