India has pledged to reduce emissions intensity by 33-35% from 2005 levels by 2030. To this end, incorporating sustainable transportation solutions such as electric mobility is emerging as a key area in the automobile industry. According to the Indian Brand Equity Foundation, the total global electric vehicle (EV) market is expected to reach $4,360 billion by 2033, up from $755 billion in 2024.

Additionally, the Indian EV market is projected to reach $164.4 billion by 2033, up from $2.3 billion in 2024. In India, EV sales grew 16.9% to 1.9 million units in fiscal year 2025, up from 1.7 million units the previous year. This shift is being led by electric two-wheelers, whose sales grew 20% year-over-year to 1.1 million in FY25, and the government estimates this will reach 1.7 million by FY30.

This ever-increasing market size is fuelling demand for advanced technology and infrastructure, opening new growth avenues for several companies.

Here are three stocks that stand to benefit from increasing EV penetration globally…

#1 KPIT Technologies: Strengthening its base in emerging EV hubs

KPIT Technologies is a technology company focused on automobile engineering and mobility solutions. It positions itself as a global partner dedicated to making software-defined vehicles a reality, helping the mobility sector move towards a cleaner, smarter, and safer future. KPIT helps customers move to software-defined vehicles and accelerate electrification.

Diversified across powertrain technologies

The company provides solutions across multiple powertrain eras, including electric (EV), hybrid, and conventional powertrains, to help OEMs address these changes. Each vertical offers software IP, software integration, feature development, and verification and validation services. KPIT is present in 14 countries across the Americas, Europe, and the Asia-Pacific (APAC) region.

Temporary dip in financial performance

From a financial perspective, revenue declined 12.8% year-on-year to ₹15.4 billion in Q1FY26. The commercial vehicles vertical fell due to a specific client ramp-down. EBITDA (earnings before interest, tax, depreciation, and amortization) grew 12.4% to ₹3.2 billion, while margins remained stable. Profit after tax (PAT) declined 15.8% to ₹1.7 billion. Rupee depreciation and cost optimization helped protect the margin.

Building momentum for the second half

Looking ahead, KPIT’s pipeline remains strong, with new contracts worth $241 million completed in the first quarter of FY26. These large contracts are expected to contribute to revenue growth in the second half. Among geographies, Europe is expected to lead growth as KPIT has the strongest pipeline. In the US, both the car OEM and truck sectors will drive growth.

The company’s first half is expected to be volatile and uncertain due to tariff-related challenges. However, management expects the second half to be better than the first, and momentum is likely to accelerate as the year progresses. KPIT sees high growth in the powertrain and connected segments of the passenger car sector in the US and Europe. KPIT is also developing a breakthrough Sodium-Ion battery technology.

Expanding footprint in India and China

The company is also bullish on the Indian and Chinese markets, seeing a growing number of products there. It focuses on India-for-India solutions to help customers deploy India-specific products. This includes work on electric trucks, buses, and passenger cars. In India, KPIT has partnered with JSW Motors to accelerate new energy mobility.

The company expects these geographies to become significant revenue contributors within the next six months and to reach three-digit million dollars within two years.

#2 LTTS Technologies: Exposure through mobility and sustainability segment

LTTS Technologies, a subsidiary of Larsen & Toubro, is a global leader in engineering research and development services and technology consulting. It focuses on design, development, consulting, and sustainment services in products and processes for its diverse global customers.

Expanding presence across geographies and clean energy solutions

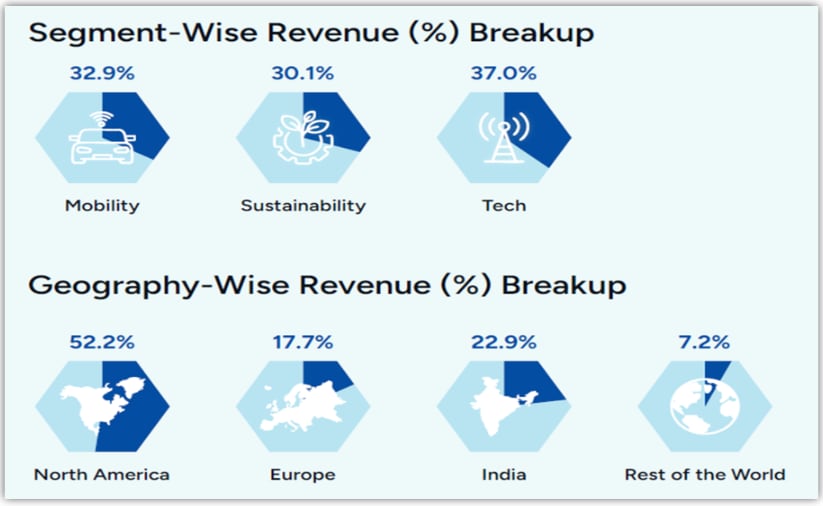

Within the geographic mix, North America is projected to contribute 52.2% of revenues in FY25, followed by Europe (17.7%), India (22.9%), and the rest of the world (7.2%). LTTS also actively engages with clean energy initiatives and services.

LTTS’s sustainability business segment accounts for 30% of the total revenue in FY25, and is the most profitable segment. This segment supports customers in adopting smart and responsible processes, including energy transition. This includes end-to-end solutions, such as renewable system design, digital energy management, and advanced energy storage technologies.

LTTS Revenue-Mix

On the other hand, LTTS maintains a leadership position in electrification and hybrid technology. Its mobility segment contributes 32.9% to its total revenue. LTTS operates an industry-leading EV lab in Bengaluru, India, serving as a hub for the development and testing of advanced EV technologies. LTTS is well-positioned in developing the next-gen EV platform, as it expects EV sales to account for 25-30% of the global automotive market by 2030.

Steady financial performance amid segmental volatility

From a financial perspective, LTTS revenue in Q2FY26 rose 15.8% year-on-year to ₹29.8 billion. The Sustainability segment achieved double-digit growth for two consecutive quarters. It grew 12.6% in Q2FY26, while the tech segment rose 28.6%. The growth was weighed down by a 10.1% decline in the mobility division, which is facing sectoral challenges.

This is because US automakers are currently undecided whether to continue investing heavily in electric vehicles (EVs) or return to internal combustion engine (ICE) technology. European companies are facing stiff competition from Chinese EV companies, which are selling cars at significantly lower prices. That said, it expects a turnaround in the second half of FY26.

Nonetheless, EBITDA increased by 5.3% to ₹4.9 billion, while PAT rose just 2.8% to ₹3.2 billion. With the tariff picture becoming clear, LTTS expects improvement in both revenue and EBIT margins in H2 of FY26 due to the increased order book and focus on profitable growth.

Poised for stronger growth in the second half

The company achieved a record high total contract value of $300 million during the quarter. This also includes a contract in the Mobility segment to establish a dedicated Offshore Development Center (ODC) in India for a global leader in lifting and material-handling solutions. In addition, the mobility segment secured 5 deals worth $10 million in Q1FY26.

Deal wins centered around SDV, AI, next-gen product design, software design development, and digital engineering. In addition, LTTS is investing heavily in AI, including Gen AI, Agentic AI, and Physical AI, to consolidate its leadership in engineering and industrial AI. LTTS plans to achieve $2 billion in revenue in the medium term and aims for double-digit growth in FY26.

#3 Tata Technologies

Tata Technologies is a global engineering and digital services company that helps businesses design, develop, and deliver better products. It operates under the vision of engineering a software-defined future for all. The company is a subsidiary of Tata Motors.

Enabling the shift toward cleaner mobility

Tata Technologies is well-positioned to enable the transition towards cleaner products, with a focus on the automotive sector. The company provides expertise in electrification (EVs), next-generation propulsion, and battery innovations. It is recognized as being among the top two global engineering service providers in electrification.

Its offerings support the development of hydrogen-based propulsion systems. The company’s work also includes circular design, carbon footprint tracking, and recyclable material development. The shift towards electrification and hybridization drives demand for engineering investments in battery technology, charging infrastructure, and vehicle architecture redesign.

Diversified presence across core industry verticals

The company’s offerings are primarily focused on three key industry sectors. The first is automotive, which is its largest vertical. This sector focuses on connectivity, software-defined vehicles, electrification, and AI-powered ecosystems. The company also has a 50:50 joint venture with BMW Group. The JV focuses on developing automotive software and solutions.

The aerospace vertical offers airframe engineering, cabin interiors, digital maintenance, repair, and overhaul, propulsion systems, and digital thread integration. Whereas the Industrial Heavy Machinery vertical focuses on off-highway equipment and commercial vehicles, and embedded software, smart manufacturing, and AI/General AI-enabled solutions.

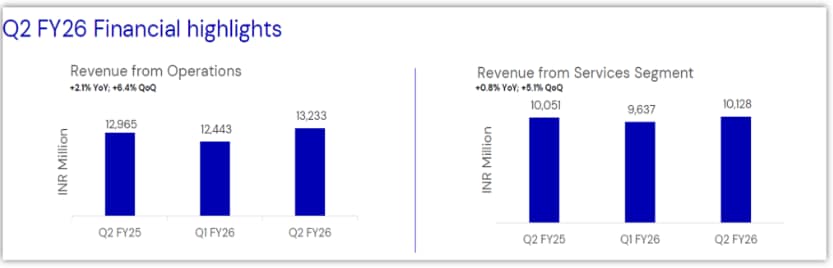

Steady financials amid short-term challenges

From a financial perspective, revenue grew 2.1% year-over-year to ₹13.2 billion, led by the technology solutions segment, which rose 6.6%. On the other hand, the services segment rose only 0.8% to ₹10.1 billion. The services segment accounted for 77% of revenue, while 23% came from technology solutions. EBITDA margin declined 190 bps to 27.2%, while PAT grew by 5.1% to ₹1.6 billion.

Tata technology financials

The near-term outlook remains cautious. The management anticipates some moderation in momentum during Q3FY26, due to temporary headwinds. The company was also hit by a cyber attack on JLR’s IT systems. The long-term outlook remains encouraging, with visible recovery signs across all three major industry verticals.

Valuations reflect long-term growth potential

From a valuation perspective, KPIT is trading at a price-to-earnings multiple of 39.4x, above industry (29.9x), but below its 5-year median of 57.9x. LTTS, on the other hand, is trading in line with its 10-year and sector median. Tata Technologies is trading at a premium to the industry median.

Valuation Comparison (X)

| Company | P/E | 10-Year Median | Industry Median |

| KPIT Technologies | 39.4 | 57.9 (5-Year) | 29.9 |

| LTTS Technologies | 34.7 | 33.5 | 34.5 |

| Tata Technologies | 40.4 | 58.8 (2-Year) |

India’s accelerating EV adoption is creating a multi-year opportunity for technology-driven companies like KPIT Technologies, LTTS, and Tata Technologies. While near-term volatility may persist due to global tariff and demand uncertainties, these firms remain well-positioned to benefit from the long-term shift toward electrification, sustainability, and software-defined vehicles, making them key beneficiaries of India’s clean energy transition.

Disclaimer:

Note: Throughout this article, we have relied on data from http://www.Screener.in and the company’s investor presentation. Only in cases where the data was not available have we used an alternate but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points, and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educational purposes only.

About the Author: Madhvendra has been deeply immersed in the equity markets for over seven years, combining his passion for investing with his expertise in financial writing. With a knack for simplifying complex concepts, he enjoys sharing his honest perspectives on startups, listed Indian companies, and macroeconomic trends.

A dedicated reader and storyteller, Madhvendra thrives on uncovering insights that inspire his audience to deepen their understanding of the financial world.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The articles’ content and data interpretation are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources, and only after consulting such independent advisors as may be necessary.