The relentless FII selling continues. August ended with a total outflow of Rs 46,902 crore. For the year, FIIs have now sold equities worth Rs 2.40 lakh crore. What particularly stands out is the quantum of FII outflow so far in 2025. The outflow till August is $15.3 billion and this amount is significantly more than the 2024 outflow of $0.8 billion in 2024.

One of the reasons that is commonly considered as the key factor contributing to outflow is the overall earnings weakness and the lacklustre performance of the Indian markets over the past year. India, in fact, has underperformed several global peers, and the Nifty is down 3% in the last 1 year. The series of geopolitical and macro headwinds have also compounded the problem for India.

What’s driving the FII selling? Nilesh Shah explains

Nilesh Shah, MD, Kotak Mahindra AMC, explained that the “FPI selling is driven by many considerations.”

He elaborated the key triggers and pointed out that,

“- FPIs have made a lot of money in India, unlike other emerging markets, whereby India allocations have become disproportionately high.

-Some selling is driven by short-term valuation concerns.

-Some might be due to the adverse impact of unfair tarriffs levied by the US.

– Selling is also driven by persistent negative coverage of India in some biased international media.”

The valuation metrics: India Vs EM peers

Though the Indian markets have seen significant correction, valuation-wise, it has moved up the scale again. India is at a considerable premium compared to its many Emerging Market peers. The Nifty and Sensex are trading around 22.7-22.8x 12-month forward PE.

This, when compared to other EM peers, highlights the gap. China, with the highest inflows, is at 10.9x 12-month forward PE while Hong Kong markets (the Hang Seng) is at 7.5x 12-month forward PE. Japan, too, is trading below the 20 mark.

Tracking flows: India Vs other Emerging markets

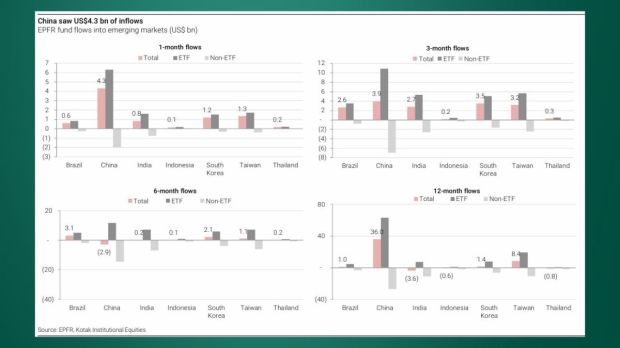

In terms of flows, most listed emerging market fund flows were positive, but flows for India showed a mixed trend. China has seen the highest inflows of $4.3 billion, followed by Taiwan, South Korea and India in July.

However, a 3-month analysis by Kotak Institutional Equities highlighted that India’s inflows at $2.7 billion were less than China, Taiwan and South Korea. But it managed to clock better flows than Brazil, Thailand, and Indonesia.

The picture completely changes when we compare the 6-month flows. As per the data analysed by Kotak Institutional Equities, while China and Taiwan consistently maintained their top 2 positions with inflows of $3.1 billion and $2.1 billion, Brazil, South Korea and Indonesia overtook India. India recorded outflows of $2.9 billion.

FII flows: A look at country allocation and India’s declining share

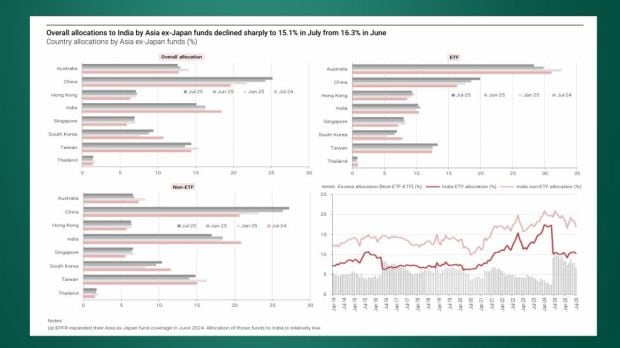

Interestingly, despite the divergent flow trends over 6 months, country allocations to China and India constitute 40% of the average Asia ex-Japan fund portfolio, as per the study by Kotak Institutional Equities.

But Asia ex-Japan fund allocations to India declined sharply to 15.1% in July from 16.3% in June, whereas allocations to India by GEM funds declined to 17.5% in July from 18.7% in June.

Allocations by Asia ex-Japan non-ETFs declined to 16.9% in July from 18.4% in June. Allocations to India by GEM non-ETFs declined to 15.6% in July from 16.7% in June.

The largest quantum of FPI Asset Under Custody comes to India from US-based investors. As of July, the top 5 countries investing in India include

-US: Investment of $356 billion

-Luxembourg: $62 billion

-Singapore: $56 billion

-Ireland: $150 billion

-UK: $40 billion.

The Trump tariff and its longer-term impact are no doubt a big overhang for the markets. With FIIs continuing to sell in the first two days of trade in September too, all eyes are on when this continuous FII selling trend will pause.