The most famous value investor Warren Buffet is well known for avoiding gold. He once said, “gold is a way of going long on fear”. He also said, referring to gold, “it won’t do anything…except look at you”. His first quote means that gold only does well when investors are fearful. His second quote means that gold is fundamentally an unproductive asset.

In fact, both these statements are true. During times of market turmoil, gold does well and the stock market crashes. Gold is indeed unproductive, in that it generates no income or dividends. And unlike other commodities that are used to produce goods or food, most gold is stored in vaults. But does this mean gold should be avoided? No, because the data tells us the opposite.

Gold vs Nifty 50

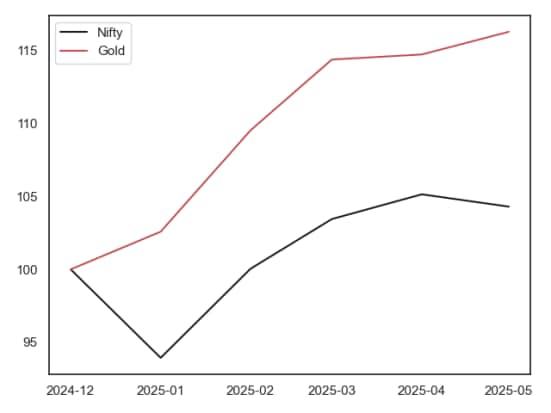

Let’s look at gold as an investment and compare it to the Nifty 50 index (henceforth the stock market). During the first five months of this year, gold is up 16.3%, while the stock market is up just 4.3%. Suppose you invested 100 at the end of last year into gold and into stocks. The chart below tells you what each investment would be worth today.

Gold is clearly the big winner this year. And it is no surprise given the news. Specifically, the unpredictability of the current US administration on tariffs has increased uncertainty. And today, uncertainty and fear remain at elevated levels.

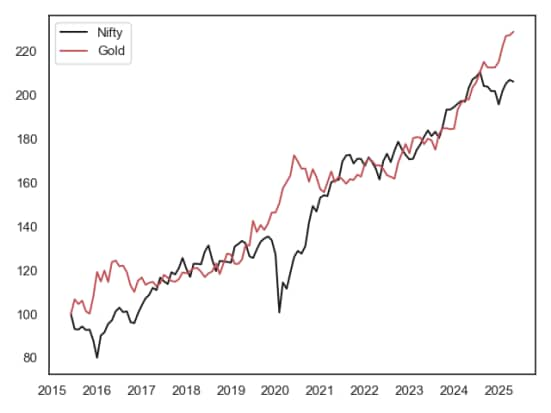

For a long-term investor, a five-month chart is not enough. Let’s look at the same chart, but over a ten-year period. Now suppose you invested 100 ten years ago into gold and into stocks. The chart below tells you what each investment would be worth today.

Surprisingly, gold still outperforms the stock market. That said, the margin is much smaller. Over the last ten years, gold’s average annual return is 12.9%. The stock market’s average annual return is 10.6%. The two lines follow each other closely. There’s one clear divergence during the COVID-19 pandemic. Gold outperforms during this time, but the stock market eventually catches up.

Still, there is something unsettling about this chart. Over the long term (and ten years is long term), stocks are supposed to be the best investment. Over shorter intervals, particularly periods of fear, we expect gold to do better. But not over such a long period of time.

Fear as an investing strategy

To be clear, the story here isn’t the stock market performing poorly. An average annual return of 10.6% is solid. The story here is why gold did even better, at 12.9% per year. Coming back to Buffet’s quote, it is possible that fear truly is a winning strategy.

In the eighteen years I’ve been covering the markets, I can’t recall a time when investors were not fearful about something. There’s been fear even when economies and stock markets have done well. Most of the time, those fears don’t materialize. But fear is a fundamental part of human nature. We especially worry about catastrophic events that are unlikely to occur. And this is what makes gold a winner.

Asad Dossani is an assistant professor of finance at Colorado State University. His research covers derivatives, forecasting, monetary policy, currencies, and commodities. He has a PhD in Economics. He has previously worked as a research analyst at Equitymaster, and as a financial analyst at Deutsche Bank.

Disclaimer: The purpose of this article is to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly encouraged to consult your advisor. This article is for strictly educative purposes only.

Disclosure: The writer invests in both gold and stocks.