By Nuvama research

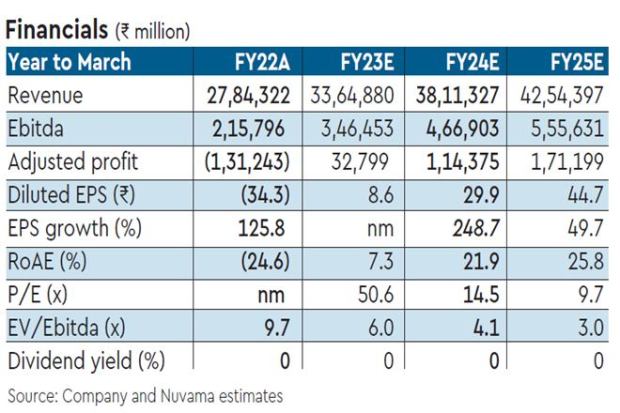

Auto major tata Motors’ (TML) total consolidated revenue jumped 29.7% in Q2 to Rs 79,611 crore which was in line with the Street expectations of Rs 79,644 crore. The company turned in Q2FY23 Ebitda of Rs 62bn, missing our estimate by 28% as margins disappointed across businesses. Besides, Q3 volume ramp-up guidance for JLR is muted. Management has indicated a marginal ramp-up in H2FY23 volume for JLR over H1. JLR is targeting to be FCF-neutral in FY23 versus an FCF-positive guidance earlier. Hence, we are lowering consolidated FY23e/ FY24e (estimates) Ebitda by 11%/7% (due to JLR, which is ~75% of consolidated Ebitda). Retain ‘BUY’ with an sum of the parts (SoTP)-based TP of `502 as we roll over the valuation to Mar-24E (estimates).

Q2FY23: Another disappointment; wait for revival gets longer

JLR reported Ebitda of £541mn, missing our estimate by 14% (second quarter of sharp miss) despite in-line revenue. The challenges of slower ramp-up of RR (Range Rover) and RRS (Range Rover Sport) persisted due to chips shortage. While management has taken steps, its impact will be visible only Q4 onwards. We are factoring in H2FY23 JLR volumes of 176K. Strong order book for Defender/ RR/RRS indicates JLR can recoup the losses. Total JLR order book stands at 205k India. India business reported a q-o-q drop in margins largely due to higher raw material cost and obsolesce costs in the PV segment. We expect q-o-q recovery in margins as commodity benefits start flowing through Q3 onwards.

JLR: Elusive volume ramp-up; India better placed

For JLR, the last three quarters have been precarious due to semiconductor uncertainty, model changeovers of RR and RRS, and ongoing China lockdown. As these issues are getting addressed, tailwinds from the new RR and RRS along with strong demand for Defender filtering into the P&L should compensate for disappointment. The strong product cycle tailwind in JLR keeps our hopes alive.

Outlook and valuation

India and JLR have tailwinds of cyclical recovery and product-cycle. This should aid balance sheet improvement. We maintain ‘BUY/SO’ with a TP of Rs 502.

Also Read: Tata Motors stock rating ‘Buy’: Product mix, demand to help, say brokerages; check recos, share price targets

Key takeaways of conference call:

JLR

Demand outlook remains strong. Order book marginally increased to 205k from 200k. However, net order addition in the quarter was lower than 100k run rate. It stood at 92k

Alternate solution identified for chips and has entered into long term arrangement to secure future supply. However, Q3 volumes will see marginal rampup over Q2. From Q4 onwards meaningful rampup should be visible. Chips issue is likely to linger for reasonable time for the industry before it normalises

Expect some increase in variable marketing expenses (VME) given that they are at significantly lower.

Pension liability has actually seen rise in surplus quarter on quarter. It is closer to £1 bn

India

Demand outlook remains healthy.

FY24 PV volume growth: Expect the growth to normalise driven by new product and intervention. Pent demand will be largely met in FY24

Margin: clear focus on double digit margins in commercial vehicles (CVs). Hence would like to retain the benefit of commodities as well as focus on cost reduction initiatives.

Share of CNG in ICVs (intermediate commercial vehicles) has declined to ~15-17% from 40% a year back I&LCVs due to reduced arbitrage post sharp jump in CNG prices. The price gap differential has narrowed from Rs 44 to Rs 15.