Defence stocks have been buzzing after the government on Monday greenlit multiple proposals from the armed forces to buy or lease defence goods worth around Rs 79,000 crore (790 billion).

The Defence Acquisition Council, chaired by Defence Minister, Rajnath Singh, approved the Acceptance of Necessity (AON) — an in-principle clearance — for several items, largely from domestic sources, for the Army, Navy, and Air Force.

While AON does not guarantee final orders and will require approval from the Cabinet Committee on Security, it sets the stage for potential procurement. Below is a table summarising the key defence procurement proposals approved for the three services.

| Armed Force | System / Equipment Approved |

| Indian Army | Loitering munitions |

| Low-level lightweight radars | |

| Long-range guided rockets for Pinaka | |

| Indigenous counter-drone system | |

| Drone Detection & Interdiction System Mk-II | |

| Indian Navy | Bollard pull tugs |

| High-frequency software-defined radios | |

| High-altitude long-range RPAS (leased) | |

| Indian Air Force | Automatic take-off & landing recording systems |

| Astra Mk-II BVR missiles | |

| Full-mission simulators for LCA Tejas | |

| SPICE-1000 guidance kits |

With this in mind, here are seven stocks to watch…

#1 Solar Industries

First on the list is Solar Industries.

Solar Industries is a global leader in the manufacturing of industrial and military explosives, initiating systems, and ammunition.

The company produces a comprehensive range of industrial explosives and initiating systems, including packaged emulsion explosives, bulk explosives, detonators, and detonating cords.

It’s recognised for driving indigenous development of high-energy explosives and for its growing innovation in drone-based loitering munitions.

Solar Industries has played a key role in supplying indigenous booster systems for strategic platforms such as the BrahMos missile, the Pinaka rocket system, and loitering munitions, underlining its rising stature in the global defence ecosystem.

Its focus on R&D has led to the development of next-generation precision-guided loitering munitions, including Nagastra-1, Nagastra-2, Rudrastra and Bhargavastra, some of which have already been deployed in critical missions.

Data Source: Annual Report

Solar Industries is also a critical supplier of rockets. Through its subsidiary, Economic Explosives Ltd (EEL), the company supplies Pinaka rockets, including:

- Area Denial Munition (ADM) Type-1 (DPICM)

- High Explosive Pre-Fragmented (HEPF) Mk-1 (Enhanced)

These rockets are key components of the Pinaka Multi-Barrel Rocket Launcher System, developed by DRDO for the Indian Army.

With the government greenlighting procurement of loitering munition systems and Pinaka rockets in focus for the Army, Solar Industries company stands out as a key defence stock to watch.

#2 Avantel

Next on the list is Avantel.

Avantel, a key player in wireless and satellite communication, designs and develops defence electronics, radar systems and network management software for aerospace and defence sectors. Despite a robust long-term growth trajectory, the company’s stock has faced headwinds recently.

Avantel is a niche defence electronics player with strong capabilities in secure communications.

The company has designed and developed a fully indigenous HF Software Defined Radio (SDR) covering a frequency range of 1.5 to 30 MHz, compliant with Software Communication Architecture (SCA) 4.1 standards.

Avantel’s HF SDR features a modular architecture, with the transceiver API at the top level and hardware access managed through the SCA core framework, while ORB layers operate on a POSIX-compliant real-time operating system (Petalinux).

Beyond this, Avantel is capable of delivering multi-frequency SDR solutions tailored for tactical and airborne applications, customised to specific defence requirements.

With the government clearing fresh defence procurement proposals and a growing focus on indigenous, secure communication systems, Avantel stands out as a defence stock to watch.

#3 Bharat Electronics

Next on the list is Bharat Electronics.

The company has 9 manufacturing plants and 25 strategic business units, BEL produces a wide range of electronic equipment for the Indian defence forces, including radar systems, weapon systems, communication systems, and electronic warfare systems.

It has diversified into arms and ammunition, missiles, cyber security, and unmanned systems.

BEL offers end-to-end electronic warfare capabilities across four core areas – radar ESM, ELINT/COMINT/SIGINT suites, fully integrated EW systems for ships and aircraft, and a range of jammers from portable units to ship/aircraft-grade solutions.

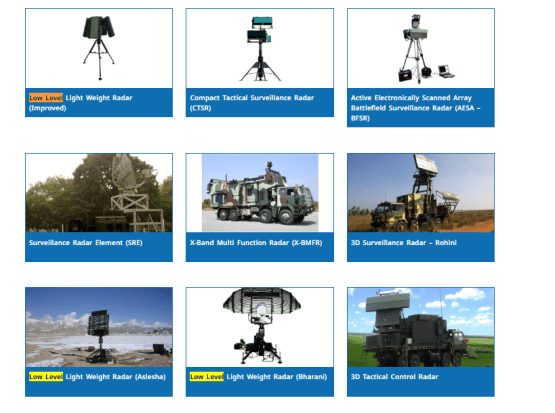

In line with the latest procurement, the company is actively involved in Low Level Light Weight Radar (LLLR) programmes, which are increasingly critical for detecting drones, UAVs and low radar cross-section (RCS) targets.

BEL’s LLLR(I) is a pulse-Doppler, software-defined radar platform that integrates an AESA antenna, GaN-based amplifiers and advanced 3D processing capabilities, making it a next-generation, true multi-mission radar suited for a wide range of aerial threats.

In addition, BEL manufactures multiple variants of LLLR, including an S-band, 3D, lightweight, battery-powered and compact radar for comprehensive 3D surveillance, as well as an L-band, 2D, lightweight and battery-operated radar.

These are designed specifically to support Army air defence weapon systems in challenging terrains such as mountainous regions, providing early alerts against hostile UAVs and aerial targets.

Data Source: BEL website

Beyond radars, Bharat Electronics also has strong capabilities in secure communications through its HF Software Defined Radio (SDR) portfolio.

This includes static high-power HF SDR systems (1kW and 5kW) for medium and long-range communications, as well as compact, man-portable HF SDRs developed in line with SCA 4.1 standards, suitable for short and medium-range tactical communication.

Data Source: BEL website

With approvals for low-level radars, counter-drone systems and secure communication equipment gaining momentum, Bharat Electronics’ diversified and indigenous product portfolio positions it as one of the key defence stocks to watch.

#4 HAL

Next on the list is Hindustan Aeronautics.

HAL is India’s flagship aerospace and defence PSU, which remains central to the country’s fighter aircraft and avionics ecosystem.

It’s one of the oldest aerospace manufacturers globally, with a range of indigenous design, development, and production of military and civil aircraft, helicopters, aero-engines, avionics, and related aerospace systems.

From fighter jets like the Tejas and Su-30 MKI to helicopters like Dhruv and Rudra, its machines have become a familiar sight across the skies and seas.

During the year, HAL has produced the Light Combat Aircraft (LCA) Tejas Mk1 and Mk1A, with the Mk1A representing a significantly upgraded variant of the indigenous fighter.

The LCA Mk1A is equipped with advanced systems such as an AESA radar, a unified electronic warfare suite, a mission computer, a digital map generator, smart multi-function displays, a software-defined radio, a combined interrogator and transponder, and an advanced radio altimeter, along with the capability to fire Astra and ASRAAM air-to-air missiles.

Validation trials for the Mk1A are in advanced stages and the platform is close to certification.

Beyond aircraft manufacturing, HAL’s Mission and Combat Systems R&D Centre (MCSRDC) plays a critical role in the design and development of mission and combat systems for fixed-wing aircraft, helicopters and other aerial platforms.

The centre develops indigenous avionics systems from concept to certification and also has strong capabilities in the design, development and upgrade of full-mission simulators, which are increasingly vital for cost-effective pilot training.

With approvals covering Astra Mk-II missile induction, increased focus on full-mission simulators, and sustained orders for the Tejas platform, HAL stands out as a defence stock to watch.

#5 Cochin Shipyard

Next on the list is Cochin Shipyard.

Cochin Shipyard Limited (CSL) stands out as one of India’s most modern and advanced shipyards.

Incorporated in the year 1972, Cochin Shipyard Limited (CSL) is a leading player in the construction of all kinds of vessels, repairs and refits of all types of vessels including periodic upgradation and life extension of ships.

Its wholly owned subsidiary, Udupi Cochin Shipyard Limited (UCSL), recently delivered the first 62-tonne Bollard Pull Tug to Ocean Sparkle Limited, part of the Adani Group.

Notably, this marks the first tug built in India under the Approved Standard Tug Design and Specifications (ASTDS) issued by the Ministry of Ports, Shipping and Waterways, aimed at standardising tugs across Indian ports and boosting indigenous shipbuilding.

The clearing of the procurement of bollard pull tugs for the Indian Navy, and the increasing emphasis on domestic sourcing of naval and port-support vessels, makes Cochin Shipyard a stock to watch.

#6 Mazagon Dock Shipbuilders

Next on the list is Mazagon Dock Shipbuilders.

It stands as the only Indian shipyard to have built destroyers and conventional submarines for the Indian Navy and was the first to manufacture these vessels.

Since 1960, MDL has constructed a total of 802 ships, including 30 warships, ranging from advanced destroyers to missile boats. The company has also delivered 8 submarines, strengthening India’s underwater defence capabilities.

It’s a key player in India’s naval shipbuilding and support vessel ecosystem. MDL has developed state-of-the-art capabilities backed by extensive experience in ship-building operations.

The company owns two 25-tonne Bollard Pull ASD tugs, capable of operating within Class IV limits of Mumbai, which can be hired on a turnkey basis to deliver safe and high-quality towing services. In addition, MDL operates a 45-tonne Bollard Pull Voith tug, primarily deployed for ship-handling and towing operations within harbour limits.

With the government approving procurement of bollard pull tugs for the Indian Navy and an increasing focus on indigenous marine support vessels, Mazagon Dock’s in-house capabilities in tug ownership and operations strengthen its positioning.

#7 Zen Technologies

Last on the list is Zen Technologies.

Zen Technologies is a key indigenous player in drone detection and counter-drone (C-UAS) solutions, offering a multi-layer, multi-sensor system designed to detect, track, and neutralise hostile drones.

The company’s Anti-Drone System focuses on early detection through passive surveillance and sensor fusion, followed by threat neutralisation primarily via electronic jamming.

At the detection level, Zen’s system uses an RF-based Drone Detector (RFDD) that continuously scans the radio frequencies commonly used between drones and their ground control stations.

Once a signal is identified, the system locks onto it and estimates the direction of both the drone and the operator, enabling early warning and tracking.

This is complemented by video-based drone identification and tracking (VDIT), which employs day and night cameras mounted on an automated positioning system.

To address autonomous drones that do not emit RF signals, Zen integrates an X-band 3D radar, capable of detecting and tracking drones by providing accurate azimuth and elevation data.

For neutralisation, Zen’s counter-drone solution includes RF jammers that disrupt communication links between the drone and its operator, effectively disabling or forcing the drone to land.

Data Source: Zen Technologies Website

With rising defence focus on counter-UAV systems, Zen Technologies’ specialised capabilities in drone detection and counter-drone solutions position it as a stock to watch in India’s evolving air-defence ecosystem.

Conclusion

With the increasing focus on indigenous manufacturing, technology transfer and AI-led automation, it’s opening up sustained growth opportunities for domestic defence players.

Supported by favourable policy measures, expanding order books and improving export prospects, the sector offers strong structural growth visibility.

Moreover, the latest defence procurement approvals are likely to further strengthen companies operating in this space.

Investors should evaluate the company’s fundamentals, corporate governance, and valuations of the stock as key factors when conducting due diligence before making investment decisions.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here…

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary