What happens when a mid-sized company suddenly decides to punch above its weight? Imagine a firm with ₹50 billion in annual revenue going out to acquire another that’s twice as large. It’s bold. Yet, this is precisely the kind of event that excites investors who track special situations stocks. These moments test not just balance sheets, but also management conviction, execution depth, and long-term vision.

In recent weeks, two midcap companies have made headlines for doing exactly that. Each has announced an acquisition larger than itself. The move could either redefine their competitive standing or stretch their financial muscle. Whether these decisions turn out to be turning points or turn out otherwise will depend on how seamlessly these companies integrate. But one thing is certain, both are making the kind of big, calculated leap that investors can’t afford to ignore.

#1 Tega Industries: : Leaping big with Molycop deal

Tega Industries is a global leader in designing and manufacturing critical consumables and equipment for the mining, mineral processing, and material handling industries. Tega is also the second-largest producer of polymer-based mill liners in the global market. The company operates across two segments: Consumables and Equipment.

A Mining Consumables Leader with Global Reach

The consumable segment focuses on the manufacturing and distribution of specialized, critical, and recurring consumable products. It delivers high-performance, abrasion- and wear-resistant solutions made from rubber, polyurethane, steel, and ceramics. These products are essential for grinding, screening, and material handling operations.

The Equipment segment focuses on the manufacturing and marketing of critical equipment for crushing, grinding, material handling, and mineral processing. Tega has also launched new products, including smart liners and sensor-based systems that monitor the real-time performance of mills, and modular screens with recyclable polyurethane.

The company serves over 700 customers in over 92 countries worldwide. Customers include gold and copper mines, steel, power, cement, iron ore, zinc, and aluminum companies. It has 10 manufacturing plants (7) in India and 3 in major mining centers such as Chile, South Africa, and Australia. The company earns 86% of the total turnover (standalone) from exports.

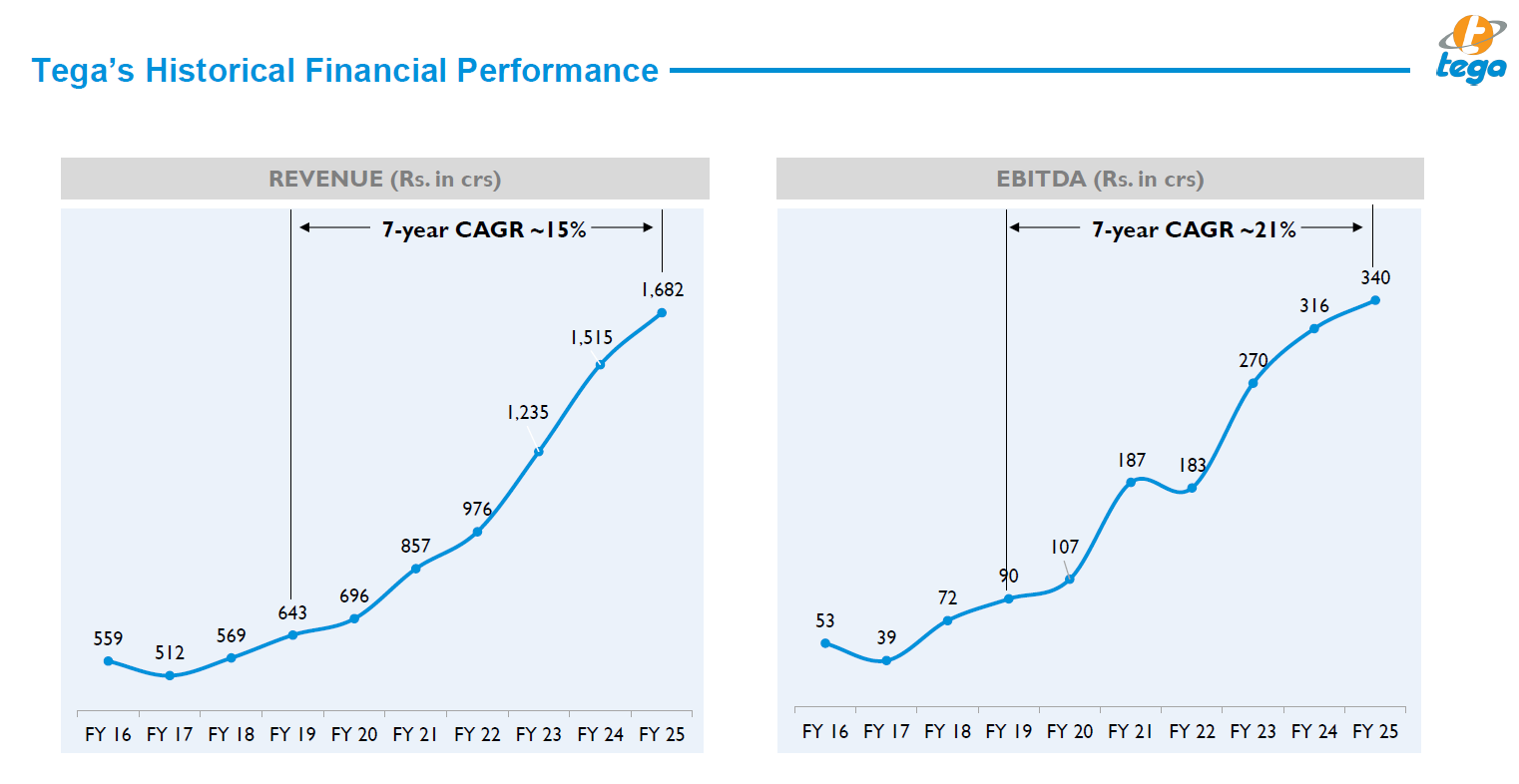

Tega Revenue has grown at a 15% CAGR during FY19-25

Molycop Deal Aims to Create a Sector Giant

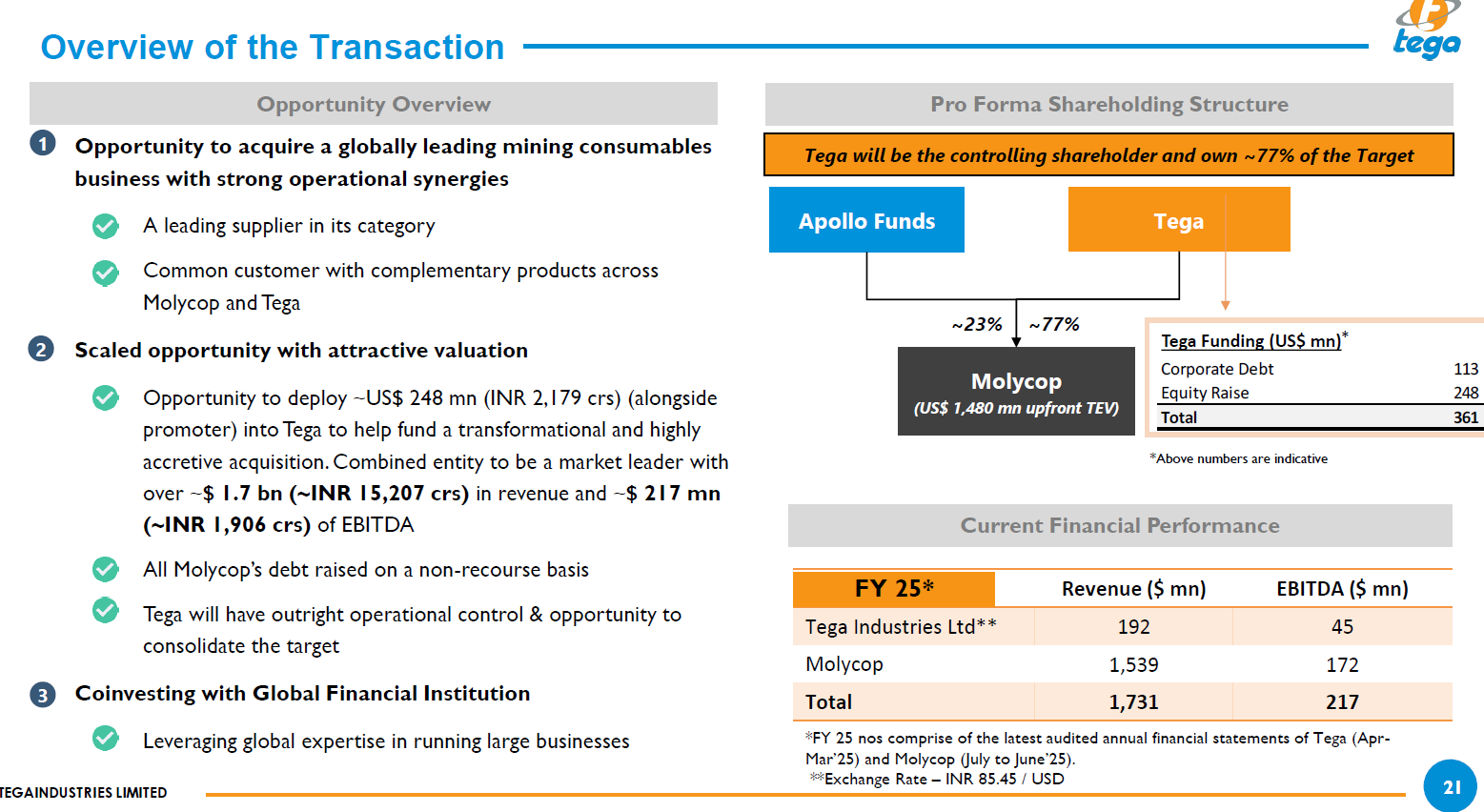

Tega, along with Apollo Funds, has entered into a term sheet agreement to acquire Molycop at an enterprise value of ₹130 billion. Additionally, a contingent deferred payment of ₹10.5 billion may become payable within 45 months of the acquisition. But this is dependent on Molycap reopening the closed mines and generating additional EBITDA (earnings before interest, tax, depreciation, and amortization).

The deal size is equivalent to Tega’s market capitalization of about ₹127 billion. Tega will take a 77% stake by paying ₹31.8 billion, while Apollo will pay ₹9.5 billion for a 23% stake. Debt on Molycop’s books stands at ₹89.1 billion. Post-acquisition, Tega’s debt is projected to be ₹101.7 billion. Molycop debt carries no recourse to TEGA, thereby insulating TEGA’s existing business.

Funding Through Equity and Strategic Partnership

For funding the acquisition, Tega is going to raise ₹21.8 billion through preferential allotment and qualified institutional placement. The balance will come from corporate debt. The equity raising will dilute promoters’ stake by about 9.6%, bringing their holding down to 65.2% (from 74.8%). Both entities will operate as distinct entities but under coordinated leadership.

The acquisition integrates Molycop’s grinding media portfolio with TEGA’s wear-resistant liners and material handling solutions. It will allow the merged entity to offer an end-to-end service across the mineral processing value chain. With this, Tega aims to become the global leader in consumables for the mining sector, thereby joining the big league.

A Global Leader in Grinding Media and Mining Consumables

Molycop is known for pioneering electric arc furnace steelmaking. It specializes in grinding media and mining consumables, including patented “Molycop” grinding balls, high-chrome balls, bolts, instrumentation, flotation chemicals, and process optimization services. It has a presence in over 40 countries, with 13 manufacturing facilities and 3 joint ventures.

Transaction Details

Integration Synergies to Drive Long-Term Growth

It serves more than 400 mines annually, including the top 10 global copper and gold miners, maintaining customer relationships averaging over 25 years. Molycap reported FY25 revenue of ₹135.2 billion (8X of Tega’s ₹16.8 billion) and EBITDA of ₹15.1 billion (4x of Tega’s ₹3.4 billion). The combined entity revenue is expected to reach ₹152 billion, up from Tega’s FY25 revenue of ₹16.4 billion.

EBITDA is likely to jump to ₹18.5 billion. TEGA consolidated EBITDA margins are expected to initially decrease from 20–21% to 11–11.5% post-acquisition. Management targets a recovery to 15% initially and further to 16–17% by the fifth year. Due to synergies, overall growth for the combined entity is expected to be even higher due to scale advantages and cross-sell opportunities.

#2 RateGain Travel Technologies: Expanding reach with Sojern acquisition

RateGain Travel is a global provider of AI-powered SaaS solutions for the travel and hospitality industry. The company assists over 3,200 customers in accelerating revenue generation through acquisition, retention, and wallet share expansion. Its marquee customers include 26 out of the top 30 hotel chains, 3 out of the top 4 airlines, and 7 out of the top 10 car rentals.

AI-Powered SaaS Platform for Global Travel

The technology stack supports the processing of over a billion transactions annually, capturing and analyzing over 148 billion+ price point searches from 700+ global partners in real time. Its business is divided into three core segments. This includes MarTech (Marketing Technology), which focuses on increasing direct bookings and optimizing return on Ad Spend.

The Martech segment contributed 47.6% of revenue. Next is DaaS (Data as a Service), which provides real-time pricing, competitive information, and demand forecasting. This segment contributed 32% of revenue. Finally, comes Distribution, which connects hotels to over 400 online travel aggregators and Gain Data Advantage systems, enabling the sharing of availability, rates, and content.

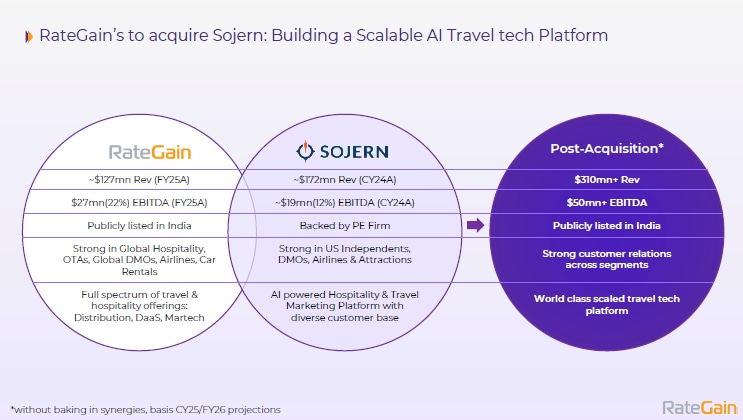

RateGain revenue in FY25 rose 12.5% year-on-year to ₹10.7 billion, driven by the MarTech segment, which rose 18.9%. Subscription and hybrid revenue streams contributed 57.5% of total revenue, ensuring revenue visibility. EBITDA grew by 22.3% to ₹2.3 billion, with margin expansion of 180 basis points (bps) to 21.6%. Profit after tax rose by 43.7% to ₹2.1 billion.

Sojern Acquisition to Deepen US Presence

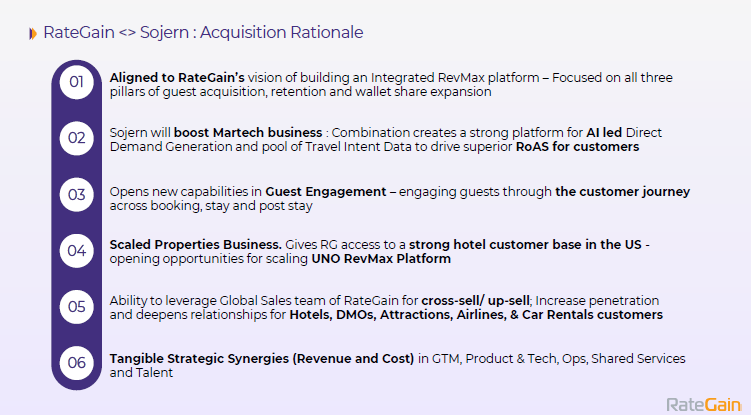

RateGain acquired 100% of US-based Sojern in September 2025 for about $250 million. A mix of cash and debt will fund the acquisition. The deal is characterized as being debt-free + cash-free + normalized working capital. The primary goal of the acquisition is to create a unique AI-first, digital marketing and distribution platform in Hospitality and Travel.

Sojern offers a Guest Experience Platform (GEP) and Guest Marketing Suite, including an AI Smart Concierge, that drives ancillary revenue and increases repeat bookings. The deal provides RateGain with access to a strong hotel customer base in the US via Sojern’s Scaled Properties Business, which can be used to scale RateGain’s UNO RevMax Platform.

Building an Integrated RevMax Ecosystem

This platform is designed to drive several key outcomes for customers: guest acquisition, engagement, and retention, as well as wallet share expansion. The acquisition is aligned with RateGain’s vision of building an Integrated RevMax platform that focuses on these three pillars.

Why RateGain is Acquiring Sojern

It will give RateGain a strong platform for AI-led direct demand generation and pool travel intent data to help customers achieve superior Return on Ad Spend (RoAS). It opens new capabilities in guest engagement, allowing hoteliers to connect with guests throughout their journey (booking, stay, and post-stay).

There are anticipated tangible strategic synergies (revenue and cost) across various areas, including Go-To-Market (GTM) strategy, Product & Technology, Operations, Shared Services, and Talent. RateGain expects to leverage its global sales team for cross-sell/up-sell opportunities across Hotels, Attractions, Airlines, and Cars.

Synergies to Strengthen Growth and Margins

RateGain consolidated revenue is expected to more than double to over $310 million, from $127 million, after accounting for Sojern FY24 revenue of $172 million. EBITDA is also expected to expand from $27 million to $50 million+, with $19 million in Sojern EBITDA. Sojern earns 85% of its revenue from the US and Europe.

Consolidated Financials will more than double.

Are Valuations Running Ahead of Fundamentals?

Rategain is trading at a price-to-earnings multiple of 35.7x, which is at a discount to the 3-year median of 61.7x. However, it is trading at a premium to the industry P/E of 29.6x. Tega, on the other hand, is trading at 64.2x P/E, a premium to the 3-year median of 47.8x and industry (35.7x).

Valuation Comparison

| Company | P/E | 3-Year Median | Industry P/E |

| Tega Industries | 64.2 | 47.8 | 35.7 |

| RateGain | 35.7 | 61.7 | 29.6 |

Both Tega Industries and RateGain have made bold, defining moves that could reshape their growth trajectories for years to come. The acquisitions may look aggressive on paper, but they also signal a shift in ambition to become global contenders in their respective sectors. For investors, the next phase will be about watching how these companies execute on integration, manage leverage, and protect margins. If done right, these bets could mark the beginning of a new growth cycle; if not, they may serve as a reminder that scale always comes with a price.

Disclaimer:

Note: Throughout this article, we have relied on data from http://www.Screener.in and the company’s investor presentation. Only in cases where the data was not available have we used an alternate but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points, and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educational purposes only.

About the Author: Madhvendra has been deeply immersed in the equity markets for over seven years, combining his passion for investing with his expertise in financial writing. With a knack for simplifying complex concepts, he enjoys sharing his honest perspectives on startups, listed Indian companies, and macroeconomic trends.

A dedicated reader and storyteller, Madhvendra thrives on uncovering insights that inspire his audience to deepen their understanding of the financial world.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The articles’ content and data interpretation are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources, and only after consulting such independent advisors as may be necessary.