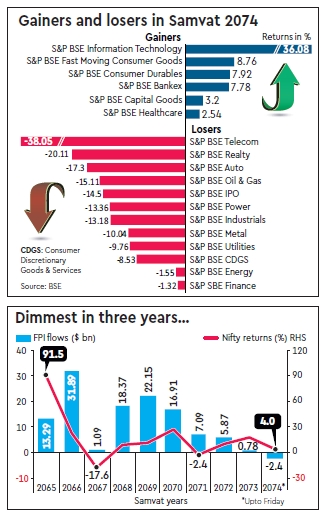

Samvat 2074 lacked cheer for Indian equity investors as the benchmark Nifty clocked a moderate gain of just 4% – its lowest gains in three years. Had the index not rallied over 5% during the week ahead of Diwali, the returns for this year would have been negative.

Nifty had posted a return of 17.6% and 10.2% in the previous two Samvat years and therefore the returns need to be seen in that light.

However, even though Nifty hit multiple highs during the year, the gain has not translated into significant gains for most of the investors as the benchmark rally was predominantly powered by a handful of stocks. As a result, more than half of the Nifty50 and about 60% of the Nifty Midcap companies ended the year in the red.

The Nifty Small Cap Index has suffered a bruising 22.6% since October 19, and 86% of its members have seen a fall in prices. The year also witnessed the return of IT stocks into investors’ radar as they bet on weakening rupee. Nifty IT index top the list of NSE sectoral indices with a gain of 32.2%, followed by Nifty FMCG, which was up by 12.7%.

While Tech Mahindra stock rallied as much as 50.7% since last Samvat, TCS and Infosys rose 48.1% and 42.9% respectively. On the other hand, the Sensex had rallied 7.68% during the period. The index currently trades at a price-to-earnings multiple of 23.15, making it second-most expensive market after Mauritius in terms of PE ratio. “The current year has been a complete washout.

Everything that could have gone wrong, did in this Samvat 2074. Crude prices have surged 47% till October and the rupee plummeted 13.3% against the dollar. Monsoon, too, was below normal,” said VK Sharma, head of capital market strategy at HDFC Securities.

Shamsher Dewan, vice president of corporate sector ratings at ICRA, said the increasing share of digital offerings and a pick-up in demand from BFSI clients helped Information Technology (IT) stocks to lead the pack among various BSE indices. The BSE IT index has gained the most 36.08%, while the BSE FMCG index followed the suit with 8.76%. Other sectoral gainers were BSE Consumer Durables (up 7.92%), BSE Bankex (7.78%), BSE Capital Goods (3.2%) and BSE Healthcare (2.54). S&P BSE Telecom index was the biggest loser among all BSE Indices. The telecom index has lost over 38% in terms of returns since last diwali. Other sectoral losers include realty, auto, oil and gas, power, metal, energy, finance, utilities and consumer discretionary goods.

The year which was haunted by both global and domestic macroeconomic headwinds saw overseas investors pull out equities worth $2.4 billion. This was first such outflow in a decade. Earlier, the foreign portfolio investors had offloaded Indian shares worth $11.75 billion in the year 2064.

However, the pace of purchase by domestic investors remained robust this year that cushioned the market against selling by foreign investors. The local institutional investors, including mutual funds and insurance players, lapped up shares worth `1.27 lakh crore, or close to $18.6 billion.

The equity market, which remained volatile due to the trade war between China and the US, rising interest rates and hardening crude prices, saw investors losing `18.6 lakh crore in the last two months. Moreover, the looming threat of a liquidity squeeze across the NBFC sector has raised concerns of spillover effects.

Market participants observe a pick-up in private capex, earnings recovery and the outcome of the general election in 2019 will set the trend for the equity market going forward.

When it comes to the laggards, the Nifty Realty and Nifty Auto led the way— losing 23% and 17.4— as the rapidly rising interest rates, slower economic momentum and rising crude oil prices made the sector less attractive to the investors.

Additionally, US Fed hiking interest rates too affected the market sentiments. Earlier, FE had reported that amid poor performances of a large number of PSUs, the combined value of shares held by the government has declined to a record low of 9% during the quarter ended September 2018. Even though the Centre achieved its disinvestment target in FY18, several PSU stocks which got listed in that year are currently trading below their issue prices.