Gold has been the talk of financial markets around the world for quite some time.

The yellow metal’s stunning rise to new all-time highs above US$ 3,000 per ounce in the global market and Rs 90,000 per 10 gm in India, has made it the topic of everyday conversation.

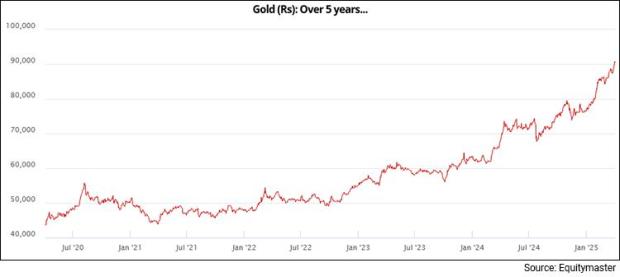

In 2024, gold delivered 20% compared to the Nifty’s 8.7% gain. And 2025 has seen the upward momentum continue.

From about Rs 78,000 to Rs 93,000, the price of gold has risen close to 20% in a little over three months so far this year.

In fact, since August 2024, the gold price has moved up from around 70,000 levels. That’s a rise of about 33% in just eight months.

Going back a little further, the price has been moving up sharply since February 2024 from 64,000 levels. That’s a gain of about 45% in little more than one year.

The gains over the last 5 years have been excellent. The price has more than doubled, delivering a compounded annual growth rate (CAGR) of a little over 16%.

These are the kind of gains that would satisfy a conservative stock market investor.

Sure, the Nifty has outperformed gold in the last five years, but that’s mostly due to the huge post covid bull market of 2020-21. Otherwise, gold has kept pace with stocks, even outperforming the equity benchmark indices.

But what about the future? Will the gold price continue to rise, or will it finally take a breather?

To figure out the answer, we must understand the factors that influence the price of gold.

#1 Trade Wars

In a nutshell, the US President Donald Trump’s tariffs has raised the yellow metal’s safe-haven appeal.

Gold has always been a safe haven asset. People flock to gold either when times are tough or when there is uncertainty in financial markets.

Recently, Trump has followed through on his election promise to impose reciprocal tariffs. This decision has raised concerns of a global trade war.

The new US tariffs are not only very high but are also broad-based. Hardly any country was spared.

In the case of some countries, the new US tariffs so high that it could potentially destroy trade relations between the two nations.

Thankfully, that is not the case with India, even though the 26% tariff is significant. The Indian government has been proactive in negotiating with the US about doing a trade deal which will address the concerns of both sides.

However, even in this case, there could be negative second and third order impacts of Trump’s decision. Other countries are likely to respond aggressively against the US.

Such retaliatory measures have the potential to turn into a full-fledged global trade war. This in turn, can lead to lower GDP growth around the world.

In such a scenario, India won’t remain insulated.

And it’s not just the reciprocal tariffs.

Trump has imposed 20% additional tariffs on imports from China. In response, China has retaliated with tariffs on US imports.

Mexico and Canada, along with many others, are still in the crosshairs of the Trump administration with the news changing regularly on this front.

A major universal tariff of 25% has been imposed on aluminium and steel. This will be applicable on all countries exporting these goods to the US.

And there is the 20% tariff on all automobiles exported to the US.

There could be more tariffs to come.

Pharma stocks that rallied on the day of the reciprocal tariff announcement because the sector was exempted, took a big hit today as media report came in about sector specific tariffs being considered for the pharma sector as in the case of the auto sector.

Even the semiconductor sector is not safe from tariffs if media reports are to be believed.

This is why some investors have begun to take defensive positions in the markets. This involves selling some of their stocks or reducing the exposure to them and moving the funds to safer assets like gold.

This is because gold prices often rise in times of financial uncertainty, due to its safe have appeal.

#2 The Risk of Inflation

Gold has always been an effective hedge against inflation throughout history.

This is what we are seeing now. If US inflation were to rise in 2025, gold will rise in tandem.

This risk has increased along with the possibility of trade wars. Trump’s policies are certain to have the negative effect of increasing the rate of inflation in the US, at least in the short term.

Financial markets are extremely sensitive to any inflation related news. The risk of inflation going up again is supporting the gold price.

#3 US Recession Fears

The trade war triggered by the US has spooked global markets because the Trump administration seems determined to see it through.

There was an implicit assumption in the markets that if the tariff policies caused an economic slowdown in the US, then Trump would ease up on the tariff pressure.

Now we know that is not the case. The reciprocal tariff policy adopted by the US, will have major negative implications for global trade and thus, economic growth rates.

Many affected countries are likely announcing their own retaliatory tariff policies. This would cause unpleasant second and third order effects all over the world, the severity of which are hard to predict.

This is why fears of a recession in the US has increased recently. Gold typically does well when there is fear of a recession in financial markets.

And that is playing out right now.

Could the Gold Price Rise to Rs 100,000 in 2025?

The short answer is yes, it’s possible.

Sentiment in the market is extremely bullish on gold right now.

Some investors are even considering selling stocks and just holding on to gold until the current period of negativity passes.

While such market behaviour may not be appropriate in the long term, the fact is most investors care more for short term returns than long term returns,

As things stand, the gold bulls have the upper hand. Thus, the ‘sell stocks buy gold’ trade is popular.

However, investors should carefully watch out for any potential changes to the underlying factors driving up gold.

Conclusion

At Equitymaster, we believe in having 5-10% of one’s portfolio in gold at all times.

However, investors should not see gold as a potential substitute for any other asset.

It makes sense to hold some precious metals in one’s long-term portfolio, but it doesn’t make sense to speculate on short term price movements.

While considering an investment in gold, have a time horizon well beyond 2025. Just because prices have gone up recently, doesn’t automatically make gold a great investment.

Do your due diligence.

Happy investing.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here…

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.