At the start of the financial year, we all make resolutions – and among them are financial resolutions, which involve planning for specific financial goals.

If you are married with kids, planning for your child’s bright financial future is on your mind. After all, we all want our children to lead a better life, both professionally and financially.

And in this age of a knowledge economy, to make it possible, providing quality education is the key. But it is getting expensive (with education inflation at 10-12%), and to make it possible, prudent investment planning matters.

Mutual funds are a potent avenue for wealth creation, plus relatively tax-efficient compared to some of the traditional investment avenues.

Among the various types of mutual funds, one such category is solution-oriented mutual funds, within which you have children’s funds.

In this editorial, we will compare two popular schemes — SBI Children’s Fund and HDFC Children’s Fund.

SBI Children’s Fund v/s HDFC Children’s Fund

SBI Children’s Fund, formerly known as SBI Magnum Children’s Benefit Fund, launched its investment plan in September 2020.

As per its portfolio as of November 2025, the fund has Assets Under Management (AUM) of Rs 5,053 crore.

HDFC Children’s Fund, on the other hand, was launched in March 2001 as HDFC Children’s Gift Fund, which was renamed with effect from November 2024.

As per its latest portfolio as of November 2025, the fund manages assets worth Rs 10,632 crore.

Both these funds are open-ended schemes designed to address children’s future needs and come with a mandatory lock-in period of a minimum of 5 years or till the child attains the age of majority, whichever is earlier.

The goal: Balancing capital growth with education planning

The investment objective is to generate long-term capital appreciation by investing predominantly in equity and equity-related securities of companies across sectors and market capitalisations. These schemes also invest in debt and money market instruments, and others with an endeavour to generate income.

However, there is no guarantee or assurance that the investment objective of the scheme will be achieved.

Growth vs. Stability: The 65% equity mandate

Both SBI Children’s Fund and HDFC Children’s Fund invest a predominant portion (around 65-100%) of their assets in equity and equity-related instruments.

The fund managers endeavour to hold a well-diversified equity portfolio without any market cap or sector bias, focusing on fundamentals of the business, sustainable business models, the quality of management, the financial strength of the company, market leadership, etc.

Attention is also given to acceptable valuations, which can offer potential for capital appreciation.

When investing in equities, these schemes, at times, also take exposure to derivatives for hedging and non-hedging purposes.

Up to 35% of the total assets are invested in debt & money market instruments. While doing so, these schemes typically consider the prevailing interest rate scenario, yield curve, yield spread, and credit risk of the different instruments.

The credit exposures and the portfolio duration calls are taken based on a thorough assessment of the general macroeconomic condition, political and fiscal environment, inflationary expectations and other economic scenarios.

Further, for diversification purposes, both these funds also invest in REITs and InvITs (up to 10%).

Besides, SBI Children’s Fund invests up to 20% of the total assets in gold ETFs, whereas HDFC Children’s Fund allocates up to 10% in non-convertible preference shares.

The mandate to invest in gold ETFs gives SBI Children’s Fund an edge.

These schemes also hold the mandate to invest up to 35% of the total assets in overseas securities, which include ADR/GDR/Foreign equity and overseas ETFs and debt securities.

The overseas securities provide geographical diversification, which has also worked in your interest as an investor.

Mid-Cap Churn vs. Blue-Chip Anchors: Inside the portfolios

SBI Children’s Fund has 76.1% of its assets allocated to domestic equities, 3.4% in overseas equities and 20.5% in cash & cash equivalents and treasury bills (T-bills).

It has 35 stocks in its portfolio as of 30 November 2025. Of these, 28.3% are large caps, 30.4% midcaps, as per the Value Research data.

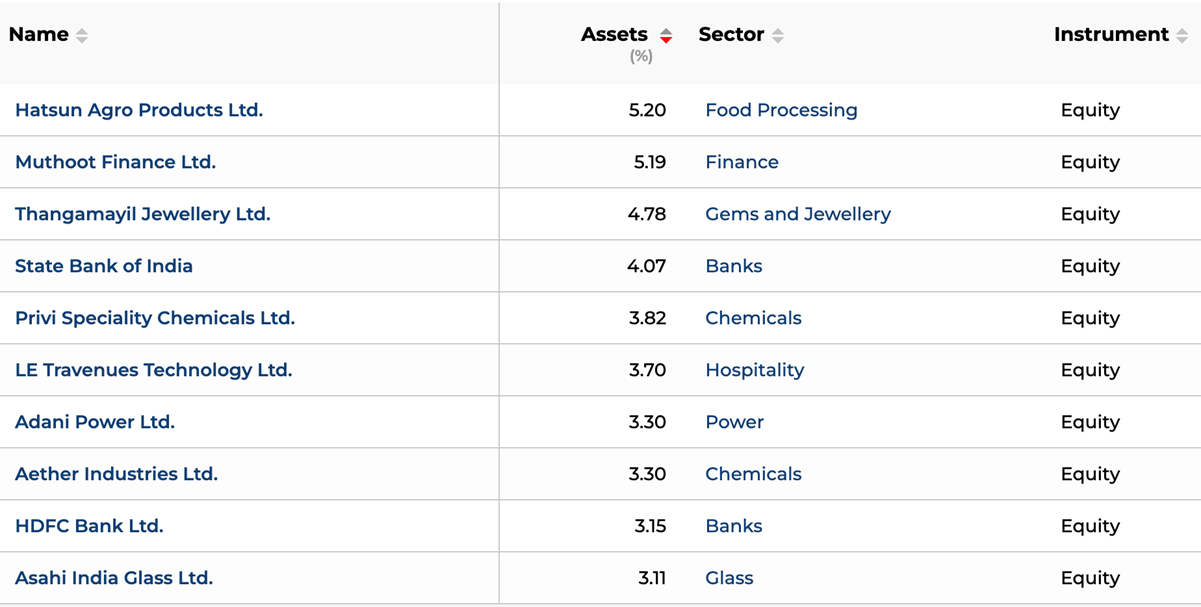

The top 10 stocks comprise 39.9% of the portfolio and include names such as Hatsun Agro (5.2%), Muthoot Finance (5.2%), Thangamayil Jewellery (4.8%), etc.

SBI Children’s Fund: Top 10 Stock Holdings

Data as per the November 2025 portfolio

Among the diverse range of sectors, the top 3 are financial services (17.4%), FMCG (9.3%), and auto & auto components (8.3%), comprising 35% of the portfolio as of November end.

In the case of HDFC Children’s Fund, 65.5% of the total assets are in domestic equities, 17.1% in Government securities (G-secs), 12.2% in corporate debt (12.2%), 0.2% in certificate of deposits (CDs), and 5.0% is held in cash & cash equivalents as per the November 2025 portfolio.

Within equities, the fund holds 44 stocks, of which 66.2% are largecaps, 18.2% midcaps, and 15.6% smallcaps, as per the Value Research data as of November end.

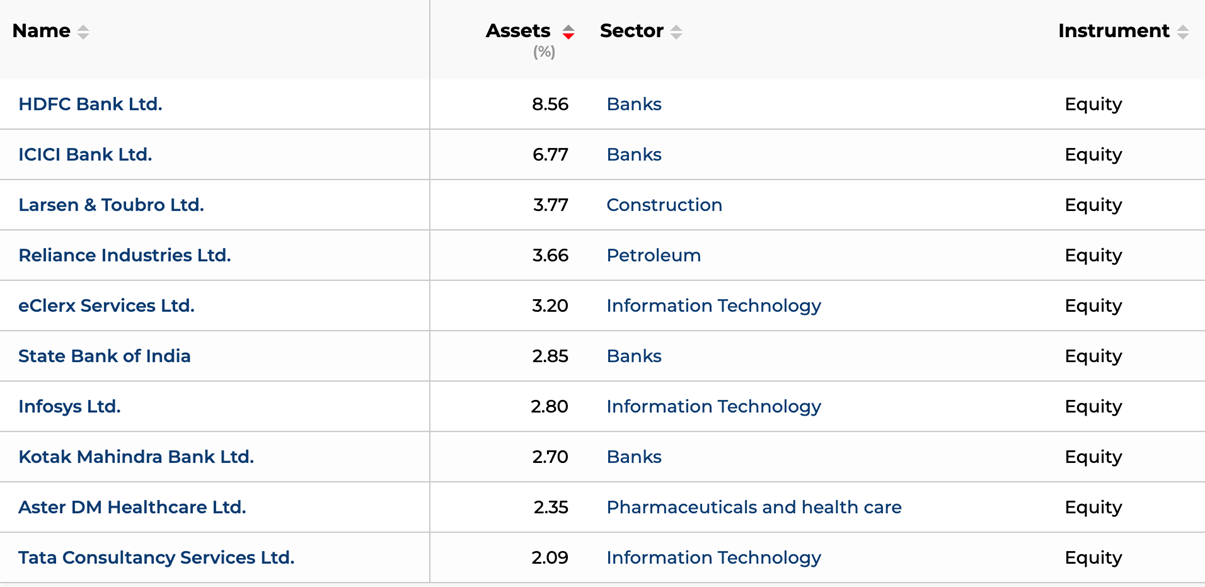

The top 10 stocks of HDFC Children’s Fund comprise 41.1% of the portfolio and include heavyweights such as HDFC Bank (8.6%), ICICI Bank (6.8%), L&T (3.8%), etc.

HDFC Children’s Fund: Top 10 Stock Holdings

Data as per the November 2025 portfolio

The top 3 sectors of the fund are banks (22.6%), IT (11.1%), and petroleum (4.3%), comprising 38% of the portfolio as of November end.

Speaking of the portfolio valuations, the average price-to-book value (PB) ratio of the underlying stocks in proportion to their underlying weights in the case of SBI Children’s Fund is 3.8, whereas the price-to-equity (PE) ratio is 31.8, according to the Value Research data.

On the other hand, HDFC Children’s Fund’s portfolio has a PB of 3.6 and a PE of 22.1.

When it comes to portfolio turnover, SBI Children’s Fund indulges in higher churning, while HDFC Children’s Fund typically follows a buy-and-hold approach.

Risk-adjusted realities: Decoding the 34.5% CAGR

SBI Children’s Fund has clocked a 34.5% compounded average growth rate (CAGR) since its inception (as of 1 January 2026).

Also, over 5 years, the fund’s returns have been 29.7% CAGR, remarkably higher than the category average and the CRISIL Hybrid 35+65 – Aggressive Index.

This is because of higher allocation to midcaps, plus the higher churning.

Although this has come with higher churn in holdings, and the risk exposure has been higher (standard deviation of 11.3, as per the financial express factsheet) compared to the category average and benchmark, it seems justified on a risk-adjusted basis if we were to consider the Sharpe and Sortino ratios of 1.3 and 1.8 — which are again higher than the category average and the benchmark (as of 1 January 2026).

Sharpe ratio is a measure of risk-adjusted return that shows how much excess return an investment generates for each unit of risk taken; it is calculated by subtracting the risk-free rate from the investment’s return and dividing the result by the standard deviation of returns.

While the Sortino ratio is also a measure of risk-adjusted return that shows how much excess return an investment generates, it considers each unit of downside risk taken. It is calculated by subtracting the risk-free rate from the investment’s return and dividing the result by the downside standard deviation of returns. In other words, it measures how well the fund has rewarded investors for the downside risk involved.

Speaking of the HDFC Children’s Fund, since its inception, it has clocked a 15.7% CAGR. Over 5 years and 10 years, it has delivered 17.5% CAGR and 14.7% CAGR, respectively, higher than the category average and the benchmark, as of 1 January 2026.

The fund has exposed its investors to low risk (standard deviation of 10.6, as per the Financial Express factsheet data) but has also delivered decent risk-adjusted returns considering the Sharpe and Sortino ratios of 1.0 and 1.4, respectively, as of 1 January 2026.

Who manages SBI Children’s Fund and HDFC Children’s Fund?

Both these mutual fund schemes are managed by veteran fund managers having vast experience in fund management.

SBI Children’s Fund is managed by Rama Iyer Srinivasan and Lokesh Mallya.

Srinivasan, who manages the equity portion of the fund, has more than 30 years of experience in equities and is currently the Chief Investment Officer – Equity. He is a post-graduate in commerce (M.Com) and financial management (MFM).

Mallya, who handles the debt portion of the fund, has over 14 years of experience in research in the Indian fixed-income market and fund management. He is an MBA and CFA, with a certification in financial risk management.

HDFC Children’s Fund is co-managed by Chirag Setalvad, Anil Bamboli, and Dhruv Muchhal. Chirag Setalvad, you may note, is also the new fund manager for HDFC Flexicap Fund.

Setalvad has over 29 years of experience, of which 25 years are in fund management and equity research, and handles the equity portion of the fund. He is a science graduate (B.Sc) and an MBA from the University of North Carolina.

Bamboli, who handles the debt portion, has a collective experience of over 31 years in fund management, research, and fixed income dealing. He is a CWA, plus a CFA and an MMS (Finance) degree.

Muchhal is a dedicated fund manager for overseas investments. He has over 14 years of experience in equity research.

Which Children’s Fund should you consider — SBI Children’s fund v/s HDFC Children’s fund?

Both these funds have fared well. They are from fund houses known to be following robust investment processes and systems.

But SBI Children’s Fund, by having a higher allocation to midcaps and indulging in portfolio churning, races a bit ahead on returns with high risk.

HDFC Children’s Fund has held a large-cap biased portfolio, followed a long-term buy-and-hold approach and churned the portfolio less. A 15.7% CAGR since inception looks quite satisfactory (as of 1 January 2026) with a low-risk exposure. It seems decent on a risk-adjusted basis given its largecap orientation.

That said, don’t just base your investment decision on past returns, which may or may not be repeated in the future.

You need to consider your risk profile, broader investment objective and time horizon before investing. If you are not sure how to go about it, reach out to a SEBI-registered investment adviser.

Happy Investing.

Note: We have relied on data from www.valueresearchonline.com, financial express factsheets, and HDFC Mutual Fund and SBI Mutual Fund factsheets throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

Disclaimer:

Disclaimer: The above content is for informational purposes only. Mutual Fund investments are subject to market risks. Please consult your financial advisor before investing.

Rounaq Neroy has over 20 years of experience in the financial markets and investments. He is a close observer of the Indian economy and writes deeply on the capital markets, mutual funds, stocks, precious metals, asset allocation, wealth management, and investment strategy. His editorials provide interesting, actionable investment ideas to guide readers in the journey of wealth creation and make wise decisions. Rounaq was the Head of Content at PersonalFN (Quantum Information Services Pvt. Ltd.), which also owns Equitymaster.com – India’s oldest and trusted equity research house.