When it comes to defence shipbuilding in India, Mazagon Dock Shipbuilders has long ruled the seas. From stealth destroyers to submarines, it builds the most complex platforms for the Indian Navy and investors have rewarded it with premium valuations.

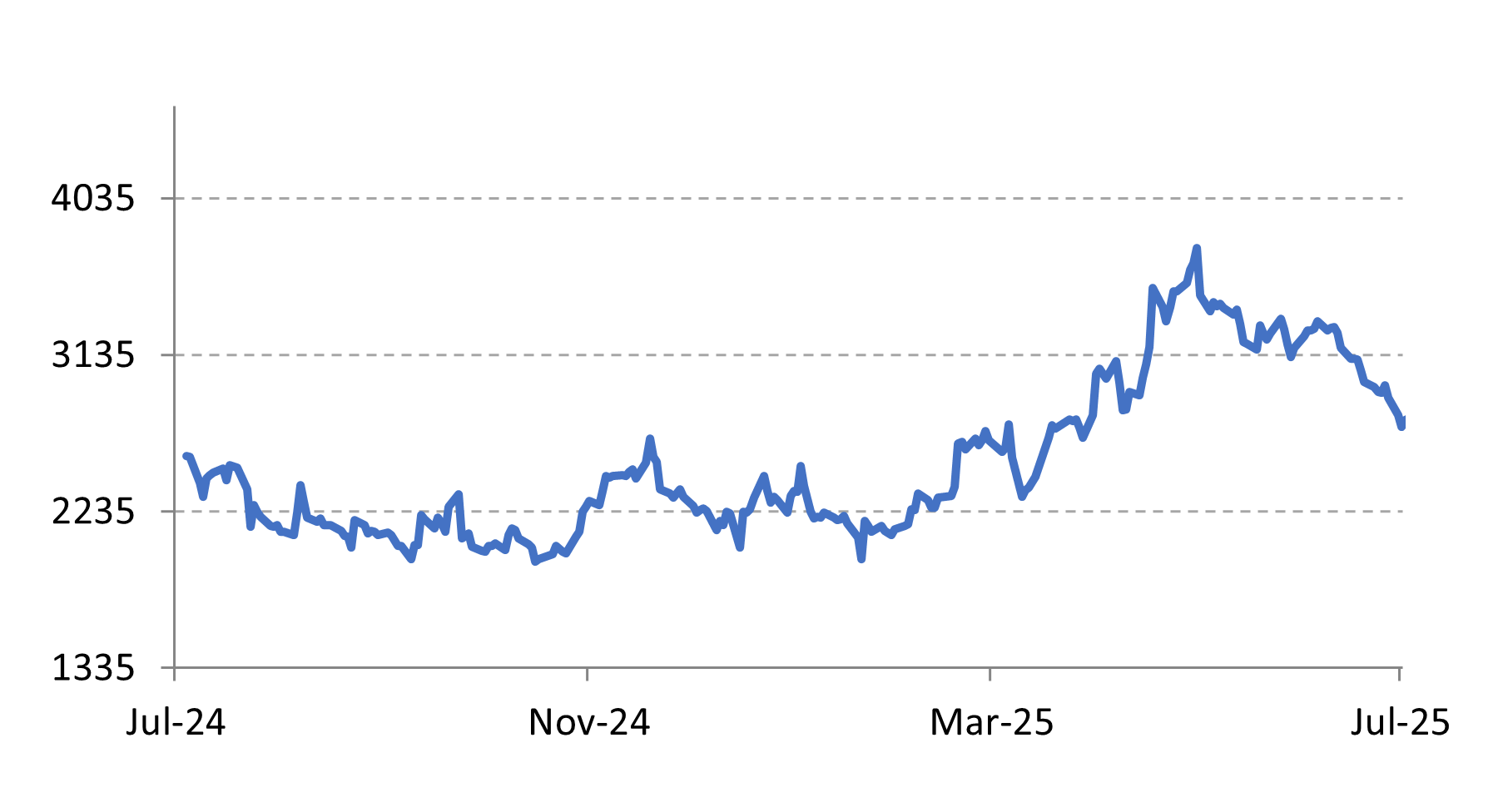

Mazagon Dock Price Chart – 1-Year

But quietly and methodically, another PSU is getting ready to challenge that status. Garden Reach Shipbuilders & Engineers, is looking less like a junior partner and more like a credible rival.

The company is smaller, yes.

But it’s leaner, more diversified and has ample opportunities that could help enhance its size.

And, from the looks of it, Garden Reach might just be walking the same path that made Mazagon Dock a market darling.

Order-book stands tall

The real reason Garden Reach is turning heads is its Rs 23,877 crore order book. That includes 40 platforms across 10 different projects, covering everything from anti-submarine ships and patrol vessels to survey ships and multi-purpose vessels for export.

Two major orders that could transform the company’s scale are in the final stages of bidding. The Next-Generation Corvette (NGC) project, worth Rs 36,000 crore, is expected to be awarded in the next few months. Garden Reach believes it has the inside track and could bag Rs 25,000–30,000 crore as the L1 bidder.

The follow-up P-17 Bravo stealth frigate project is even larger, with an estimated value of Rs 70,000 crore. Garden Reach is competing with Mazagon Dock and one other shipyard for the order.

Together, these could more than double Garden Reach’s order book over the next 12–18 months.

But it doesn’t stop there.

The pipeline includes a lot more things such as 31 waterjet fast attack crafts, 120 fast interceptor crafts, 6 next-gen offshore patrol vessels, 5 next-gen survey vessels and 2 multi-purpose vessels.

Even if Garden Reach wins only a part of these, it’ll have enough work to keep yards busy well beyond 2030.

Diversifying beyond defence

While Mazagon has stayed focussed on submarines and warships, Garden Reach is casting a wider net.

It recently won a World Bank-funded order for 13 hybrid ferries from the West Bengal government. It also signed a multi-purpose vessel deal with a German client and is executing two export orders for friendly foreign nations.

The company has also built out its ship repair vertical, a capital-light, high-margin segment that’s still small but growing quickly. It has already started executing export repair contracts, including those from European clients.

In other words, Garden Reach isn’t just dependent on the Indian Navy. It’s hedging its future through diversification, something most PSUs struggle with.

Execution is gaining steam

Large order books are great. But they mean nothing without delivery discipline. On that front, Garden Reach’s track record is improving.

Its flagship Project-17 Alpha stealth frigates total about Rs 19,300 crore, of which roughly Rs 11,400 crore remains to be executed. Garden Reach handles three ships alongside Mazagon Dock. The first built by Garden Reach, INS Himgiri, completed Contractor Sea Trials in March 2025 and is expected to be delivered by mid 2025 — ahead of schedule.

Under the Anti Submarine Warfare Shallow Water Craft (ASWSWC) project, Garden Reach is building eight of 16 vessels under a Rs 6,311 crore contract. The first ship, INS Arnala, was delivered in May 2025 and commissioned in June. Subsequent vessels like INS Ajay are already launched and due by late 2025 or early 2026.

In the Next Gen Offshore Patrol Vessel (NGOPV) contract, part of an Rs 17,500+ crore deal shared with Goa Shipyard, Garden Reach’s share is about Rs 3,300 crore for four vessels. Construction began in early 2024 and deliveries are slated to begin from late 2026. That’s rare in a PSU context.

A rock-solid balance sheet

Garden Reach’s balance sheet is debt-free. The shipbuilder has reported consistent profitability and no history of messy write-offs or impairments.

Over the past 10 quarters, the company has steadily grown both its top line and bottom line, all while keeping costs in check. In Q4FY25, revenue rose 62% year-on-year to Rs 1,642 crore. Operating profit margins improved sharply to 13%, up from 9% a year ago.

For FY25, Garden Reach’s revenue rose 41% year-on-year to Rs 5,076 crore, while profit after tax grew 48% to Rs 527 crore. Operating profit margins improved to 8%, from 7% in FY25.

Unlike many capex-heavy PSUs, Garden Reach has achieved this growth without raising debt or diluting equity. That puts it in rare company, especially in India’s defence ecosystem, where delays and working capital blowouts are common.

What Garden Reach can learn from Mazagon

There are clear parallels. Mazagon Dock’s stock took off once its revenue Rs 5,000 crore, profit started compounding and dividends flowed. Garden Reach, while smaller, is entering a similar phase.

With consistent execution, export opportunities and the potential to win once-in-a-decade mega-contracts, it seems well-placed to go places.

To be clear, Mazagon is still far ahead on several fronts. FY25 revenue of Rs 11,432 crore and PAT of Rs 2,414 crore dwarf Garden Reach’s current scale. Mazagon has deeper submarine and destroyer capabilities, more automation and stronger Navy ties. It also sits on a war chest cash, with zero debt.

But, keep in mind, Garden Reach is starting from a smaller base, which makes its growth runway much longer. The company is also more diversified and doesn’t carry the weight of legacy projects that could slow down profitability.

So what could go wrong?

To win big orders, Garden Reach may price too tightly. Any cost overruns or material delays could dent margins. While export diversification is good, it also brings risks of contract penalties, compliance issues and foreign exchange losses. The Denmark hybrid ferry contract, for example, led Mazagon to take provisions this year.

It’s one thing to deliver 2–3 ships a year. It’s another to manage 40+ vessels across defence, commercial and export contracts simultaneously. Scale brings complexity and Garden Reach is still learning to handle it.

Then there’s valuation. Garden Reach isn’t exactly cheap. It trades at over 57x trailing earnings, which is higher than even Mazagon Dock at around 52x despite Mazagon being larger and enjoying higher margins. The market is clearly pricing in a big leap in Garden Reach’s scale and profitability, assuming its pipeline will convert smoothly, execution will remain disciplined and exports will ramp up without trouble.

But expectations can be tricky. If any of the large defence orders like the P-17 Bravo frigates or the Next-Gen Corvettes face delays or go to competitors, investor sentiment could take a hit. Even if Garden Reach wins, many of these projects will start contributing to revenue meaningfully only by late FY26 or FY27. That leaves a window in FY25 and FY26 where revenue growth may slow despite a healthy pipeline.

In conclusion, for a stock trading at premium multiples, any slip in execution, cost overruns or delay in order conversion could spark a correction. The long-term story remains intact, but the valuation leaves little room for disappointment.

Disclaimer

Note: We have relied on data from www.Screener.in throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Manvi Aggarwal has been tracking the stock markets for nearly two decades. She spent about eight years as a financial analyst at a value-style fund, managing money for international investors. That’s where she honed her expertise in deep-dive research, looking beyond the obvious to spot value where others didn’t. Now, she brings that same sharp eye to uncovering overlooked and misunderstood investment opportunities in Indian equities. As a columnist for LiveMint and Equitymaster, she breaks down complex financial trends into actionable insights for investors.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article. The website managers, its employee(s) and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.