PSU stocks have been on a steady rise in recent years. A big reason behind this is the strong government push, coupled with attractive valuations that have drawn more institutional investors.

With the government prioritising infrastructure growth, banking reforms, defence modernisation, and energy security, PSUs have seen their financials improve and growth prospects brighten — giving investors more confidence in the sector.

Here are a 3 PSU stocks that you could add to your watchlist. Readers should note, this is not a recommendation of any kind.

#1 Bharat Electronics

First on our list is Bharat Electronics Ltd (BEL), India’s largest defence electronics company.

BEL is an Indian state-owned aerospace and defence company primarily engaged in the design, development, and manufacture of a wide range of advanced electronic products and systems for the Indian armed forces, including the Army, Navy, and Air Force.

The company reported good numbers in Q1 FY26. Revenue stood at Rs 44,397 m, compared to Rs 42,436 m in Q1 FY25. The net profits surged to Rs 9,607 m from Rs 7,810 m YoY.

Moving forward, the company has an order book of nearly Rs 740 billion (bn). These orders cover a wide spectrum of defence and strategic electronics such as shipborne communication systems, jammers, simulators, test rigs, electronic warfare equipment, and more.

The strong order pipeline and long-term contracts give BEL good revenue visibility. Its Navratna status and government backing enhance its competitive positioning and risk profile.

Thus, BEL is well-positioned for sustained growth in the coming years.

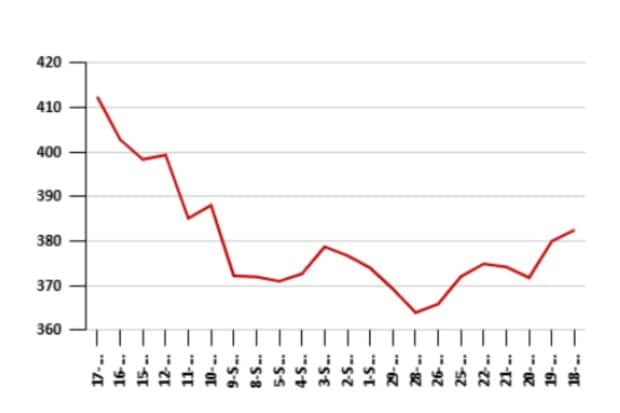

How Shares of BEL Have Performed

In the past five days, BEL shares rallied to Rs 415 from Rs 385. In the last one month, the share price has gained 7%. In the last one year, the shares have gained 44.8%.

The stock touched its 52-week high of Rs 435.95 on 1 July 2025 and its 52-week low of Rs 240.15 on 19 February 2025.

BEL Share Price – 1 Month

Data Source: BSE

#2 Canara Bank

Second on our list is Canara Bank

Canara Bank is a major public sector bank in India. It offers a wide range of retail banking products and services. The bank also provides corporate banking services like working capital finance, term loans, cash management, merchant banking, and syndication services.

The last few years have been good for Canara Bank as net interest margins have risen and asset quality has improved.

For Q1 FY26, the interest earned rose to Rs 315,230 m from Rs 291,730 m in the corresponding period last year. The net profits surged to Rs 48,362 m from Rs 39,772 m in Q1 FY25.

The bank has transformed into a growth story with key drivers such as strong retail lending growth, especially in gold loans and housing loans, and consistent recovery from old bad loans contributing to profitability.

It operates with a diversified lending portfolio focused on retail, agriculture, and MSME sectors.

How Shares of Canara Bank Have Performed

In the past five days, Canara Bank shares have moved higher to Rs 115 from Rs 112. In the last one month, the share price has gained about 5.5%. In the last one year, the shares have gained 9%.

The stock touched its 52-week high of Rs 119.3 on 9 June 2025 and its 52-week low of Rs 78.58 on 3 March 2025.

Canara Bank Share Price – 1 Month

Data Source: BSE

#3 Hindustan Aeronautics

Next on our list is Hindustan Aeronautics Ltd (HAL).

The company is an Indian public sector aerospace and defence company. It’s one of the largest aerospace and defence manufacturers, involved in designing, manufacturing, repairing, and overhauling aircraft, helicopters, jet engines, marine gas turbine engines, avionics, etc.

The company performed well in Q1 FY26. Consolidated revenue was placed at Rs 48,190 m, against Rs 43,475 YoY. Net profits during the period came in at Rs 13,735 m, marginally lower than Rs 14,311 in the corresponding period of last year.

HAL has a robust order book valued at around Rs 2,000 bn, with multi-year double-digit earnings growth expected.

New large contracts, such as the ongoing production and order pipeline for 83+ Tejas Mk-1A aircraft and an additional 97 aircraft approved by the Indian government, provide strong revenue visibility.

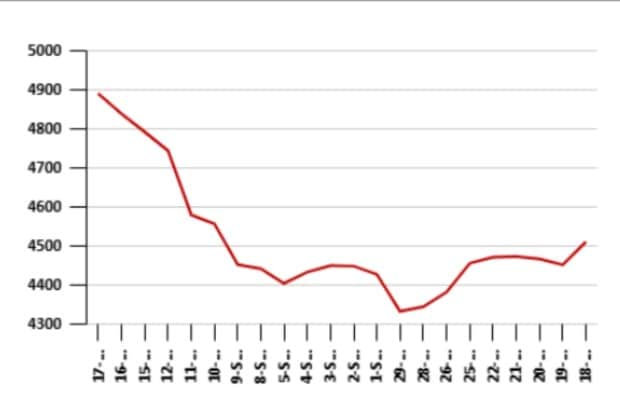

How Shares of HAL Have Performed

In the past five days, HAL’s shares have moved to Rs 4,860 from Rs 4,580. In the last one month, the share price has gained 7.5%. In the last one year, the shares are up about 9.5%.

The stock touched its 52-week high of Rs 5,166 on 16 May 2025 and its 52-week low of Rs 3,045.95 on 3 March 2025.

HAL Share Price – 1 Month

Data Source: BSE

Conclusion

PSUs across banking, energy, infrastructure, and defence have shown sustained revenue growth with solid order books, thereby boosting investor confidence.

Strong government capital expenditure, strategic disinvestments, operational efficiencies, and rising profitability, have improved market valuations of these stocks.

Investors should evaluate the company’s fundamentals, corporate governance, and valuations of the stock as key factors when conducting due diligence before making investment decisions.

Happy investing.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here…

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.