India’s consumer discretionary story is typically recounted in shorthand.

If consumption is strong, investors run to the biggest brands.

If demand reduces, the story quickly turns cautious.

What gets lost in that binary framing is the middle layer of consumption businesses. Companies that are neither mass Fast Moving Consumer Goods (FMCG) nor national retail giants, nor services, but have quietly built profitable models that work across cycles.

These businesses don’t rely on advertising bombardments or rapid expansion of their footprint. They depend on how effectively they monetise demand that already exists.

That difference matters because it’s where mispricing often lasts the longest.

This article looks at three such consumer discretionary stocks, all with market capitalisations above ₹3,000 crore.

What links them is not sector similarity, but a shared trait: their operating performance has improved meaningfully in FY24–FY25, yet market perception hasn’t fully caught up.

Tips Music – The IP Business the Market Still Treats Like a Film Studio

Tips Music is often discussed in the same breath as Bollywood wistfulness. That framing plays down what the business has become.

Tips is essentially an intellectual property monetisation company today. Its large inventory of music rights generates repeated revenue through streaming platforms, short-video apps, licensing deals, and international markets, with minimal incremental capital.

Over the past few years, the company’s revenue growth has not come from producing significantly more content. It has come from monetising the same collection across more platforms, geographies, and formats, including licensing deals and overseas markets.

That shift explains a crucial data point many investors gloss over: why margins remain structurally high even as revenue grows.

Revenue for Q2 FY26 was ₹89 crore, while the net profit excluding exceptional items was ₹53 crore. Between FY23 and FY25, Tips’ sales revenue rose steadily, but operating costs did not rise proportionately.

Employee expenses and overheads remained reasonably stable, while topline grew. The result: net margins constantly above 50%. This is not cyclical margin expansion.

It is operating leverage baked into the business model.

The Incremental Economics of Digital IP

The key insight is incremental economics. Once a song is owned, every additional stream costs almost nothing.

Unlike studios that must keep ploughing heavily to stay relevant, the Tips’ directory becomes more valued with time as distribution channels increase. That’s why return ratios look extreme, and also why they are maintainable as long as consumption migrates digitally.

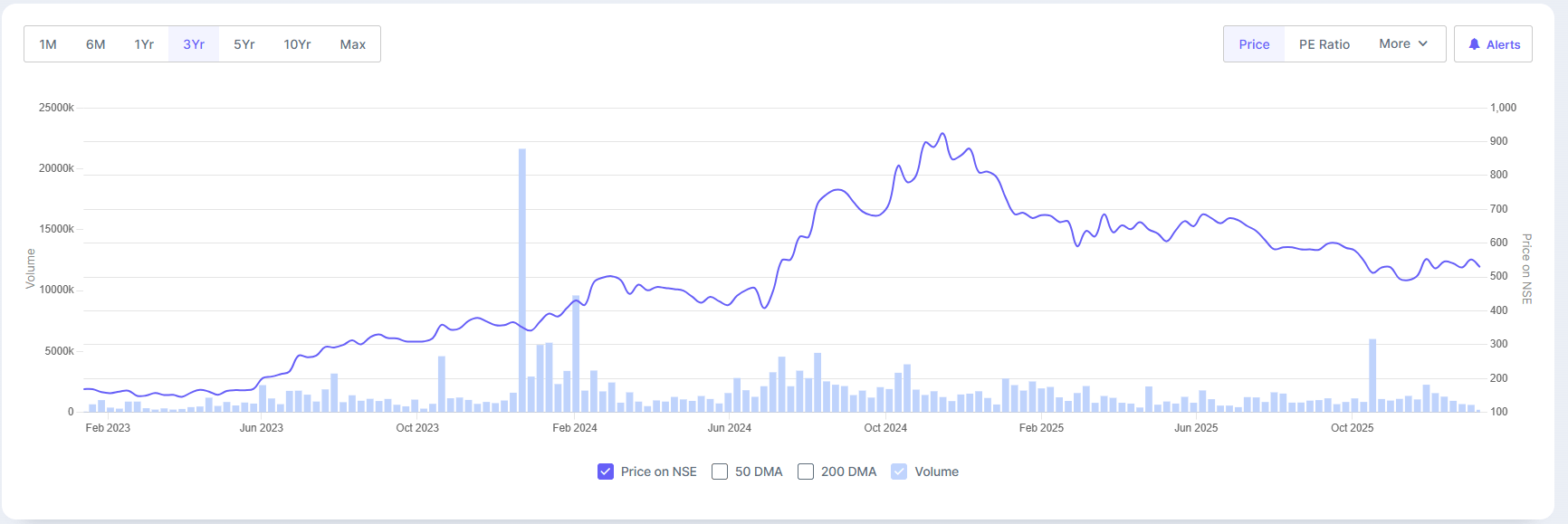

The return on equity over the past three years is 77% while the profit grew at a compounded annual rate of 36%. The stock price grew 47% during the same period.

Tips Music 3-Year Share Price Trend

The Media Studio Stigma: A Valuation Trap?

A 39x P/E creates immediate discomfort, especially when investors are trained to regard media firms as hit-or-miss ventures. However, it is trading at par with the sector median at ~39x.

But its Enterprise Value/EBITDA (earnings before interest, taxes, depreciation, and amortisation) stands at a premium of ~29x compared to the industry median of ~9x.

And yet, it is overlooked as the market is still attached to the old mental model of film-based revenues.

Why it could still surprise

If catalogue monetisation continues to grow faster than costs, which FY25-26 numbers suggest, then Tips Music begins to resemble global IP owners more than Indian media firms.

Re-rating, if it happens, will come not from growth surges but from conviction in earnings strength.

Ethos – India’s Quiet Luxury Consumption Proxy

Ethos is often labelled as a “luxury retail” play. That description is not the whole story.

As India’s largest luxury watch retailer, Ethos lies at the crossroads of expanding affluence and premium discretionary spending.

Its collection includes some of the world’s most sought-after watch brands, making it a clean play on high-end spending rather than volume-driven retail.

Luxury watch retail does not behave as normal retail brands do. Supply is restricted, discounting is restrained, and the demand is driven as much by accessibility and brand trust as by price.

That changes the brand economics completely.

Between FY23 and FY25, Ethos expanded revenues meaningfully. Q2FY26 saw the company make a revenue of ₹383 crores, while the net profit excluding exceptional items was ~₹24 crore.

The EBITDA margins stayed broadly stable between 12-16%. That stability is the real signal. In discretionary retail, margins usually reduce when growth is bought through expansion or discounting. Ethos has so far escaped that trap.

What really makes it stand out

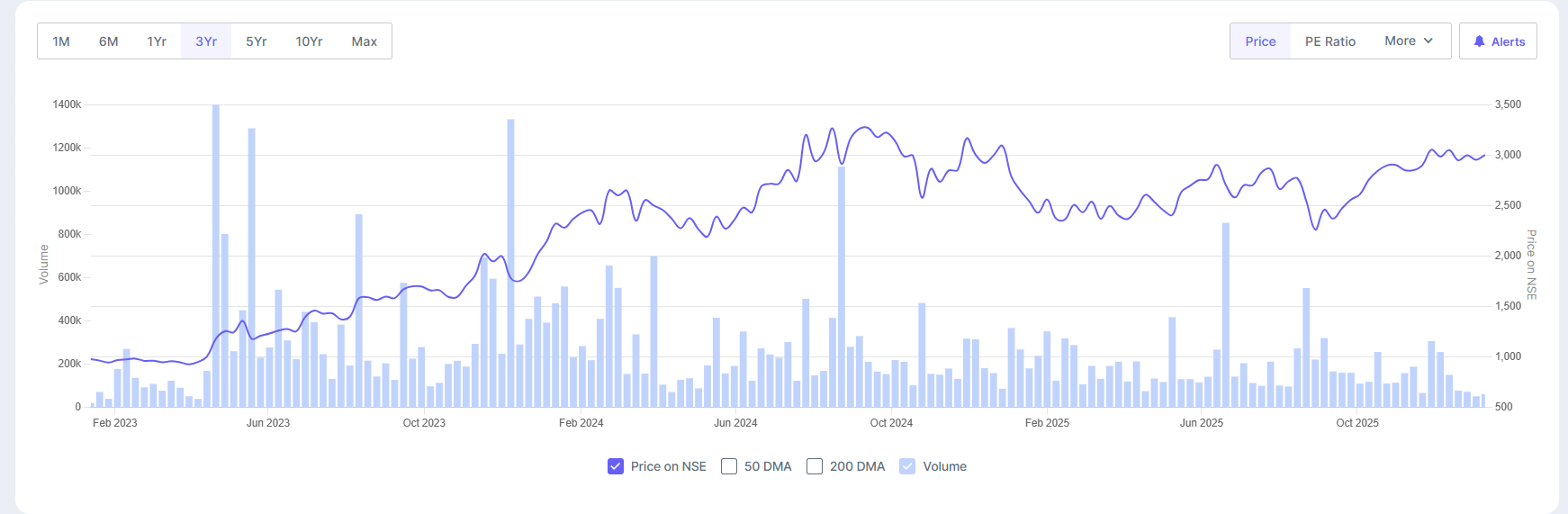

The return on equity over the past three years is 11% while the profit grew at a compounded annual rate of 60%. The stock price grew 44% during the same period.

Ethos Ltd. 3-Year Share Price Trend

The margin strength tells us growth is coming from higher average ticket sizes and better mix, not aggressive pricing. Fixed costs are being absorbed steadily as volumes rise, not pursued through store creation.

Inventory discipline matters here. Luxury retail fails swiftly if inventory turns are slow. So far, Ethos’ numbers suggest the opposite, operating leverage without inventory strain.

Why it’s still underappreciated

At ~85x earnings, most investors stop their analysis. And it’s trading at a premium compared to the sector median of ~26x. Its EV/EBITDA at ~34x is far higher than its median of ~15x.

However, globally, luxury consumption businesses tend to appear expensive before operating leverage becomes evident, rather than after.

The Indian market, though, is still contemplating whether luxury demand is structural or cyclical. Ethos sits right in that indecision gap.

Why could it surprise

If premium consumption normalises, not booms, just normalises, Ethos doesn’t need explosive growth to support its valuation. It needs stability.

That’s a lower bar than the market assumes.

Aditya Vision -A Regional Consumption Story Most Investors Ignore

Aditya Vision rarely features in general consumption conversations, largely because it doesn’t operate nationally.

The company is a regional consumer durables retailer, with a strong footprint in eastern India. Its strength lies in local execution, understanding demand, improving store economics, and expanding in under-penetrated markets.

That turns out to be a feature, not a shortcoming.

Between FY23 and FY25, Aditya Vision aggressively expanded its revenue. FY25 saw the company post a revenue of ₹2,260 crore, growing ~30% YoY. The net profit excluding exceptional items was ₹108 crore.

In Q2FY26, Aditya Vision posted a revenue of ₹458 crore, with a net profit of ~₹13 crore excluding exceptional items. The operating margins stayed stable between 8-10%.

These numbers matter because regional retail stores often break when expansion dilutes returns.

Here, it hasn’t.

What really makes it stand out

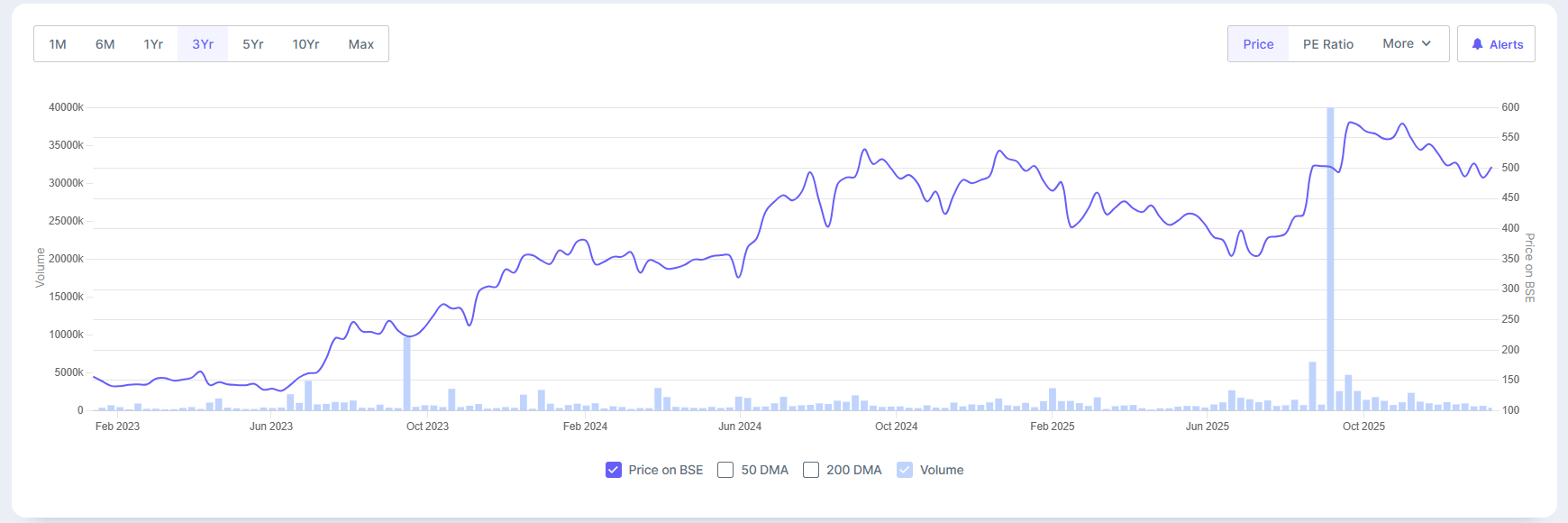

The average return on equity over the past three years is 26% while the profit grew at a CAGR of 45%. The stock price rose 49% during the same period.

Aditya Vision 3-Year Share Price Trend

Unit Economics in Tier-II Markets

Return on capital employed (ROCE) staying high during expansion tells us new stores are not destroying capital. Stock, receivables, and store-level finances are being controlled tightly enough to maintain returns.

In tier-II and tier-III markets, the local brand recall and distribution strength usually matter more than national branding.

Aditya Vision gains from that dynamic, letting it grow without competing head-on with national chains on price.

Why is it overlooked

At ~60x P/E multiples, this stock is trading at a premium compared to the sector median of ~52.3x. Its EV/EBITDA at ~31x is far higher than its median of ~15x.

Yet, it is ignored.

Most regional businesses struggle for investor mindshare. Investors prefer scalable national narratives, even when regional players render better unit economics.

Why could it surprise

If aspirational consumption continues to deepen outside metros, Aditya Vision’s growth runway may be longer than the market currently prices in.

The risk is execution, but the numbers so far suggest restraint.

Risks That Could Still Derail the Story

The biggest risk across these stocks is not a sudden collapse in consumer demand. It is unstable implementation in conditions where the hopes are already high.

All three companies function in segments where growth often looks healthy on the income statement, even as strain quietly develops on the balance sheet.

IP-led models, inventory-heavy businesses, and discretionary retail each collapse in different ways, but the cautionary signs tend to appear in the same places.

Fault Lines: Working Capital and Operating Leverage

Working capital weakness is the first fault line. Whether it is inventory intensity in retail, receivables in regional expansion, or delayed cash realisation from platforms and partners, the pressure does not show up in profits immediately.

It shows up progressively in cash flows. If revenue growth starts requiring disproportionate investments, then the return profile that supports current valuations weakens quickly.

Operating leverage cuts both ways. The same fixed-cost arrangements that support margin expansion during good periods can level earnings growth if the revenue growth slows down.

In such cases, the margins may not crash totally, but incremental profitability can freeze, which matters deeply when stocks are priced for continuous execution.

Valuation leaves little room for average performance. None of these stocks is cheap in absolute terms. The market is already assuming steady margins, measured expansion, and stable execution.

If performance simply turns ordinary, not poor, multiples can reduce even if headline profits continue to grow.

Consumer discretionary cycles are hardly ever linear. Demand does not disappear overnight, but it does become irregular. When that happens, businesses with stronger cost control and inventory discipline outperform, while others quietly lose competence.

The risk is not a sharp downturn, but a slow erosion of operating metrics that only becomes obvious in hindsight.

Finally, concentration risk continues to be underappreciated. Whether it is platform reliance, premium consumer segments, or regional focus, these businesses are not broadly diversified.

Any adverse shift in their central demand drivers can have a massive impact compared to larger, more diversified peers.

In consumer discretionary investing, the danger is rarely obvious, and that is exactly why close tracking matters more than confidence.

Where the Market May Be Looking in the Wrong Place

The common mistake in consumer discretionary investing is to mistake visibility with durability.

Large brands feel safer because they are familiar. But the numbers suggest that earnings quality is being shaped elsewhere, in companies that are changing demand into cash more efficiently, shrinking operating leverage, and improving returns without depending on aggressive expansion or headline-driven growth.

None of these guarantees outperformance. Valuations already assume discipline, and any slippage in working capital, margins, or returns will be punished quickly. But as things stand, the operating numbers are greater than the dominant narrative.

For investors, the takeaway is simple but uncomfortable: the next leg of India’s consumption story may not come from the loudest brands or the most crowded trades.

It may come from companies where execution is improving faster than perception, and where the market reacts only after the numbers have been doing the work for some time.

Disclaimer:

Note: We have relied on data from www.Screener.in throughout this article. Only in cases where the data was not available have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points, and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Archana Chettiar is a writer with over a decade of experience in storytelling and, in particular, investor education. In a previous assignment, at Equentis Wealth Advisory, she led innovation and communication initiatives. Here she focused her writing on stocks and other investment avenues that could empower her readers to make potentially better investment decisions.

Disclosure: The writer and her dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.