The price of any asset is fundamentally governed by the forces of supply and demand. When the number of buyers exceeds the number of sellers, the price rises—this is a basic economic principle. In the case of Bitcoin, the recent price increase signals heightened demand relative to available supply.

To analyze this trend, it is essential to examine the behavior and motivations of those driving this demand. What factors are influencing individuals and institutions to increase their exposure to Bitcoin at this moment? Understanding their rationale is key to interpreting the current rally and anticipating its future trajectory.

A major catalyst behind Bitcoin’s recent price surge is growing investor concern over U.S. fiscal policy and expectations of increased money supply. At the center of this sentiment is former President Donald Trump’s proposed “One Big, Beautiful Bill”—a sweeping legislative package that has passed the House of Representatives and is currently under debate in the Senate. The bill includes significant policy shifts, including tax cuts, welfare reforms, expanded energy exploration, and heightened border security measures.

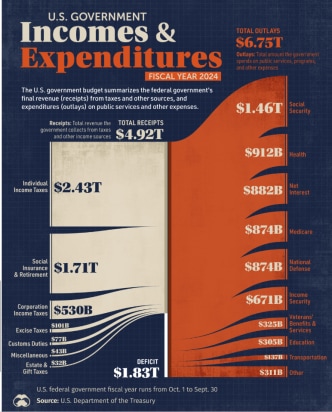

Like any government, the United States operates with revenues—primarily from taxes—and expenditures, such as defense, social programs, and interest payments on debt. When expenditures exceed revenues, the result is a budget deficit. To finance this gap, the government must either borrow money or increase the money supply—effectively printing more dollars. Because the U.S. dollar is a fiat currency, the federal government retains full control over its issuance through its central bank the federal reserve.

Excessive money printing, however, dilutes purchasing power of money and leads to inflation—a rise in prices that typically outpaces wage growth. Inflation erodes consumer confidence and often results in political backlash, particularly when it affects the affordability of everyday goods and services.

The largest components of U.S. federal spending include interest payments on national debt, defense, and entitlement programs such as Social Security and Medicaid. For over two decades, the U.S. has run persistent budget deficits, relying on domestic and international investors to fund its borrowing. These investors continue to lend based on the belief that the U.S. government will meet its obligations—either through taxation or fiscal prudence.

Currently, the U.S. national debt exceeds $36 trillion. Annual interest payments on this debt amount to approximately $882 billion and are projected to surpass $1 trillion by fiscal year 2026, rising to $1.8 trillion by 2035, according to the Congressional Budget Office. These increases are driven by both a growing debt load and rising interest rates.

The global financial system rests on trust, and that trust falters when a borrower cannot meet obligations. Any hint that the U.S. might default would severely damage confidence in the U.S. dollar, potentially triggering a spike in interest rates and widespread financial instability. Rating agencies have downgraded the US government debt or bonds from the safest rating. This makes it hard for interest rates to come down. No president wants high interest rates because that makes more paid in interest and reducing that to zero like we had for many years put inflationary pressures.

Governments, however, face limited choices when managing deficits: raise taxes, cut spending, or continue borrowing. Increasing taxes is politically unpopular, particularly if it impacts the middle class or small businesses. Meanwhile, cutting major expenditure areas such as Social Security, Medicare, or defense spending often provokes strong opposition from key constituencies. As a result, many investors believe the path of least resistance—especially in an election cycle—is continued deficit spending, funded through additional borrowing or monetary expansion. This will certainly reduce purchasing power of current dollars and for those concerned about the long-term value of fiat currencies, Bitcoin becomes an appealing alternative: a decentralized, fixed-supply asset that cannot be inflated away by political compromise.

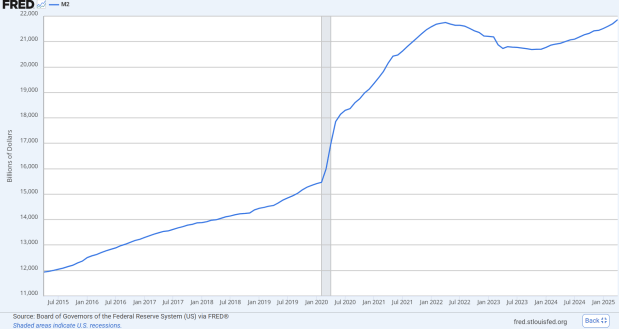

To track the amount of money circulating in the economy, economists often refer to two key measures: M1 and M2. “M1” represents the most liquid components of the money supply, including physical currency, checkable deposits, and travelers’ checks. M2 is a broader metric that encompasses M1 along with less liquid assets such as savings deposits, time deposits (e.g., certificates of deposit), and money market funds. Together, these indicators provide insight into monetary expansion and liquidity within the financial system.

Following the onset of the COVID-19 pandemic, the United States saw an unprecedented expansion in the M2 money supply. Stimulus packages, emergency relief measures, and aggressive monetary easing led to the largest injection of liquidity in modern history. This surge in money creation was a major driver of the inflationary pressures that followed, contributing to a sharp rise in the prices of essential goods and services across the country. As inflation accelerated, it became a key political issue—ultimately playing a role in the erosion of public support for the Biden administration.

Despite early assurances from the Federal Reserve and many economists that inflation would be “transitory,” persistent price increases forced the central bank to take corrective action. Interest rates were raised, and the pace of monetary expansion was curtailed. However, data from early 2024 indicates a renewed uptick in the M2 money supply, raising concerns among investors about the return of inflationary conditions.

In such an environment, investors often seek refuge in assets that can preserve value amid currency debasement. Traditional hedges include gold, real estate, and equities. However, among these, Bitcoin stands out as uniquely scarce—with a fixed supply of 21 million coins and no central authority capable of altering its issuance. This quality continues to drive interest in Bitcoin as a long-term store of value in the face of expansive fiscal and monetary policies. With almost 4 million bitcoins lost, there is not enough bitcoins for every millionaire to even have one bitcoin each in his wallet.

Bitcoin and gold have no cash flows. They are the true hedge against inflation. In fact in the last 15 years gold has outperformed the US stock market also. Bitcoin has outperformed gold at an even astonishing pace. Stocks cannot grow beyond a certain point, it still works on principles of discounted cash flows. Valuation of bitcoin or pricing works on belief and any price can justify belief unlike stock markets where price is driven by discounted cash flows and growth.

In the world of investing, participants generally fall into two broad categories: retail investors and institutional investors. Retail investors are individuals—everyday participants in the market—who often aim to maximize returns, take calculated risks, and grow their personal wealth.

In contrast, institutional investors—such as hedge funds, pension funds, and family offices—typically focus on preserving capital and achieving returns that exceed risk-free benchmarks with controlled exposure to downside risk. Understanding the mindset of institutional investors requires an appreciation of their incentive structures.

Unlike retail investors, institutional managers are responsible for managing large sums of money—often in the hundreds or thousands of crores. Their primary concern is capital preservation, not aggressive growth. For example, a pension fund or a family office with ₹1,000 crore under management might charge a 2% annual management fee, equating to ₹20 crore, plus a performance fee—often 20% of profits generated above a benchmark. If the value of the assets they manage declines, these institutions not only lose performance-related compensation, but they also risk losing the trust of their clients. This can result in significant capital withdrawals, further damaging fund stability and reputation.

The emphasis, therefore, is on stability, credibility, and controlled growth, which fundamentally shapes how institutional investors allocate capital—often favoring assets that are less volatile or that can act as hedges in uncertain macroeconomic environments.

Retail investors have long been dismissed as “dumb money” when compared to the perceived sophistication and strategic acumen of large institutional investors. However, in the case of Bitcoin, the early advantage belonged to the retail crowd. Institutional capital largely stayed on the sidelines during Bitcoin’s formative years—hesitating at price points of $100, $1,000, and even $10,000 and $50,000—due in part to widespread skepticism and public condemnation from major banks, regulators, and mainstream economists who labeled it a bubble, a fraud, or even a Ponzi scheme.

Now, that narrative is shifting.

Institutional investors are making up for lost time, channeling funds into Bitcoin exchange-traded funds (ETFs), purchasing equity in Bitcoin-heavy companies such as MicroStrategy, and even acquiring their corporate debt to gain indirect exposure to the firm’s substantial Bitcoin holdings.

Meanwhile, sovereign wealth funds and national governments are also beginning to allocate capital to Bitcoin, signaling a broader institutional acceptance of the asset. Trump Media & Technology Group (TMTG), the parent company of Truth Social, has announced plans to raise approximately $2.5 billion to establish a Bitcoin treasury. The capital will be secured through a private placement comprising $1.5 billion in common equity and $1 billion in convertible senior notes.

MicroStrategy continues to lead the corporate Bitcoin adoption movement, with holdings now exceeding $60 billion in value. In parallel, Cantor Fitzgerald has launched a $2 billion Bitcoin-backed lending initiative, aimed at providing financing solutions to institutional investors using Bitcoin as collateral. In the healthcare sector, KindlyMD has entered into a merger agreement with Nakamoto Holdings to form a publicly traded company focused on Bitcoin accumulation. The newly merged entity intends to grow its Bitcoin holdings on a per-share basis and position itself as a leading Bitcoin-focused firm.

On May 27, KindlyMD completed its first Bitcoin purchase—acquiring 21 BTC valued at $2.3 million. In another significant move, GameStop acquired 4,710 Bitcoin on May 28, 2025, becoming the 13th largest publicly listed holder of Bitcoin, surpassing Semler Scientific. This purchase follows the company’s March 2025 board resolution to adopt Bitcoin as a reserve asset. Yet, one question remains: when will Indian corporates or the Indian government follow suit? Despite widespread retail interest and adoption of Bitcoin among individual investors in India, institutional players and policymakers remain noticeably absent from the conversation. The reluctance to engage with this emerging asset class—despite global momentum—remains a puzzling anomaly.

There is a growing belief among market participants that Bitcoin’s market capitalization may eventually reach parity with that of gold. Gold’s global market cap stands at approximately $22 trillion, while Bitcoin’s remains around $2 trillion. If Bitcoin were to match gold’s valuation, it would imply an 11-fold increase in price—potentially pushing its value toward $1 million per coin. The key uncertainty lies not in the plausibility of this convergence, but in its timing—whether it unfolds over the next five years or takes a decade to materialize. And if by that time if gold price doubles like it did in the last 10 years, then bitcoin should reach market cap of 44 Trillion or 2 million dollars per bitcoin. Recent developments lend weight to this trajectory.

Since the launch of U.S. spot Bitcoin ETFs in 2024, assets under management have already surpassed $135 billion. For context, gold ETFs were introduced in 2004, and by 2009 had only reached $40 billion in AUM and today after 20 years it has reached 350 billion dollars in assets under management. This stark difference highlights the rapid institutional adoption of Bitcoin as an investable asset class. Just as gold ETFs once opened the doors for widespread institutional participation in precious metals, Bitcoin ETFs are now doing the same for cryptocurrencies.

This dynamic—coupled with limited supply and growing demand—may continue to put upward pressure on Bitcoin’s price. While various models, such as the Stock-to-Flow model, are frequently cited by bankers to influencers to forecast Bitcoin’s future price trajectory, their assumptions and accuracy vary. I would not call these models illogical but I like to keep it simple because simple is easy to understand. Governments across the world are used to printing money like drug addicts. Like any dependency, stepping back from aggressive money printing could induce economic withdrawal symptoms. In such an environment, Bitcoin, which cannot be debased at will, offer an alternative store of value—and perhaps, a necessary one.

The path to a potential $1 million price per Bitcoin is unlikely to be linear. Historically, Bitcoin has experienced severe drawdowns—often ranging from 70% to 80%—as seen during the market corrections of 2013, 2017, and 2021. Each of these downturns had different triggers: the collapse of the ICO boom in 2017 and the Terra-Luna implosion in 2021 are just two notable examples. Looking ahead, a future correction could be sparked by rising interest rates and corporate treasury meltdown from MicroStrategy.

It was not long ago that US had interest rates at 20% to stop the government excesses in the 1980s under Volcker and Reagen. In such a scenario, selling pressure may intensify rapidly, triggering forced liquidations across funds and institutional holdings. This cascade effect could extend to Bitcoin miners, some of whom may face insolvency, and to companies like MicroStrategy, where bondholders might demand redemptions—potentially requiring the liquidation of Bitcoin reserves, further amplifying downward pressure.

Market sentiment is heavily influenced by the psychological forces of fear and greed. In bullish environments, enthusiasm and conviction run high. But when sentiment shifts, those same actors—especially short-term holders—often rush for the exits, accelerating the decline. Positive momentum attracts buyers and drives prices higher, but negative developments can just as swiftly trigger a self-reinforcing cycle of panic selling.

For companies allocating significant portions—or even 100%—of their corporate treasuries to Bitcoin, this volatility presents both an opportunity and a risk. As the saying goes, “live by the sword, die by the sword.” The rewards may be immense, but so too are the potential consequences if the tide turns.

Nithin Eapen is a technologist and entrepreneur with a deep passion for finance, cryptocurrencies, prediction markets and technology. You can write to him at neapen@gmail.com

Disclaimer – The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.