A report by Adecco estimates that India’s aerospace, drone, and space technology industry could more than quintuple to US$44 billion (about ₹4 lakh crore) by 2033. The report states the sector is now becoming a full-scale industry, generating employment amid strong demand for engineers, data scientists, and business professionals. It is estimated that this sector will create over 200,000 jobs over the next decade.

This sustained growth phase is supported by policy thrust toward domestic manufacturing, rising defence allocations, and a steadily expanding civil aviation ecosystem. Higher passenger traffic and ongoing airport infrastructure upgrades are together creating a more integrated and resilient aerospace value chain.

Government-led reforms, rising private participation, and deeper collaboration with global OEMs are accelerating this shift, positioning India as a meaningful contributor across multiple layers of the global aerospace and defence landscape.

This opportunity extends well beyond aircraft manufacturing. The ecosystem now spans avionics, radar, precision-engineered components, electronic subsystems, and satellites, along with their upstream and downstream supply chains.

Here are three stocks that could benefit from this growing market…

#1 MTAR Technologies: Aerospace and defence revenue seen scaling 5x by FY30

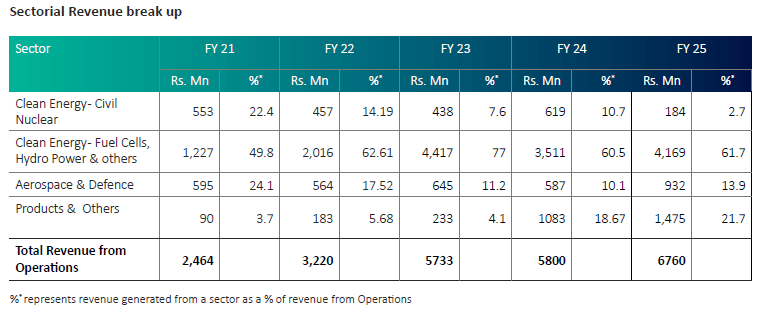

The aerospace and defence sector is a significant and growing segment for MTAR Technologies. It supplies precision-engineered assemblies and components for domestic defence programs and other applications. Clean Energy is the largest business segment, accounting for 64.4.8% of FY25 revenue, followed by Products and Others (21.8%) and Aerospace and Defence (13.8%).

MTAR Revenue-Mix

Aerospace capabilities anchored in space and launch systems

MTAR manufactures complex subsystems and precision-engineered products for space, defence, and multinational (MNC) aerospace customers. Its key products include Propulsion Systems, Modules, and Structures.

It is a long-term partner of ISRO, providing mission-critical products for launch vehicle programs, like the Polar Satellite Launch Vehicle and the Geosynchronous Satellite Launch Vehicle (GSLV). ISRO here stands for Indian Space Research Organisation.

Deepening engagement with ISRO across critical propulsion programmes

The company is developing Grid Fin Structures for the Gaganyaan human spaceflight mission and is advancing the Semi-Cryo Engine, intended to enhance GSLV payload capacity. The first hardware for the Semi Cryo Engine is expected by the beginning of FY27.

MTAR aims to increase its share of business with ISRO by expanding into products such as thrust chambers, motor casings, and lightweight alloy structures.

It has also submitted a tender for actuation systems for launch vehicles. Given ISRO’s plan for nine launches in 2025 and the increasing focus on institutional investment, MTAR expects a 20% or more increase in revenue from the space systems segment.

Expanding footprint with global aerospace OEMs

MTAR supplies products like aerostructures (wing kit assemblies), metallic boxes, engine components, housings, and drone equipment to MNC clients. It supplies these to global original equipment manufacturers like GKN Aerospace, Thales, Elbit Systems, Israel Aerospace Industries (IAI), and Collins Aerospace.

Domestically, MTAR supplies canisters, magnesium gearboxes, and actuation systems for helicopters. It has specifically delivered 5-ton and 10-ton actuators for the LCA Tejas program. MTAR expects to receive bug orders for these components.

It has also developed combustor assemblies, Electro-Mechanical Actuators, and roller screws for the Scramjet Engine for domestic defence projects. Moreover, MTAR has also partnered with Adani Aerospace for the Advanced Medium Combat Aircraft programme. The overall project entails developing five prototypes initially, followed by the manufacturing of 126 aircraft. Bid results are anticipated by March 2026.

Dedicated aerospace facility sets the stage for scale-up

To capitalise on the opportunities in the aerospace sector, MTAR has established a dedicated aerospace facility. This facility has been fully operational since January 2025. MTAR is rapidly progressing through the prototyping phase and moving towards production for several clients.

Specifically, it is currently manufacturing for GKN Aerospace. MTAR is also developing prototype projects awarded by Israel Aerospace Industries. It expects all first articles for this project to be completed by June 2027. Following this, production is expected to commence, which is projected to increase MTAR Aerospace and Defence’s margin from 14% in FY25.

Order book visibility underpins aerospace ramp-up

On the financials front, the Aerospace and Defence segment is projected to experience substantial near- and long-term growth. This sector’s order book represents 25.2% of MTAR’s total order book of ₹1,297 crore. MTAR expects to fulfil orders worth about ₹100 crore in this vertical in FY26, anticipating 80% growth from FY25 revenue of ₹93.2 crore. Of this, MTAR has already booked revenue of ₹41.4 crore in the first half of FY26.

Given that Export accounted for 78% of total revenue in the H1 of FY26, the MNC vertical will be the core revenue driver. The segment is expected to grow at an annual rate of 45-50% over the next five years. The company aims to grow its aerospace business to approximately ₹500 crore over the next 4 to 5 years.

#2 Data Pattern: ₹20,000 Crore Total Addressable Market

Data Patterns is a fully integrated defence and aerospace electronics solutions company. The company specialises in the design, prototyping, testing, qualification, production, and manufacturing of high-reliability electronic systems. Key areas of focus include radar, electronic warfare, communication systems, and avionics.

IP-led defence model built around future tenders

Its business model focuses on anticipating future defence requirements and developing indigenous, IP-driven solutions in advance to enhance its eligibility for high-value tenders. It possesses specialised domain expertise critical for aerospace applications, including Avionics, Radars, Electronic Warfare, and Communication Systems.

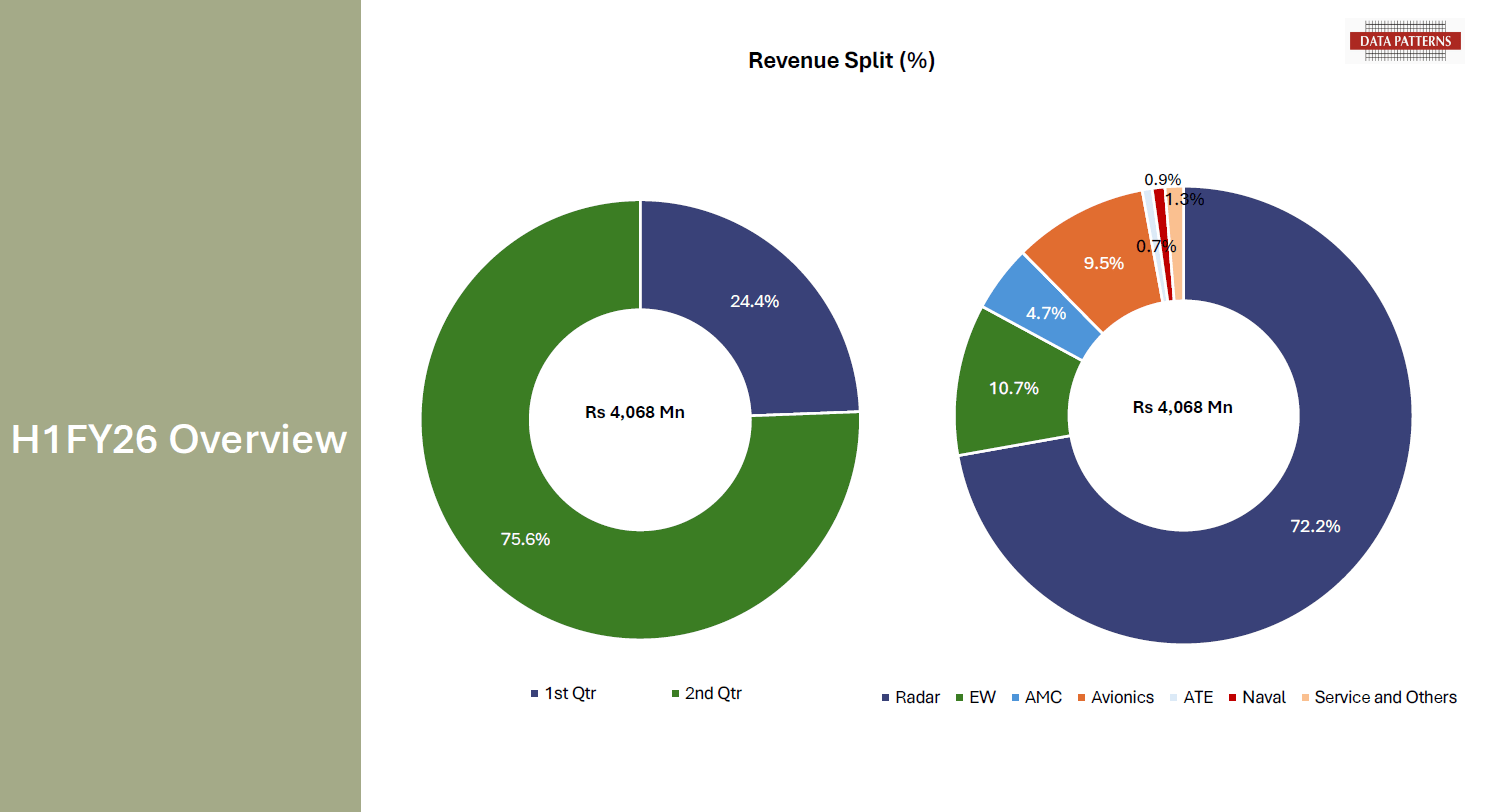

Data Patterns Revenue-Mix

Radar systems remain the core revenue driver

Radar is the largest business segment, accounting for 72.2% of the revenue in the first half of FY26. Within this segment, it develops full radar systems, including specialised airborne applications such as Fire Control Radars for fighter aircraft like the MiG-29 and Su-30.

The company is also developing Maritime Patrol Radar suitable for platforms such as Unmanned Aerial Vehicles and rotary-wing aircraft, as well as radar systems for utility helicopters.

Electronic warfare and avionics deepen platform presence

Then comes the Aerospace Electronic Warfare (EW), which accounted for 10.7% of revenue. In this, it manufactures receivers, Airborne Wideband Jammer Pods, and the Talon Shield Jammer Pod for Su-30 aircraft to protect against enemy radars. The company developed an EW suite for the Super Sukhoi aircraft (of which the pod is a part) and offered it to the Air Force.

Avionics is another part of Data Patterns’ revenue profile, contributing 9.5% of the total revenue in H1 FY26. Specific systems include glass cockpit displays and systems for platforms such as the Light Combat Aircraft and Intermediate Jet Trainers. The company states that its avionics range is unique in India.

In Communication Systems, it develops air and satellite-based platforms, including Airborne Software-Defined Radios, specialised radio relays for airborne platforms, and a Two-Channel (2-CH) Programmable Radio (SDR Next Generation System) suitable for supersonic aircraft. The company is also involved in the BrahMos missile program.

Space, missiles, and next-gen aircraft expand the addressable market

The company has a history of association with Indian space organisations, including building a Nano Satellite deployed in 2017. It also develops Satellite and Ground Station technology and is involved in developing the S-Band Space Surveillance and Tracking Radar (Alpha Radar) for tracking and discriminating deep-space targets.

₹20,000 Crores Total Addressable Market

In addition to all of the above, the company is also part of a consortium (along with BEML and Bharat Forge) for the Advanced Medium Combat Aircraft project. The Total Addressable Market for products currently under development is estimated at ₹15,000-20,000 crores. Management aims to report a revenue growth rate of 20–25% over the next 2-3years.

Order book depth underpins growth visibility

As of 30 September 2025, the order book stood at ₹673.6 crore, providing revenue visibility of over a year based on FY25 revenue of ₹520 crore. Radar, avionics, and electronic warfare (EW) together accounted for 53.6% of the total order book. It expects to secure ₹1,000 crore in orders in H2 of FY26. The order pipeline for the next 24 months is worth ₹2,000-3,000 crore.

It also aims to focus on export markets and is exploring opportunities in Europe, South America, and other international regions. Performance remained exceptional in H1 FY26, with revenue rising 108.5% to ₹406.8 crore. However, margins declined by 1192 basis points (bps) to 24.7%, resulting in net profit growth of only 18.4% to ₹74.7 crore.

#3 Astra Microwave: ₹25,000 Crore Opportunity

Astra Microwave provides technological solutions across a range of domains, including defence and aerospace, and space exploration. The company is a prominent designer and manufacturer of high-performance microwave modules, subsystems, and systems that address the stringent requirements of the defence, space, and meteorology sectors.

Defence continues to anchor the revenue base

By the first half of FY26, 81.7% of the revenue came from defence, followed by space (2.2%) and meteorology (3.2%).

In Space, Astra has been engaged in India’s space program for 25 years. The company has contributed to all major Indian satellite launches since 2008. This followed an invitation from the Indian Space Research Organisation (ISRO) in 2004 to private industry to participate in the space business.

The company has commissioned a facility in Bengaluru for the design and assembly of small satellites. Astra is currently developing its own satellite, Astra SAT-1, intended to be revenue accretive and expected to be launched within 24 months.

Deepening role in India’s space and satellite ecosystem

Astra also provides critical systems and components for various aerial and missile platforms, supporting India’s goal of achieving defence self-reliance. This includes telemetry subsystems for aircraft platforms, including the LCA Tejas and the IJT. Telemetry is crucial for missile testing, evaluation, and UAV (drone) tracking. It is also a supplier for major airborne radar programs.

Expanding from components to systems in electronic warfare

Astra is also positioned in Electronics Warfare, evolving from supplying components to building systems. The company has emerged as a successful bidder as a lead system integrator for an EW suite for the Su-30 aircraft. It is concurrently developing EW systems with DRDO, including ESM and ECM systems for naval applications.

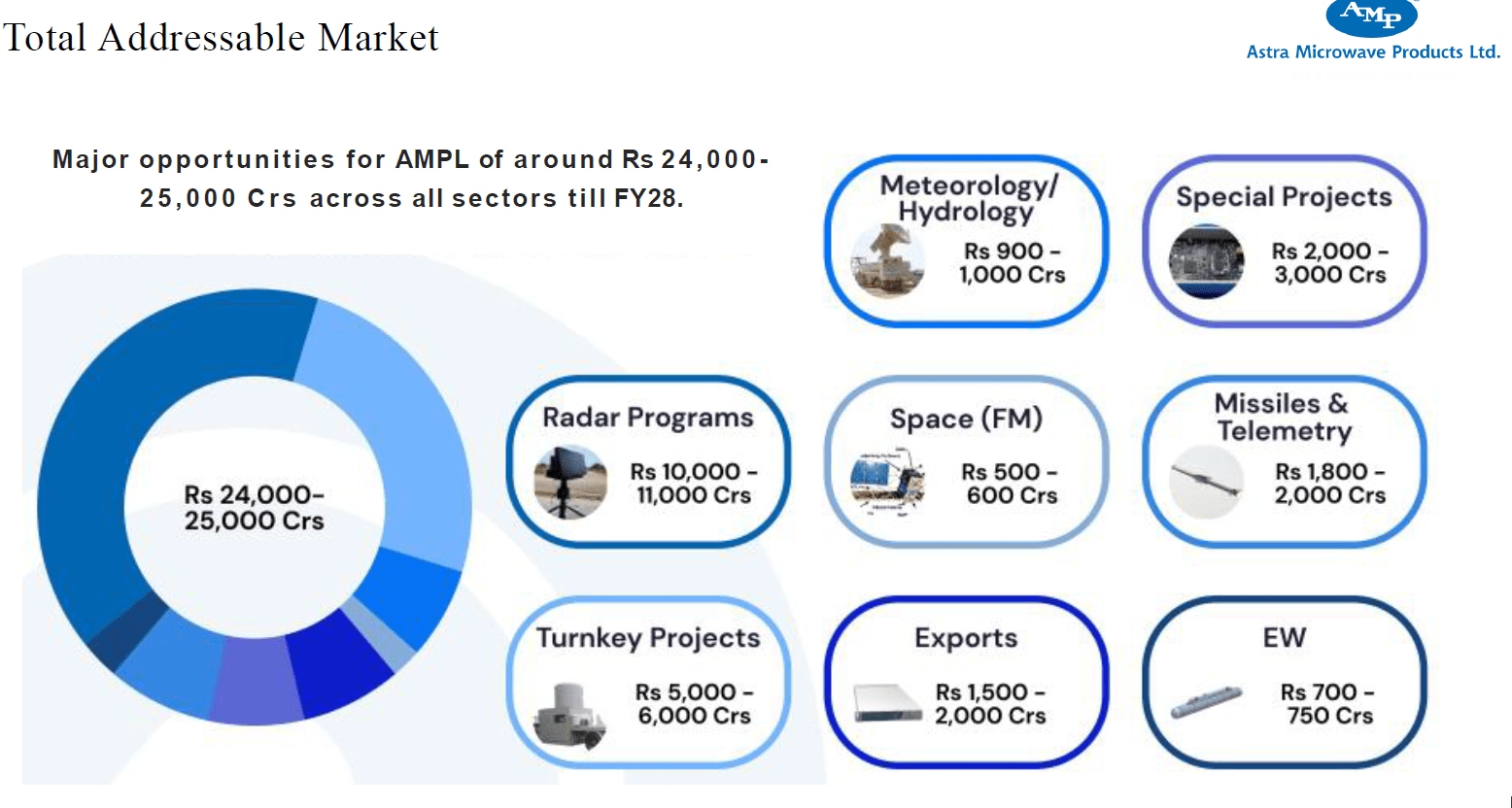

Turnover is expected to double by FY29

Looking ahead, Astra sees the space sector as a major opportunity, accounting for 2.2% of its revenues in H1 FY26. The company also plans to capitalise on major defence programs like ike QRSAMs, Uttam radars, and Su-30 EW upgrades. Astra estimates that total opportunities worth ₹25,000 crore will arise across all sectors by FY28. Of this, radars (₹11,000 crore) and missiles and telemetry (₹2,000 crore) will contribute majorly.

Total Addressable Market

Eventually, it has an ambitious long-term vision to double its turnover over the next 3-4 years, becoming a US$1 billion (about Rs 9,000 cr at current exchange rates) revenue company. The anticipated revenue for FY30, driven by these programs, is projected to be in the ₹2,250-2,500 crore range. As of 30 September 2025, Astra’s order book stood at ₹1,916 crore, accounting for about 2 years of revenue.

Valuation premium contrasts with return ratios

MTAR Tech’s valuation (price-to-earnings multiple) is significantly higher than both the industry median and its own 4-year median valuation. This is despite modest return ratios: Return on Capital Employed (RoCE) of 10.5% and Return on Equity (RoE) of 7.5%.

Valuation Assessment (X)

| Company | P/E | 4 Year Median P/E | RoCE (%) | RoE (%) |

| MTAR | 159 | 84.7 | 10.5 | 7.5 |

| Data Pattern | 62.6 | 69.0 | 21.0 | 15.2 |

| Astra Microwave | 53.4 | 55.1 (5Y) | 18.7 | 14.4 |

| Industry P/E | 60.1 | 18.1 | 14.0 | |

Data Patterns is trading in line with both the median and the industry, and its return ratios are also superior. Astra Microwave is trading at a slight premium compared to the industry and its own median multiple. Nevertheless, the scale of the opportunity remains significant, and this optimism is already reflected in premium valuation multiples.

Disclaimer

Note: Throughout this article, we have relied on data from http://www.Screener.in and the company’s investor presentation. Only in cases where the data was not available have we used an alternate but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points, and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educational purposes only.

About the Author: Madhvendra has been deeply immersed in the equity markets for over seven years, combining his passion for investing with his expertise in financial writing. With a knack for simplifying complex concepts, he enjoys sharing his honest perspectives on startups, listed Indian companies, and macroeconomic trends.

A dedicated reader and storyteller, Madhvendra thrives on uncovering insights that inspire his audience to deepen their understanding of the financial world.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The articles’ content and data interpretation are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources, and only after consulting such independent advisors as may be necessary.