India’s metro network is expanding at a pace rarely seen in urban infrastructure. According to a report by PIB, Operational routes have grown from 248 km in five cities to over 1,000 km across twenty-three cities within a little over a decade. Daily ridership has also climbed from 28 lakh to more than 1.1 crore, showing how quickly commuters are shifting to this relatively new mode of travel.

The government now expects cities to prepare detailed mobility plans, set up unified transport authorities, ensure economic viability, and bring in private participation before seeking central support. This has brought structure and long-term visibility to metro development.

As metros continue to expand, tunnel construction is picking up as well. Growing city density and the lack of open space on the surface are pushing many new routes below ground, especially where planners want smoother, uninterrupted corridors. Tunnels now feature prominently in metro extensions, hillside routes, and multi-modal links. This shift reduces land acquisition hurdles and supports faster construction, creating steady demand for companies capable of handling complex underground engineering.

This combined surge in metro and tunnel activity makes the broader transit ecosystem an interesting space for investors. Public spending remains strong, project visibility is high, and ridership growth is stable. Most projects also run over several years, offering a long runway for companies with reliable execution strength.

In this environment, only a handful of engineering and construction players really come to the fore, largely because they have the scale, the specialised skills and the steady involvement in major metro and underground projects. They have long experience with complex civil structures, strong execution capabilities, and a visible pipeline of urban-transit projects.

This blend of proven expertise and ongoing project traction makes them better placed than many peers to benefit from India’s shift toward fast, clean, and underground mobility.

#1 The heavyweight: Larsen & Toubro

Larsen & Toubro (L&T) is a multinational conglomerate which is primarily engaged in providing engineering, procurement and construction (EPC) solutions in key sectors such as infrastructure, hydrocarbon, power, process industries and defence, information technology and financial services in domestic and international markets.

This L&T group company saw steady momentum in its heavy civil and transport infrastructure segments during Q2 FY26, helped by a solid pipeline of domestic projects and better on-ground execution. Management pointed out that government spending on transport corridors — especially metros and elevated routes — remains strong, with most large opportunities still coming from state and central agencies.

Executives said an extended monsoon slowed progress in some infrastructure jobs during the quarter, but activity is expected to pick up in the second half as execution cycles normalise. Order prospects in the infrastructure segment stand at Rs 6.5 trillion, with transportation and heavy civil works together forming over a third of the pipeline.

This includes opportunities in large urban corridors where tunnel and metro construction remain core components. L&T expects improved execution efficiency and a clearer payment environment to support margin stability as these long-cycle projects scale through FY26.

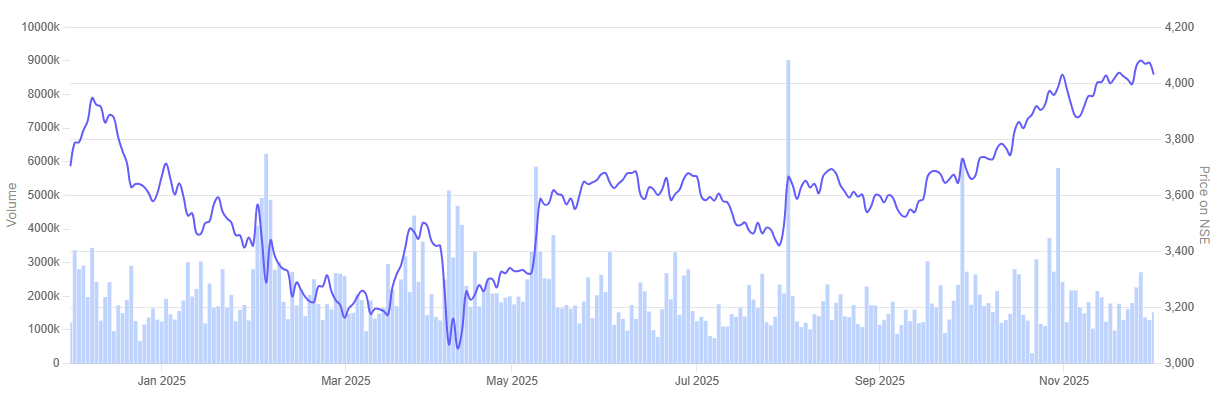

In the past one year Larsen Toubro share price is up 8.9%

Larsen Toubro 1 Year Share Price Chart

#2 The rail specialist: Ircon International

Ircon International (IRCON) commenced its business in 1976 as a railway construction company, it diversified progressively since 1985 as an integrated engineering and construction PSU specializing in large and technologically complex infrastructure projects in various sectors such as railways, highways, etc.

Ircon International reported steady progress on its rail and transport engineering portfolio despite a challenging quarter. Revenue for Q2 stood at Rs 2,112 crore, supported by continued execution across domestic railway and EPC corridors, which form the company’s core business.

Management said project activity was slower in the first half but is expected to pick up as execution typically accelerates in later quarters. At the end of Q2 FY26 the order book remained strong at Rs 23,865 crore, with 91% linked to domestic projects, including large railway and connectivity works that often involve tunnelling and complex civil structures.

Fresh inflows of more than Rs 4,000 crore in the first half highlight sustained demand, while some existing jobs have also seen expanded scope. Ircon is diversifying into signaling technologies and select hydro projects as competition intensifies in conventional rail packages.

Margins remain under pressure due to lower-priced bids and losses in a few projects, but management expects stability as new orders move into execution.

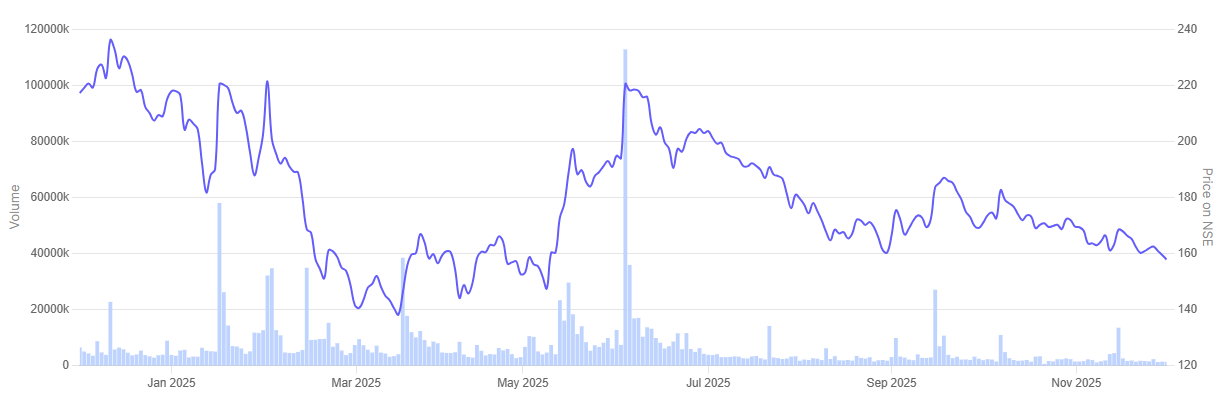

In the past one year Ircon International share price tumbled 27.4%

Ircon International 1 Year Share Price Chart

#3 The underground expert: Afcons Infrastructure

Incorporated in 1959, Afcons Infrastructure is an infrastructure engineering and construction company.

Afcons Infrastructure reported steady momentum across its transport and underground engineering portfolio, supported by strong execution on metro, rail and tunnel projects. Management said order inflows were healthy, with marine and urban-transport packages forming a significant share of the pipeline.

The company highlighted progress on several complex underground works, including long-distance tunnels and city-centre excavation jobs that require advanced engineering and tight coordination with local authorities. Approvals and clearances on a few large projects were delayed, but activity is expected to accelerate as conditions stabilise in the second half.

Overseas operations also contributed, with contracts in Africa and the Middle East adding scale to its tunnelling and heavy civil businesses. Afcons said margins were affected by cost pressures and slower site mobilisation in some regions, but it expects improvement as newer projects move into the execution phase.

The company remains focused on expanding its presence in high-value transport corridors and technically demanding underground infrastructure.

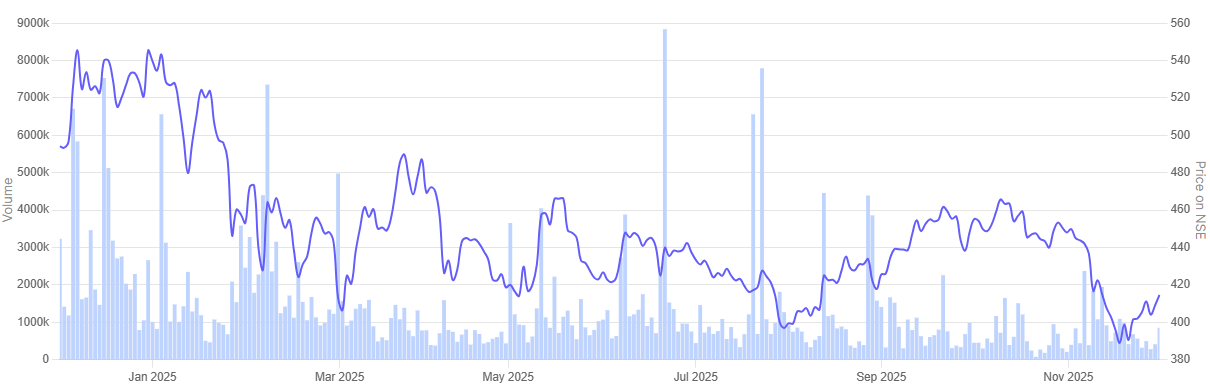

In the past one year Afcons Infrastructure share price is down 16%.

Afcons Infrastructure 1 Year Share Price Chart

#4 The turnaround bet: Hindustan Construction Company

Established in 1926, Hindustan Construction Company (HCC) is the flagship of the Hindustan Construction Company Group (HCC Group). HCC is involved in engineering and construction of infrastructure projects such as dams, tunnels, bridges, hydro, nuclear and thermal power plants, expressways and roads, marine works, water supply, irrigation systems and industrial buildings across the country.

Hindustan Construction Company reported steady progress across key metro and underground engineering projects during the quarter. The company highlighted the inauguration of its Mumbai Metro underground stations, including CST, Kalbadevi, Girgaon and Grant Road, marking a major milestone in its urban transit portfolio.

Work on the Patna Metro packages, secured this year, is also advancing, while the newly won Indore Metro project has been fully mobilised and is moving into active execution. HCC said tunnelling is progressing well at the Vishnugad Pipalkoti hydro project, where 7.5 km of the 12.1 km TBM drive has been completed.

Management noted that several bids under evaluation include complex transport and underground works, and the company remains selective in pursuing larger projects with better margins. HCC expects execution to improve as new metro and tunnel contracts ramp up, supporting a more stable outlook even as legacy projects taper off.

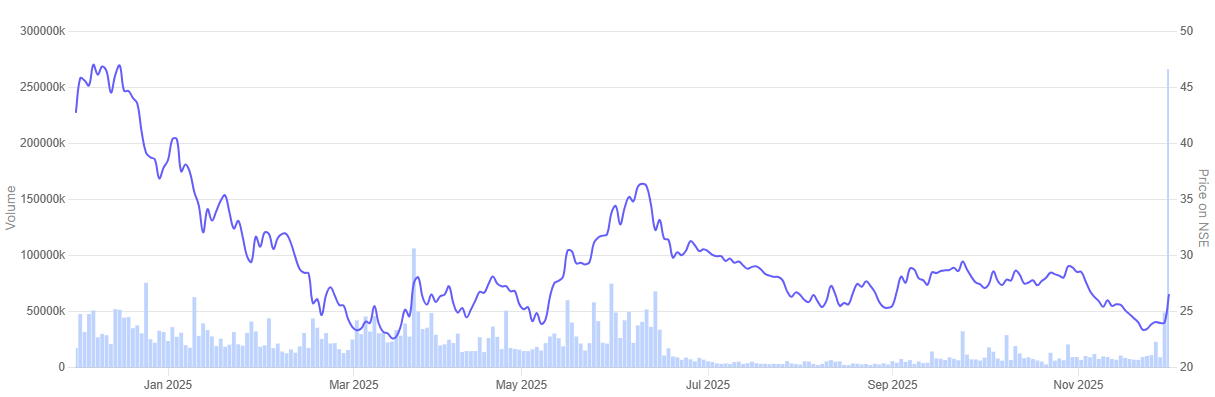

In the past one year Hindustan Construction Company share price is down 16%

Hindustan Construction Company 1 Year Share Price Chart

Valuations

Let’s now turn to the valuations of the engineering and construction companies in focus, using the Enterprise Value to EBITDA multiple as a yardstick.

Valuations of Engineering and Construction Companies in India

| Sr No | Company | EV/EBITDA | 10 Year EV/EBITDA Median | ROCE |

| 1 | Larsen and Toubro | 17.1 | 14.2 | 14.5% |

| 2 | Ircon International | 12.9 | 4.0 | 11.6% |

| 3 | Afcon Infrastructures | 9.7 | 10.2 | 19.6% |

| 4 | Hindustan Construction Company | 9.0 | 9.8 | 25.2% |

| Industry Median | 18.2% |

The picture here is more nuanced than in other sectors. Larsen & Toubro is trading above its 10-year median, reflecting its scale, balance-sheet strength and steady ROCE profile. Ircon, however, stands out for a different reason. Its current multiple is far higher than its historical median, suggesting a sharp re-rating even though its return ratios remain moderate.

Afcons and HCC, on the other hand, trade broadly in line with their long-term medians despite delivering strong Return on Capital Employed (ROCE) — in fact, both show healthier profitability metrics than the industry median.

This raises an important question. When companies with stronger returns are not always valued at a premium, and some others trade well above their usual ranges, it becomes important to step back and see whether the market is judging future growth and execution risks fairly.

As always, the most attractive opportunities emerge when strong businesses with solid returns are available at reasonable valuations.

Conclusion

India’s push toward faster, deeper and more connected urban transit has created a steady market for companies with the skill and scale to handle complex civil engineering. The momentum in metro corridors and the growing shift toward underground routes suggest that this theme will remain relevant as cities continue to expand.

Yet, while the structural opportunity is clear, the performance of individual companies will still depend on execution quality, balance-sheet discipline and the ability to manage long project cycles without slipping on margins.

Valuations add another layer to the discussion. Some companies have seen their valuations move up sharply, yet others with stronger returns still trade near their long-term ranges. This gap suggests that the market is weighing each business differently, and the results may not play out in the same way for everyone. For investors, the broader story is encouraging, but it doesn’t lend itself to quick conclusions.

It helps to look closely at the quality of the order book, the pace of execution and the financial footing of each company, along with where the valuation stands today. In a sector shaped by long project cycles and shifting risks, taking the time to make a thorough assessment becomes especially important before deciding on any investment.

Note: We have relied on data from www.Screener.in throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Ekta Sonecha Desai has a passion for writing and a deep interest in the equity markets. Combined with an analytical approach, she likes to dig deep into the world of companies, studying their performance, and uncovering insights that bring value to her readers.

Disclosure: The writer and her dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.