Ten years ago, in our presentation deck, we used to have a slide titled.

“The value of an Asset is determined by what happens in India.

But

The Price of that Asset is determined by Foreign Investors”.

This was of course with respect to the equity markets.

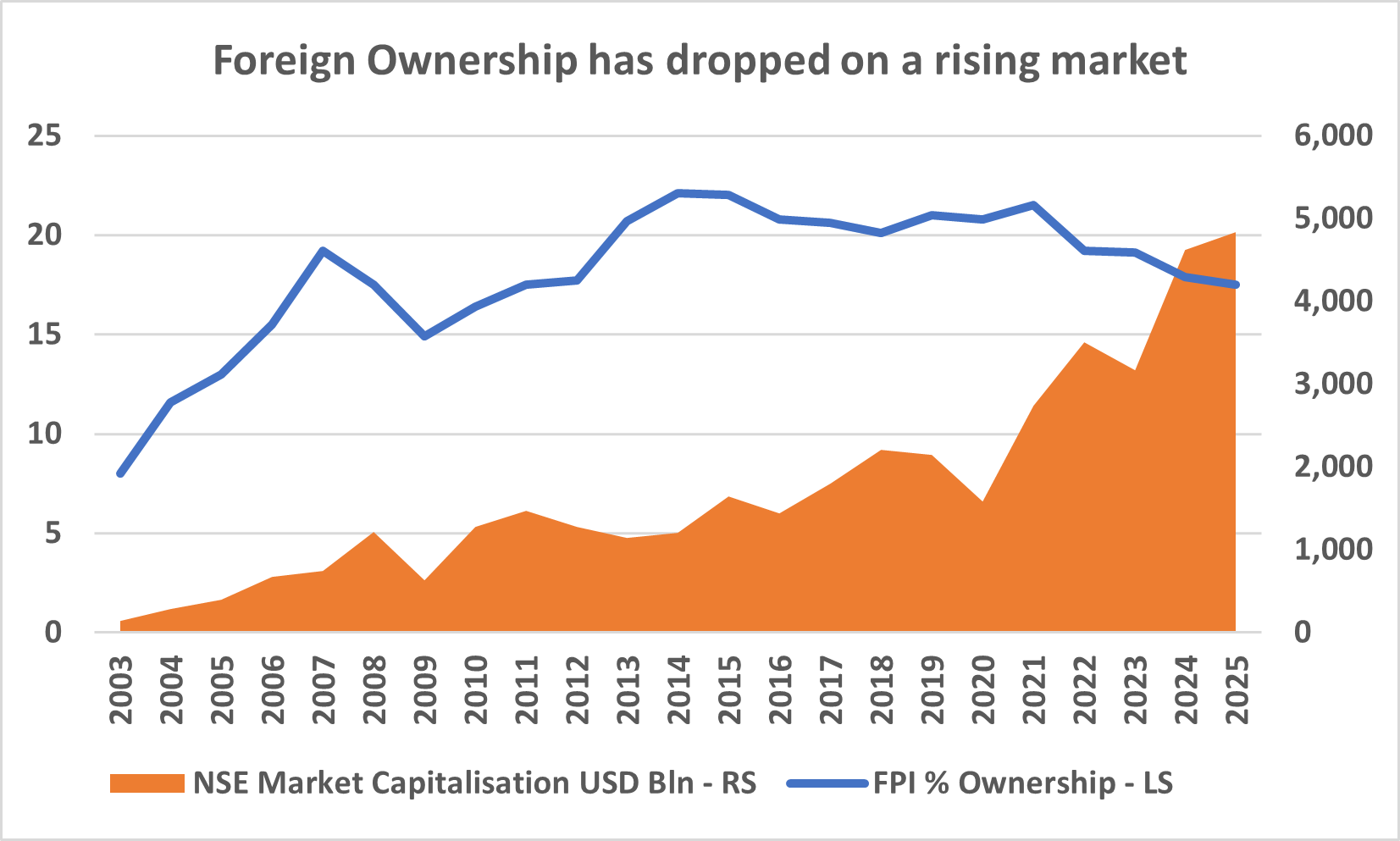

Foreign Investors owned more than 20% of the entire Indian equity market then. In narrower indices, like the NSE Nifty-50 Index, Foreign Portfolio Investors (FPIs) owned ~28% of the total market capitalisation in 2014.

If you adjust that for free float (ownership after removing promoters/founders who own almost ~50% in the companies), the FPI ownership in Nifty-50 of the free-float used to be as high as ~55%.

Thus, when foreign investors inflow was high, the markets would move up. And when foreign investors net sold, the Indian stock markets would crack.

The FPIs still hold sway in the Indian markets. However, their impact on share prices, valuations and on market levels are waning.

Foreigners are no longer the dominant investor in the Indian market.

Over the last 5 years, as the markets have surged and the market capitalisation has increased, foreign ownership has dropped to 17.5% of the whole market due to lack of net new flows. When seen for the narrower NSE Nifty-50 Index, the FPI share has fallen from >28% to ~24.5%.

In a previous column, Are Foreign Investors exiting India, I showed how foreign investors have been net sellers for over 4 years now. I nuanced the title by showing that the FPI net outflows are yet less than 3% of their overall market value that they own in India.

However, I did make the point that, such continued outflows and low net inflows should be concerning given the general Hype about investing in India and India’s markets.

The Humble and Silent Indian “SIP” Saver is over-powering the Foreign Institutional Investor

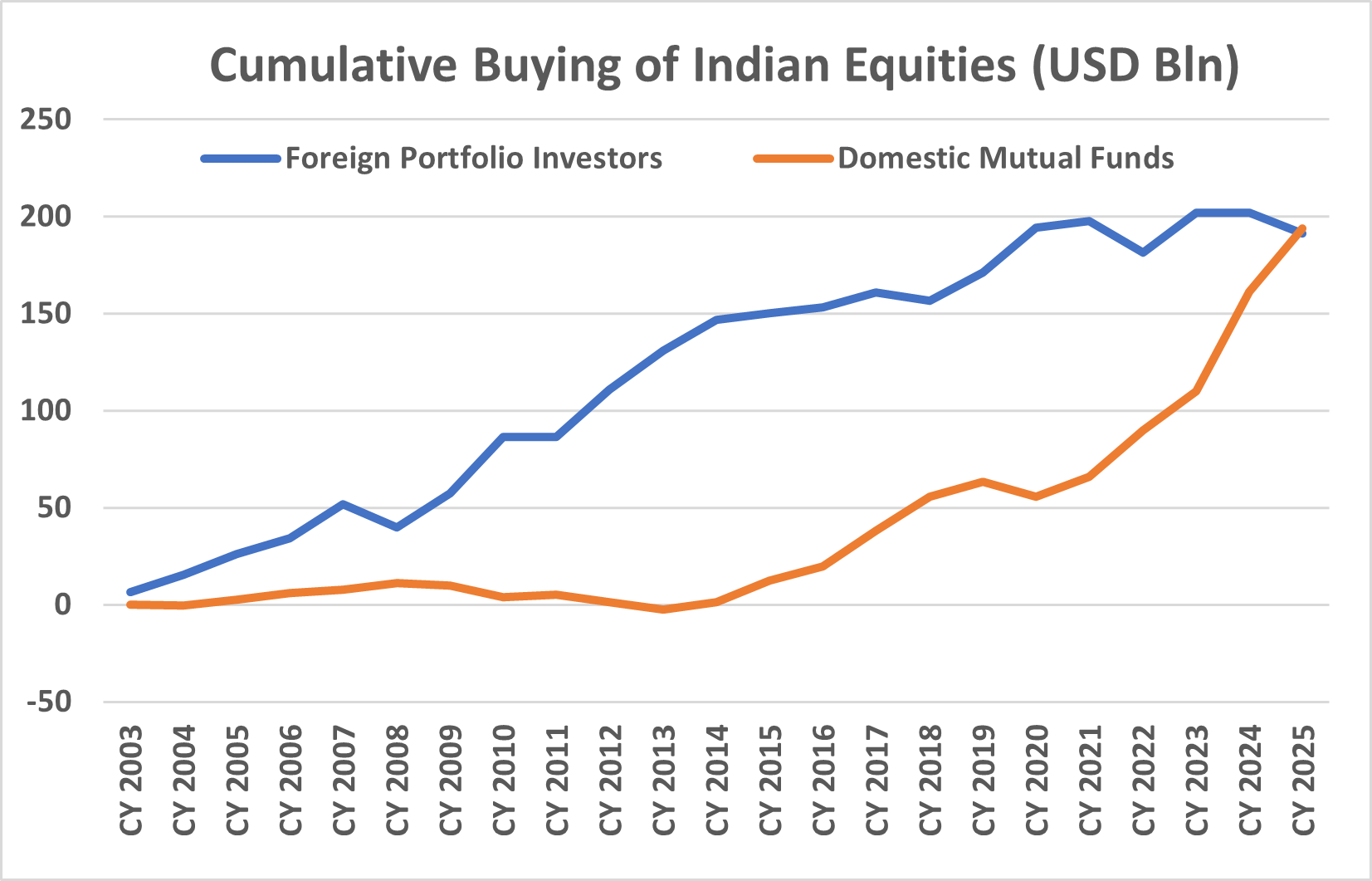

In 11 years from 2014, Indian retail investors have showered their love on Indian mutual funds who have invested USD 190 billion into the Indian stock markets.

Foreign Investors have invested only ~USD 44 billion in the same period.

The ‘orange’ Indian mutual fund buying line is like a hockey stick.

The ‘blue’ Foreign Portfolio Investor’ line has plateaued.

The Indian markets seem to be gyrating on – ‘we don’t need no foreign investor’ for its performance.

‘We Don’t Need No Foreign Investor’ !

Indian Mutual Funds are raking in ~ USD 3 billion through monthly systematic investment plans (SIP). A sizeable part of that is in Equity mutual funds.

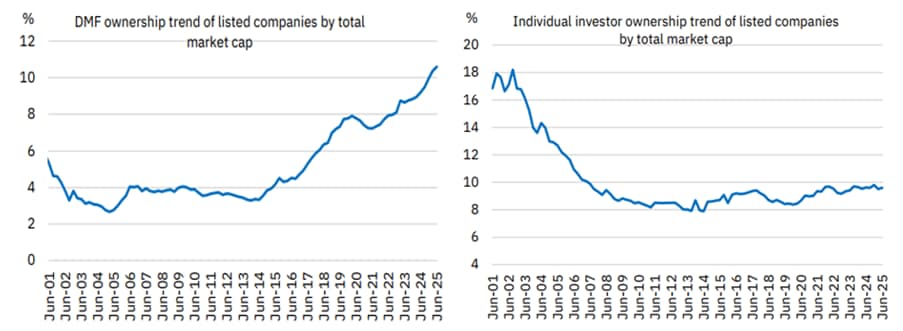

The Indian household savings pattern has undergone a dramatic change in the last decade. Apart from investments in mutual funds, direct investing in equity markets has also picked up with individual accounts increasing from ~16 million in 2014 to over 110 million in 2025.

The investments by individual investors through mutual funds and directly in equities has led to a situation where their total ownership, as per a report from NSE, at 18.5% of the whole market is now more than that of the FPIs at 17.5%.

This is when equities make up less than 7% of an Indian’s total saving and ~14% of financial saving. This has of course risen sharply in recent years, and may be peaking for now, however, the scope for sustained increase is structural given India’s young demographic age of ~29 years and relatively low income.

The Indian markets remain influenced by foreign investors, and the value of an India asset is yet somewhat determined by foreign flows. However, the fact that we have attracted such meagre net flows over the last 10 years from global investors who are already under invested in India and as the charts above depict, there are slowly losing their influence.

And given that, the Indian investor has tasted success with investing in mutual funds, it is likely that the markets gyrate more to the tunes and moods of the domestic Indian investor.

Disclaimer

Arvind Chari is a Chief Investment Strategist and has been with Quantum Advisors India group since 2004. Arvind has over 20 years of experience in long-term India investing across asset classes. Arvind is a thought leader and guides global investors on their India allocation.

This article is for educational and discussion purposes only and is not intended as an offer or solicitation for the purchase or sale of any investment in any jurisdiction. No advice is being offered nor recommendation given and any examples are purely for illustrative purposes. The views expressed contain information that has been derived from publicly available sources that have not been independently verified. No representation or warranty is made as to the accuracy, completeness, or reliability of the information.

The views and opinions expressed in this article are my personal views and should not be construed of the Firm. There is no assurance or guarantee that the historical result is indicative of future results, and the future looking statements are inherently uncertain and cannot assure that the results or developments anticipated will be realized.