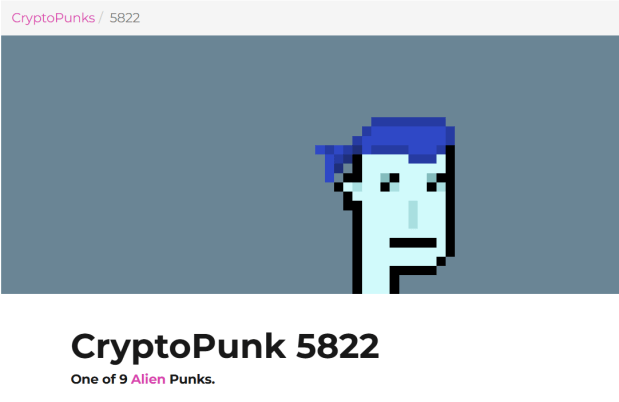

This is CryptoPunk 5822. There is nothing physical of this image. It is digital so you can make a copy of it but it will not be the original. It sold for 23 Million dollars on February 2022.

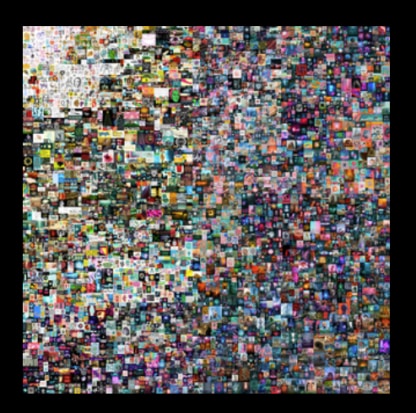

This is first 5,000 days a digital artwork or collage of 5,000 images created by Mike “Beeple” Winklemann and it sold for 69 Million dollars in 2021 at a Christie’s auction and you would not get a physical artwork though after spending all that money. It was purchased by Vignesh Sunderasan a Singapore-based crypto investor.

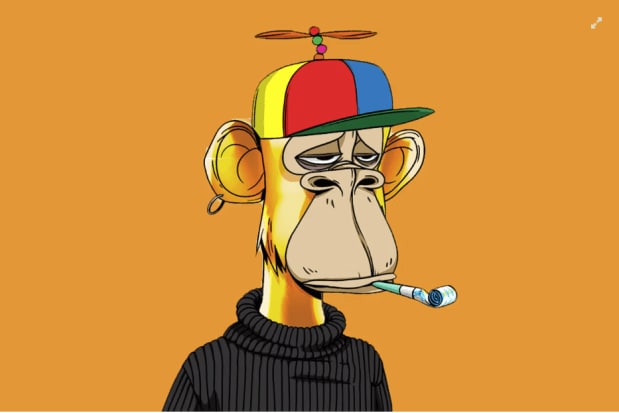

This is Bored Ape Yacht club NFT number 8817 and it sold for 3 Million dollars in 2021 at the Sotheby auction. This was considered a rare ape because it had golden fur.

This is an RTFKT sneaker. It was sold for approximately 135,000 USD in 2022. The specific shoe was designed by the artist Takashi Murakami. The NFT was purchased by AliSajwani. The transaction involved a Nike Dunk Genesis Cryptokick. Sneakers are collectors items, so it’s not unusual to see rare ones fetch huge prices.

Limited edition Yeezys regularly go for five figures, and shoes with historical value, like those worn by Michael Jordan during iconic games, sometimes auction for over a million. But here someone paid $100,000 plus for a pair of virtual Nike sneakers. There is no real shoe here even. At the same time a real unworn Nike sneaker could not fetch more than 350$.

Has the world gone crazy?

Welcome to the crazy world of NFTs if you have not heard about it.

The Core Idea: What “Non-Fungible” Actually Means

NFTs, or Non-Fungible Tokens, represent a new class of digital assets that are fundamentally different from fungible tokens such as Bitcoin. We have previously explored the concept of Bitcoin and its role as a decentralized currency.

It is important to understand the economic principle that separates these cryptos like bitcoin and NFTs: fungibility.

Fungibility is a defining characteristic of sound money. It refers to the property by which each unit of an asset is perfectly interchangeable with any other unit of the same type, without any difference in value or function. For instance, if one were to hand over a $100 bill and receive another $100 bill in return, the transaction would leave both parties unchanged in terms of value. It is irrelevant to see which specific note is held; all $100 bills are identical in worth. This principle extends further: one $100 bill is equally interchangeable with two $50 bills or ten $10 bills. The same principle applies in financial markets.

Consider Apple stock (AAPL). If one investor owns a single share of AAPL and another investor holds a single share as well, those shares are identical in terms of ownership rights, dividends, and voting power. No share of a particular class of stock carries special privileges over another. Thus, shares of the same class within a company are also fungible.

Non-fungible means that each item is unique and not interchangeable on a one-to-one basis, even if they look similar. Key non fungible examples in the real world are real estate like houses. Even if two houses are both “3-bedroom, 2-bath,” they’re not identical. Location, neighborhood, view, and condition all make one house different in value from another. You can’t just swap two houses and say the exchange is perfectly fair without negotiation.

A Digital Answer to an Analog Problem

Collectibles like Baseball Cards, Stamps and art are another example. A Babe Ruth rookie card is not the same as a random rookie card from another player. Even if two cards show the same player, conditions like mint vs. worn make them different. Each piece of art by Picasso or Van Gogh is unique and valued individually.

Baseball cards have long held a cherished place in American culture, blending sports fandom with the thrill of collecting. The tradition dates back to the late 19th century, when tobacco companies began inserting cards featuring baseball players into their products as promotional items. Over time, these cards became highly sought after collectibles, sparking a robust secondary market where rarity, player popularity, and card condition determined value.

By the mid-20th century, companies such as Topps dominated the baseball card industry, producing annual sets that enthusiasts eagerly pursued. The culture of trading cards on playgrounds, at local hobby shops, and later at large conventions, created a vibrant community of collectors. However, with the growth of this market came persistent challenges. Counterfeiting became increasingly sophisticated, and disputes over authenticity and condition frequently arose. Collectors often relied on third party grading services to certify a card’s legitimacy and quality, but even these systems were not immune to manipulation, human error, or bias. Stories of doctored cards, forged signatures, and tampered packaging highlighted the vulnerabilities in the physical trading space.

The global sports trading card market size was approximately $11.5 billion in 2024 and is projected to reach around $52 billion by 2034, according to market reports from March 2025 with a projected CAGR between of 8%. These figures encompass the entire sports trading card industry, not just baseball cards. Collectors Inc, is a global leader in the collectibles industry, providing authentication, grading, and management services and it was valued at four billion dollars in 2022.

With the innovation of bitcoin, it was possible to send value over the wire without a trusted middleman. It opened up the possibility of trading digital art over the wire via smart contracts. Digital art was not a scarce commodity. Prior to blockchains and bitcoins, every digital art or image you send over the network, the receiver could copy and forward it again. And there was no difference in the original and the each forwarded and copied image. Artists had a problem of establishing verifiable ownership of digital works. Also artists or creators generally had no more revenue share in their works after their first sale. NFTs and smart contracts just changed the whole industry of digital arts and memes.

The Pioneers: A Brief History of Early NFTs

The honor of being called the first NFT generally goes to “Quantum”, a digital artwork created in May 2014 by Kevin McCoy, a digital artist, and Anil Dash, a technologist. It was a pixelated, pulsing octagon animation that McCoy registered on the Namecoin blockchain. Although the technology at the time was rudimentary compared to modern blockchains like Ethereum, Quantum pioneered the concept of provenance and uniqueness in digital assets. It set the foundation for what would later explode into the NFT ecosystem.

Ethereum and its ERC-721 standards emerged in 2017 and changed the whole game of NFTs giving rise to projects such as CryptoPunks and CryptoKitties, which popularized NFTs to a broader audience.

CryptoPunks was launched in June 2017 by Larva Labs, a creative studio founded by Canadian software developers Matt Hall and John Watkinson. Inspired by the punk movement and cyberpunk aesthetics, they generated 10,000 unique 24×24 pixel art characters using an algorithm. Each “punk” was a small, digital portrait: humans, zombies, apes, and aliens with randomized attributes like hairstyles, hats, and accessories. These tokens were released for free: anyone with an Ethereum wallet could claim a Punk. At the time, Ethereum’s ERC-721 standard for NFTs hadn’t even been finalized, so CryptoPunks operated on a custom smart contract that essentially pioneered the NFT concept on Ethereum.

In the early years (2017–2019), CryptoPunks traded modestly, often for a few dollars or fractions of an ETH. As NFTs exploded in 2020–2021, CryptoPunks became the definitive “OG” NFT project, valued for being both historically important and culturally iconic. By 2021, during the NFT boom, prices skyrocketed: Common Punks routinely sold for six figures in USD, the Rare Alien, Ape, and Zombie Punks reached multimillion-dollar sales. One Alien Punk (#5822) sold for 8,000 ETH (~$23.7 million) in February 2022—among the highest NFT sales ever. CryptoPunks became a status symbol, with celebrities like Jay-Z, Serena Williams, etc.. purchasing and displaying them as profile pictures. Initially, Larva Labs managed the project, but in March 2022, they sold the intellectual property rights of CryptoPunks (and their later project, Meebits) to Yuga Labs, the creators of the Bored Ape Yacht Club.

CryptoPunks remain one of the most valuable and recognizable NFT collections. Floor prices, the lowest price for a Punk fluctuate with broader crypto and NFT market cycles, but as of 2025, they still command tens of thousands of dollars minimum. They are increasingly seen as digital artifacts or “historical NFTs,” valued not just for rarity but for their pioneering role in NFT history.

CryptoKitties was launched in November 2017 by the Canadian startup Axiom Zen, a venture studio based in Vancouver. The game was later spun out into a separate company called Dapper Labs. CryptoKitties was one of the first blockchain games and a defining moment for NFTs. Players could purchase, collect, breed, and trade digital cats, each represented as a unique NFT on the Ethereum blockchain. Each cat had distinct traits (“cattributes”) such as fur color, eye shape, and patterns, determined algorithmically. Unlike fungible tokens like Bitcoin or Ether, each CryptoKitty was unique, embodying the concept of non-fungibility in a playful and accessible way. CryptoKitties became so popular that it congested the Ethereum network, slowing transactions and highlighting scalability issues.

Early adopters paid anywhere from a few dollars to hundreds of thousands of dollars for rare cats. The most expensive sale at the time was “Dragon,” a CryptoKitty that sold for 600 ETH (≈ $170,000 in 2018). Breeding rare traits became a speculative frenzy, with some collectors treating cats as investments while others enjoyed the game-like aspect. CryptoKitties demonstrated the fun, gamified side of blockchain, introducing thousands of people to Ethereum who might never have engaged with it otherwise.

Dapper Labs went on to develop Flow Blockchain, a more scalable blockchain designed for NFTs and gaming and partnered with the NBA to launch NBA Top Shot, which became a mainstream NFT success in 2020–2021. Dapper Labs raised hundreds of millions in venture funding and became one of the most recognized names in the NFT space. After the initial hype, CryptoKitties’ popularity declined as novelty wore off and newer NFT projects emerged. The game still exists, but its player base is much smaller.

Dapper Labs shifted focus to larger-scale projects like NBA Top Shot, NFL All Day, and the broader Flow ecosystem. Despite fading from mainstream attention, CryptoKitties retains historical significance as one of the first viral NFT projects, proving that blockchain could power consumer entertainment at scale. The legacy is that CryptoKitties Introduced NFTs to the world in a fun, gamified way, Exposed Ethereum’s scalability limits, sparking innovation in blockchain infrastructure and laid the foundation for Dapper Labs’ rise, leading to Flow and major sports partnerships.

NBA Top Shot was launched in October 2020 by Dapper Labs, the team behind CryptoKitties, in partnership with the National Basketball Association (NBA) and the NBA Players Association (NBPA). Built on Dapper’s nft purpose built Flow blockchain. NBA Top Shot became the first NFT project to reach mainstream popularity. By March 2021, sales were surging, with daily transactions exceeding $10 million at peak. Total sales volume surpassed $200 million in February 2021 alone. Within its first year, NBA Top Shot generated over $700 million in marketplace transactions across hundreds of thousands of users. Some individual Moments sold for six figures, such as a LeBron James dunk that went for over $200,000. While NBA Top Shot was a cultural phenomenon in early 2021, momentum slowed by late 2022 as the wider NFT market cooled. Secondary market prices for many Moments dropped significantly as supply expanded and speculative demand receded.

NBA Top Shot introduced hundreds of thousands of first-time NFT users, many of whom had never interacted with blockchain before. Its success encouraged other leagues to explore NFTs, including the NFL (“NFL All Day”), UFC (“Strike”), and Major League Baseball. The NBA and NBPA benefited from licensing fees and royalties on every transaction, showing how sports organizations could monetize digital fandom at scale.

OpenSea, founded in 2017 by Alex Atallah and Devin Finzer, quickly became the dominant marketplace for Non-Fungible Tokens (NFTs). Inspired by the success of early blockchain projects like CryptoKitties, the platform set out to be the “eBay of NFTs,” offering a venue where creators and collectors could mint, buy, and sell unique digital assets ranging from art and music to in-game items and domain names. By lowering barriers to entry and supporting multiple NFT standards such as ERC-721 and ERC-1155, OpenSea became the default gateway to the NFT ecosystem. The platform’s growth exploded during the NFT boom of 2020–2021. Monthly trading volumes surged from a few million dollars in early 2020 to billions by mid-2021.

In August 2021, OpenSea recorded more than $3.4 billion in transaction volume in a single month, making it one of the fastest-growing startups in the world. This surge was fueled by projects such as CryptoPunks, Bored Ape Yacht Club, and Art Blocks, which became cultural phenomena and cemented OpenSea’s role at the center of digital culture. Investor enthusiasm mirrored this meteoric rise.

In January 2022, OpenSea closed a funding round led by Paradigm and Coatue that valued the company at $13.3 billion, making it one of the most valuable private crypto firms globally. The round reflected both investor confidence in NFTs as an emerging asset class and OpenSea’s commanding market share and at one point exceeding 90 percent of all NFT marketplace transactions. Despite its dominance, OpenSea has faced challenges. Technical glitches, customer service complaints, and controversies around insider trading and stolen NFTs have raised questions about oversight and trust. Competition also intensified with the rise of marketplaces like LooksRare, Blur, and Magic Eden, which sought to attract traders through lower fees, reward systems, or specialized community features. Market downturns in 2022–2023 reduced trading volumes dramatically, testing the resilience of both OpenSea and the broader NFT ecosystem. Today, OpenSea remains a leading NFT exchange, though its position is less absolute than during its peak. Its legacy lies in having provided the infrastructure for an entirely new digital economy, one where ownership, creativity, and speculation intersect.

NFT.NYC founded by Jodee Rich is one of the world’s largest and most influential conferences dedicated to NFTs and the broader Web3 ecosystem. First held in 2019 in New York City with less than 300 people attending, it quickly became a flagship event, attracting artists, developers, investors, and major brands exploring the future of digital ownership. Known for its high-energy atmosphere and diverse programming, NFT.NYC features panels, workshops, and exhibitions covering art, gaming, collectibles, and decentralized finance. At its peak in 2021 and 2022, the conference drew twenty thousands of attendees at an average ticket price of a thousand 1,000 dollars and served as a cultural hub where partnerships were forged and projects debuted. Today, it continues to symbolize the mainstreaming of NFTs, blending industry thought leadership with community-driven creativity.

The Cambrian Explosion: An Ecosystem is Born

The NFT ecosystem is far from dead. In fact, it continues to show growth and resilience. The global NFT market is valued around US $49 billion in 2025, up from approximately $36 billion in 2024.

In just the first quarter of 2025, global NFT sales exceeded US $8.2 billion. The average sale price for NFTs has leveled off at around US $940, signaling more mature, deliberate buying behavior. Daily active NFT wallets now average around 410,000, a 9% year-over-year increase. Meanwhile, the total number of NFT users is estimated at about 11.6 million worldwide, up from 10.2 million in 2023.

NFTs once offered a flashy playground for celebrities, but many projects have since faded. Donald Trump has released several branded NFT collections, like superhero-style trading cards but they’ve been controversial. One release even restricted resale until January 31, 2025, and raised concerns over licensing and campaign funding. Shakira debuted La Caldera, a four-piece digital art collection created with BossLogic. Prices ranged from 0.6 ETH (~$935) up to 20 ETH (~$61,000). Proceeds supported her foundation and sustainability efforts. Projects like “Stoner Cats”, backed by Ashton Kutcher and Mila Kunis, have run afoul of regulators. The NFT-funded animated series was fined US $1 million by the SEC for conducting an unregistered securities offering.

Beyond Collectibles: The Evolving Use Cases

From the start, brands saw NFTs not only as digital collectibles but also as a way to reinvent loyalty programs. Unlike traditional reward points, which are centralized, non-transferable, and often forgotten by customers, NFTs promised programmable, tradable, and status-driven loyalty assets. The pitch was simple: make points feel like property, not coupons. A loyalty NFT sits in a customer’s wallet, not on a brand’s server, creating a stronger sense of control. Unlike traditional points, NFTs can be sold, gifted, or traded—adding real value and liquidity. Certain NFTs grant access to exclusive clubs, events, or perks, turning loyalty into social currency. Smart contracts allow brands to design tiered rewards, limited-edition perks, or gamified experiences.

Starbucks launched “Odyssey,” an NFT-based extension of its Rewards program on the Polygon blockchain. The project initially drew buzz but was shut down in 2024 due to shifting corporate priorities and waning user engagement.

Nike acquired RTFKT Studios, creators of virtual sneakers and avatars, in 2021. Adidas partnered with Bored Ape Yacht Club, Punks Comics, and Gmoney for its NFT launch in 2021. Holders received access to exclusive merchandise and virtual experiences. The project showed strong early traction but has since slowed, mirroring the wider NFT market correction. Their “CryptoKicks” NFTs allowed users to own and even “breed” digital sneakers, blending fashion, gaming, and status.

Brands like Gucci and Louis Vuitton tested NFT drops linked to VIP access and fashion items. Hotels and airlines experimented with NFT passes for priority upgrades and event access, though few scaled. A ton of marketing research can be done on loyalty, tokenomics, speculation with regards to NFTs and crypto airdrops like Do tokenized loyalty programs increase engagement, trust, and customer value relative to traditional points-based programs?

The Investor’s View: Risks and Realities

The rules of how artists or creators of art are incentivized or paid have changed with NFTs. The project can be built in such a way that every sale can have a small percentage sent to the original artist. Even if initially the NFTs were sold at a very low price, as long as the community likes it and trades it, the original creator can be acknowledged and compensated with every sale. You cannot do that in traditional art. When Jeff Koons – Rabbit (1986, sculpture) was sold for the highest auction record for a living artist at approximately $91.1 million, sold in 2019, the original sculptor need not get anything off of it.

The Bored Ape Yacht Club (BAYC), created by Yuga Labs in April 2021, is one of the most recognizable and influential NFT collections. Comprising 10,000 algorithmically generated cartoon apes with unique traits, BAYC quickly transcended digital art to become a cultural phenomenon. Ownership granted not just profile-picture bragging rights, but also membership in an exclusive community, complete with private events, merchandise, and additional NFT airdrops like Mutant Apes and Kennel Club. Prices for Bored Apes soared during the NFT boom of 2021–2022, with rare apes selling for millions of dollars and celebrities such as Eminem, Steph Curry, and Paris Hilton joining the club. Today, BAYC remains a “blue-chip” NFT project, symbolizing both the hype and staying power of the Web3 movement.

Among them, one ape (Bored Ape #1798) had a brown fur coat, a striped shirt, a fisherman’s cap, and a world-weary look. Two BAYC community members, Safa and Valet Jones, purchased this ape and decided to give it a personality. They named him Jenkins the Valet, imagining him as the Yacht Club’s parking attendant and storyteller. The idea was that Jenkins had “seen it all” at the BAYC and could narrate tales about the community’s characters.

Amid this community, Jenkins the Valet emerged as a storytelling experiment that highlighted how NFTs could extend beyond static art into media franchises. Jenkins was a fictional character, represented by a single Bored Ape, who served as a valet parking attendant for the Yacht Club. The creators built an entire narrative universe around him, securing representation with Creative Artists Agency (CAA) and planning books and other media projects. Holders of related NFTs, called the Writer’s Room, were given a say in shaping Jenkins’ stories, blending decentralized ownership with collaborative creative production. While the initial buzz cooled as the broader NFT market slowed, Jenkins the Valet remains a case study in how NFTs can evolve into participatory intellectual property turning a single cartoon ape into a character with narrative, commercial, and cultural potential.

Maybe one of you reading this might be able to create a character collection and build a universe with amazing story telling around it.

Nithin Eapen is a technologist and entrepreneur with a deep passion for finance, cryptocurrencies, prediction markets and technology. You can write to him at neapen@gmail.com

Disclaimer – The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.