When it comes to naming the top super investors of India, Mukul Agarwal is name that will probably always make it in the top few. Founder of Param Capital Group, Agarwal is widely known for his bold investment strategies which almost always have a strong impact on the markets. Which is we he is also one of the Warren Buffetts of India!

Currently, Mukul Agarwal holds 64 stocks in his portfolio, all worth Rs 7,578 cr. However, what has caught the attention of investors across the board are the 6 fresh additions to his portfolio worth almost Rs 450 cr.

Let us try and see if we can find out what is the reason behind his buying spree.

Valor Estate Ltd

Incorporated in 2007, Valor Estate, earlier known as DB Realty Limited, is engaged in the business of real estate construction, development, and other related activities.

With a market cap of Rs 9,956 cr, most of the company’s projects are based in and around Mumbai and are under various stages of planning and construction. Mukul Agarwal just bought a 1.2% stake in the company worth Rs 120 cr.

The company sales saw a 46% compound growth from Rs 160 cr in FY20 to Rs 1,133 cr in FY25. EBITDA (earnings before interest, taxes, depreciation, and amortisation) was a negative Rs 235 cr for FY20, saw an operating profit after years in FY24 of Rs 150 cr, but was down to operating losses of Rs 97 cr in FY25.

Net profit saw a rocky road in the last 5 years, with a string of losses:

| FY | FY20 | FY21 | FY22 | FY23 | FY24 | FY25 |

| Profits/Cr | -440 | -167 | 22 | -90 | 1,317 | -118 |

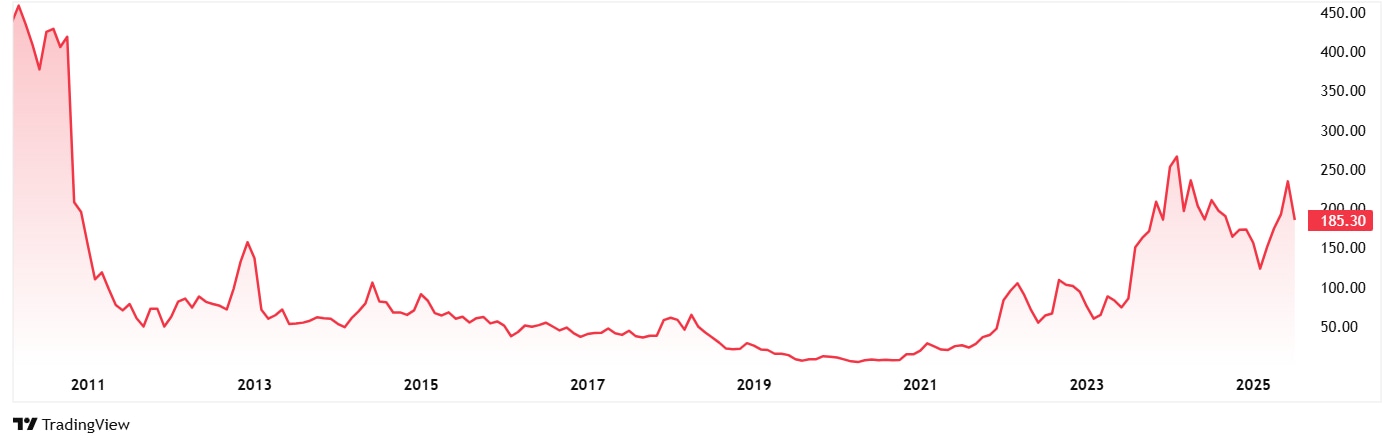

The share price of Valor Estate Ltd was around Rs 6 in July 2020, and as of the closing on 25th July 2025, it is at Rs 185, which is almost a 3,000% growth.

The company’s share is trading at a negative PE due to consistent losses, but the industry median is around 38x currently. The 10-year median PE for the company is however 19x, while the industry median for the same period is 28x.

Wendt India Ltd

Wendt India is a leading manufacturer of Super Abrasives, Machining Tools, and Precision Components. It is a joint venture between 3M (via Wendt GmbH) and Carborundum Universal (Murugappa Group). Both the companies hold 37.5% shares in the company.

With a market cap of Rs 1,934 cr, the company is a preferred supplier for many of the automobile, auto component, engineering, aerospace, defense, ceramics customers for their Super Abrasive Tooling solutions, Grinding & Honing Machines, and Precision components.

Mukul Agarwal just bought a 2.5% stake in the company worth Rs 48.4 cr.

The company’s sales grew from Rs 143 cr in FY20 to Rs 234 cr in FY25, which is a 10% compound growth. The EBITDA saw a compound growth of 23% from Rs 19 cr to Rs 53 cr in the same period. The net profits grew from Rs 10 cr in FY20 to Rs 39 cr in FY25, logging in a compound growth of 31% in 5 years.

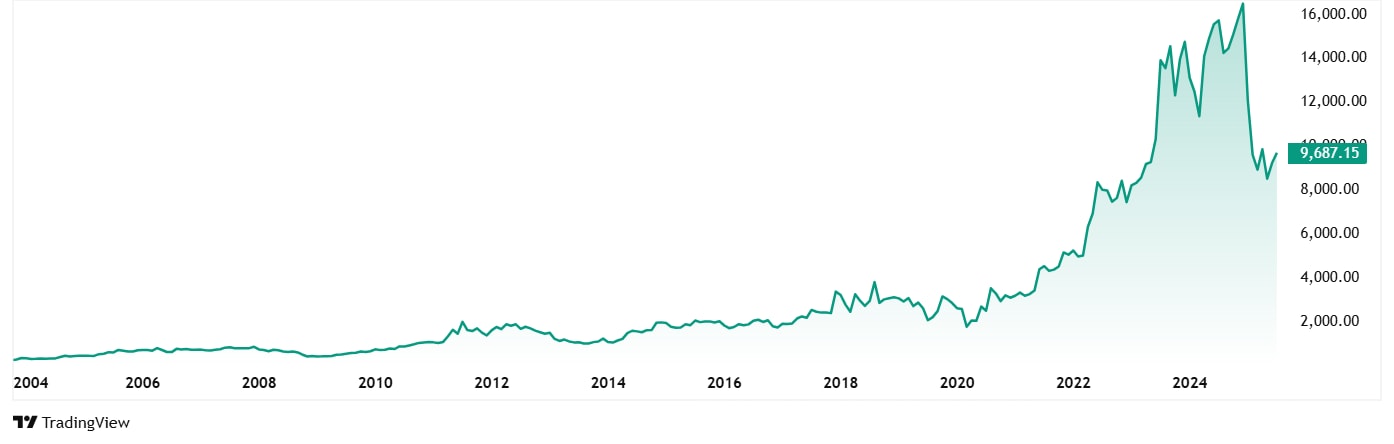

The share price of Wendt India Ltd was about Rs 2,565 in July 2020, and as of closing on 25th July 2025 it was at Rs 9,672, which is a jump of almost 280%.

The company’s share is trading at a PE of 55x which is closer to the industry median of 51x. The 10-year median PE for Wendt is 46x, while the industry median for the same period is just 36x.

Tatva Chintan Pharma Chem Ltd

Incorporated in 1996 Tatva Chintan Pharma Chem Ltd it is a manufacturer of a diverse portfolio of structure Directing Agents, Phase Transfer Catalysts, electrolyte salts for batteries, and Pharmaceutical and Agrochemical Intermediates and other Speciality chemicals.

With a current market cap of Rs 2,680 cr, the company has a portfolio of 214 products divided into categories of Pharmaceuticals & Agrochemicals Intermediates, Structure Directing Agents (SDA), Phase Transfer Catalyst (PTC) and Electrolyte Salts & Others.

Mukul Agarwal just bought a 1.3% stake in the company worth Rs 34.4 cr.

The company’s sales have grown at a compound rate of just 8% in the last 5 years from Rs 263 cr in FY20 to Rs 383 cr in FY25. The EBITDA however has seen a drop from Rs 55 cr in FY20 to Rs 34 cr in FY25. The net profits also dropped from Rs 38 cr in FY20 to Rs 6 cr in FY25.

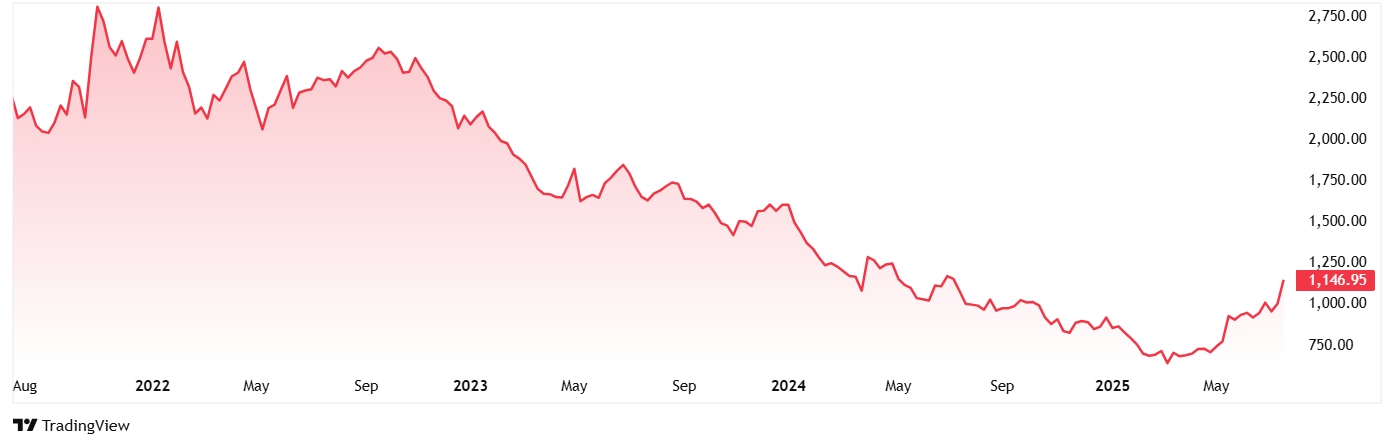

The share price of Tatva Chintan Pharma Chem Ltd was around Rs 2,265 when it was listed in July 2021. As of closing on 25th July 2025, the price was Rs 1,146 which is almost a 50% drop.

The company’s share is currently trading at a PE of a huge 374, while the industry median is at 35x. The long-term median for the company is76x, which is higher than the industry median for the same period which is 28x.

Yatharth Hospital & Trauma Care Services Ltd

Incorporated in 2008, Yatharth Hospital and Trauma Care Services Limited is a multi-care hospital at Noida, Greater Noida, and Noida Extension, Uttar Pradesh.

With a market cap of Rs 6,040 cr, Yatharth Hospitals has the 8th and 10th largest private hospitals in the NCR, with 7 hospitals across North India with 87% of the beds in Metro. Mukul Agarwal just bought a 1.1% stake in the company worth Rs 69 cr.

The company’s sales have grown at a compound rate of just 45% in the last 5 years from Rs 136 cr in FY20 to Rs 880 cr in FY25. The EBITDA logged in a compound jump of about 42% in the same period from Rs 38 cr to Rs 220 cr. The company posted losses of Rs 2 cr in FY20 and then turned things around with logging in profits consistently and closing FY25 at profits of Rs 131 cr.

The share price of Yatharth Hospital & Trauma Care Services Ltd was around Rs 330 at listing in August 2023, which has grown to Rs 627 as of closing on 25th July 2025, which is a 90% jump.

The company’s share is trading at a current PE of 46x, and industry median is around 69x.

Jammu and Kashmir Bank Ltd & Monolithisch India Ltd

Agarwal also bought 1.3% stake in Jammu and Kashmir Bank Ltd worth Rs 153 cr, and another 2.3% in Monolithisch India Ltd worth Rs 21 cr.

To know more, read A detailed analysis into Jammu and Kashmir Bank Ltd and A deeper dive into Agarwals buy into Monolithisch India Ltd.

Big Moves – What Next?

Mukul Agarwal’s fresh buys have raised lot of questions and rightly so. After all he is not the average joe when it comes to Indian markets. He is a mammoth that has proven his power and strength time and again.

These 6 companies he has added to his portfolio for almost Rs 450 cr, have a mix of companies showing a turnaround, companies still struggling with profits and also companies that have shown some solid growth. The question is what is it that triggered this mixed bag of buys.

Now that is something that probably only Mukul Agarwal himself knows. However, it would not be wise to turn your eyes away from these stocks, given that they have managed to get Agarwal’s attention. Add to watchlist maybe?

Disclaimer:

Note: We have relied on data from www.Screener.in and www.trendlyne.com throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Suhel Khan has been a passionate follower of the markets for over a decade. During this period, He was an integral part of a leading Equity Research organisation based in Mumbai as the Head of Sales & Marketing. Presently, he is spending most of his time dissecting the investments and strategies of the Super Investors of India.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.