Vanaja Sunder Iyer, who we proudly hold in our list of Warren Buffetts of India is a very well respected and highly followed investor known for her community service and mentoring initiatives.

And she just bought stakes in stocks worth over Rs 660 cr, causing ripples across the investor community. What is it about these stocks that caught Iyer’s attention to splurge on them. Let us try and find out.

Looking for profits, big growth coming in?

Established in 1935, Linde India Ltd (formerly BOC India) is a leading industrial gases and engineering company and a member of Linde Plc.

With a market cap of Rs 51,688 cr, the company operates India’s largest air separation plant and runs over 35 facilities nationwide.

As per the exchange filings for the quarter ending September 2025, Vanaja Iyer has bought a 1% stake in the company which is worth Rs 525 cr.

Let us take a quick look at the financials of the company to see what could have caught Iyer’s attention.

The company was reporting annual financial figures on a calendar year cycle until December 2021 and moved to a financial year reporting from March 2023.

The company’s sales were Rs 1,762 cr in December 2019 and at the end of March 2025 the sales were at Rs 2,485 cr, logging in a compounded growth of 7% in 5 years.

The EBITDA (earnings before interest, taxes, depreciation, and amortization) was Rs 415 cr in December 2019 and in FY25 it was Rs 765 cr, which is a compounded growth of 13%.

The net profits is an area which looks like a concern, as the company’s profits went from Rs 727 cr in December 2023 to Rs 455 cr at the end of FY25.

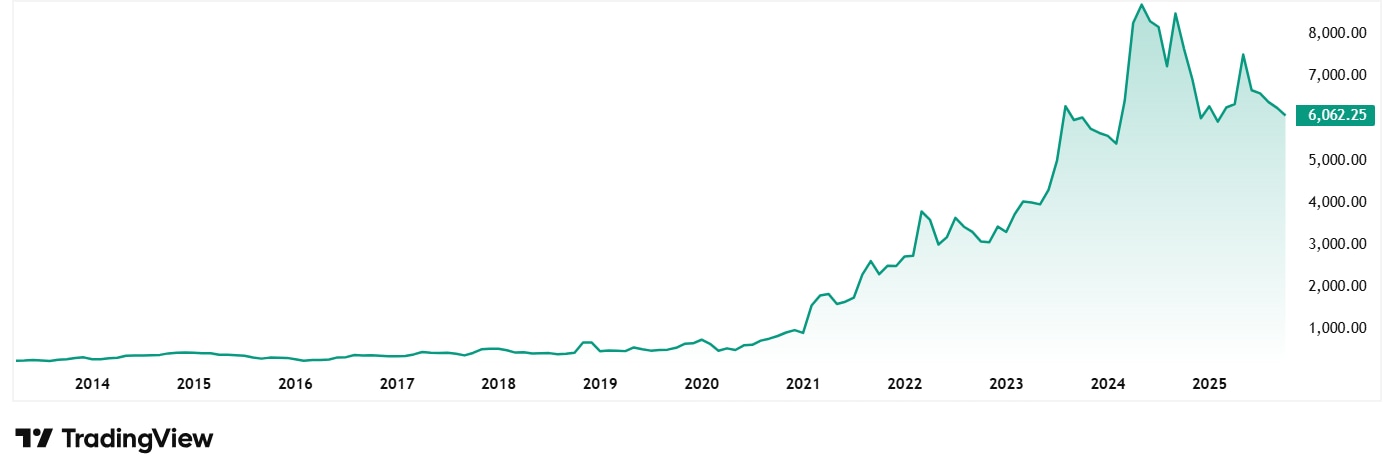

The share price of Linde India Ltd was around Rs 834 in October 2020, which has jumped to its current price of Rs 6,062 as of closing on 28th October 2025. That is a jump of 627% in 5 years. Rs 1 lac invested in the stock 5 years ago would have turned to Rs 7.27 lacs today.

At the current price, the share is trading at a discount of 25% from its all-time high price of Rs 8,040.

The company’s share is trading at a PE of 115x which is higher than the current industry median of 64x. The 10-year median PE for Linde India is 128x while the industry median for the same period is 57x.

In the last annual report, the company’s chairman Michael James Devine said, “Looking ahead, I am optimistic about the opportunities that lie before us. The Indian industrial gases market is expected to grow at a compound annual growth rate of 7.1%, significantly above global averages, supported by expanding manufacturing capacity, increasing demand for specialty gases, and the adoption of clean technologies. This growth trajectory aligns perfectly with our strategic capabilities and market positioning. Our strong presence in key industrial clusters, combined with our technical expertise and customer relationships, positions us well to capture this growth.”

Mahindra’s latest takeover – Turnaround story in making?

Incorporated in 1983, SML Mahindra Ltd is engaged in the business of manufacture and sale of Commercial Vehicles and their parts.

Mahindra & Mahindra Limited (M&M), acquired 63,62,306 equity shares constituting 43.96% of the equity share capital of the Company from Sumitomo Corporation and 21,70,747 equity shares constituting 15% of the equity stake of the Company from Isuzu Motors, collectively aggregating to 85,33,053 equity shares constituting 58.96% of the existing share capital of the Company. Accordingly, M&M has acquired sole control of the Company and became the Promoter of the Company w.e.f. 1st August 2025.

The current market cap of the company is Rs 4,588 cr and Vanaja Iyer just bought a 1.4% stake in it worth Rs 63.5 cr.

The company’s sales grew from Rs 1,154 cr in FY20 to Rs 2,399 in FY25, logging in compounded growth of 16%.

The EBITDA grew at a compound rate of 81% from Rs 12 cr in FY20 to Rs 235 cr in FY25.

The company has shown a solid turnaround in the recent years after recording losses in FY20, FY21 and FY22. From losses of Rs 21 cr in FY20, the company turned the tide and logged in profits of Rs 122 cr in FY25.

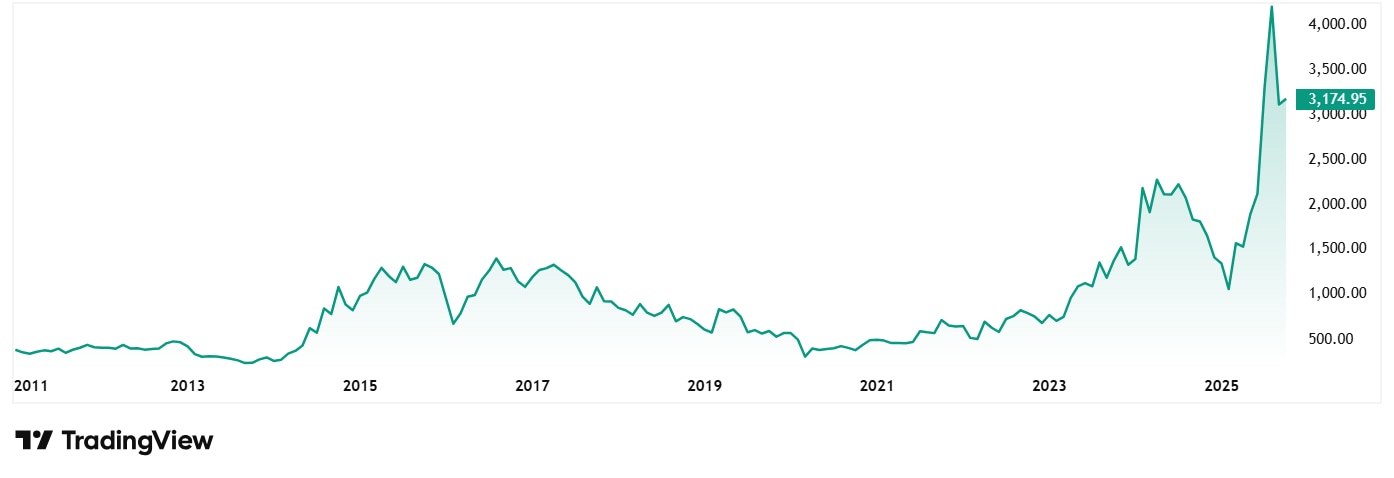

The share price of SML Mahindra Ltd jumped from around Rs 375 in October 2020 to its current day price of Rs 3,173 as of closing on 28th October 2025.This is a jump of 746% in 5 years.

Rs 1 lac invested in the stock 5 years ago would have been close to Rs 8.5 lacs today.

The company’s share is trading at a PE of 32x which is same as the current industry median. The 10-year median PE for SML Mahindra is 39x while the industry median for the same period is 27x.

The company also has an impressive ROCE which is currently 27%, while the industry median is 14%.

In the recent investor presentation from September 2025, the company has noted that in Medium to Long Term the Improving conditions of road infrastructure, development of state highways & expressways, focus on power generation, housing, health & education coupled with increasing disposable incomes and changing commuting habits, are expected to maintain the growth momentum in the Indian Commercial Vehicles market.

3 more buy decisions

Apart from the above two stocks, Vanaja Iyer also bought stakes in the following companies.

XPRO India Ltd – Iyer bought a 1% stake in this company worth Rs 27 cr. The company is engaged mainly in the business of polymers processing at multiple locations and is a leading manufacturer in India of Coextruded Plastic Films, thermoformed liners and specialty films (including dielectric films and special purpose BOPP Films)

Techera Engineering India Ltd – 1% stake worth Rs 5.3 cr. The company designs, manufactures and supplies precise tooling and components for the aerospace and defence industries.

Solarworld Energy Solutions Ltd – 1.5% stake by Iyer worth Rs 39.7 cr. The company is a solar energy solutions provider specializing in engineering, procurement, and construction (EPC) services for solar power projects.

Strategic investments or Diwali shopping spree?

Vanaja Iyer is one of the super investors of India whose movements cause ripples. So, one would understand the frenzy around her portfolio, given she added not one or two, but 5 new stocks worth Rs 660 cr.

While the profits for Linde India seem worrisome right now, the management is confident of a turnaround. On the other hand, SML Mahindra has already turned the tide for good and started logging in profits.

Whether these were strategic moves or just some Diwali shopping, only time will tell. But one thing is sure, that Iyer does not make loose decisions. So, one might want to add these stocks to a watchlist and follow them with a sharp eye.

Note: We have relied on data from www.Screener.in and www.trendlyne.com throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Suhel Khan has been a passionate follower of the markets for over a decade. During this period, He was an integral part of a leading Equity Research organisation based in Mumbai as the Head of Sales & Marketing. Presently, he is spending most of his time dissecting the investments and strategies of the Super Investors of India.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.