Bitcoin has reached a remarkable milestone—crossing ₹1 crore (approximately $120,000). I have been writing or talking about bitcoin from the time it was in the 100-500$ range. It has reached 120,000 USD or one crore Indian rupees today. Back then, some of my talks were even canceled for discussing a topic considered controversial or “banned” in certain circles. Today, it is no longer taboo, but the most common question remains unchanged: where does Bitcoin go from here? Does it crash to zero, rise to $200,000, or even reach a million dollars?

This same question has followed Bitcoin at every stage—$1,000, $5,000, $10,000, and $100,000. My answer has always been honest: I wish I had a crystal ball. But while we can’t predict the future, we can examine what people—both critics and believers—have said along the way.

Bears will be bears

A perennial bear, Peter Schiff who is a well known gold bug, financial advisor and economist has maintained from 2018 that bitcoin is a bubble destined to collapse to zero since it has no intrinsic value. He reiterated this view as recently as April 2025 and it kept going higher.

Aswath Damodaran, a professor of finance at NYU Stern School of Business and known as “Wall Street’s Dean of Valuation,” says it is a currency nobody uses. Nobel prize winner Nouriel Roubini has rejected bitcoin as an inflation hedge and has been saying bitcoin price will go to zero from 2018.

Charlie Munger called bitcoin immoral, evil and worthless.

Jamie Dimon, CEO of J P Morgan and regarded as the most powerful bankers in this world, called it worthless, likened it to a “pet rock”, and questioned its value as an investment.

The Indian central bank governor Shaktikanta Das was against bitcoin saying it will cause financial instability.

Is the world’s fourth largest GDP country scared that a private digital hash stored on peoples’ computers can cause financial instability or is it fear rooted in ignorance or is it fear that bitcoin and cryptos will replace the central government issued currency? Imagine you listened to all these guys and never bought a bitcoin?

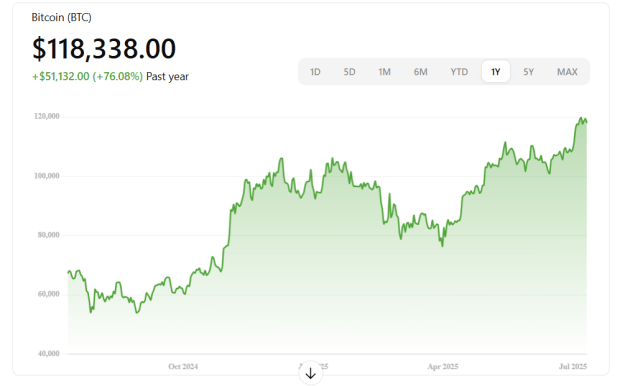

This is the one year price graph of bitcoin

Now let us look at the short term and long-term predictions of some of the bulls or optimists in this space.

Bulls remain bullish, more than ever Michael Saylor, CEO of MicroStrategy and one of the largest corporate buyers of bitcoin, predicts that the price of a single coin could top $13 million by 2045.

According to Tom Lee worth 200 million dollars of Fundstrat Global Advisors, Bitcoin is poised for significant gains in the coming years. His predictions are optimistic, with short-term targets of 200-250K USD and 1.5 million dollars in the next decade.

Mike Novogratz, CEO of Galaxy digital and another billionaire predicts that Bitcoin price may reach $1,000,000 relatively soon.

Tim Draper, a prominent Venture Capitalist and billionaire, predicts bitcoin to hit 250K USD by end of 2025.

Who would you trust your money and invest decisions with? Poor or salaried economists and academics? Or people who handsomely profited with this funny money virtual thingy? Academia and traditional investors have a tough time getting on to any new technology or even understanding that the market is not a static organism and it evolves.

Now if the question is what is my perspective? I generally only believe in faith and long-term investments mainly because of taxes. There is no point in selling and paying 50% taxes. So long term I believe bitcoin will hit 2 million dollars a bitcoin provided the cryptography or private keys are not broken by some quantum computer. Even that there is a solution of replacing the algorithm by quantum resistant algorithms. The reason for that belief is simple, I believe bitcoin is a better store of value and it will replace gold in market cap. Governments across the globe will keep inflating their fiat paper currency and every asset class will increase in price with the base fiat currency.

Now if you are a day trader and live off of making gains by price movements, you have to know what short term or daily bets or positions you have to wager. If you are trading on your own money I personally do not think it’s the best way of generating wealth but each to his own. But if you can raise money and run a fund then you need to trade and show your investors you bring value to the table. If you live in jurisdictions that have no taxes on short term capital gains you should trade daily or monthly or based on events.

I am a firm believer in history or patterns that repeat and bitcoin is a prime example for that.

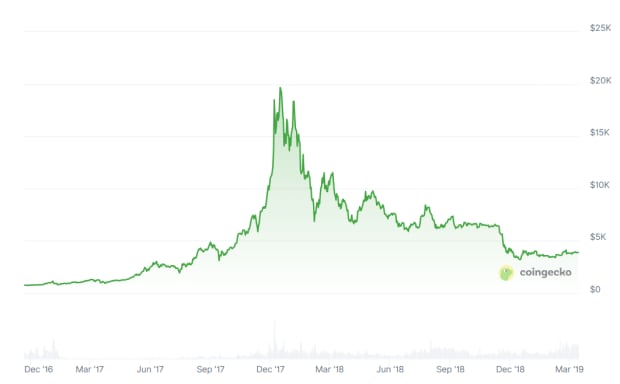

This is one bitcoin price pattern that I noticed. The halvening or halving of bitcoin happened in 2012, 2016, 2020 and 2024. This is where rewards to the miners become half of what they were before. I wrote about this here.

Between 2013-2015

Between 2017-2019

Between 2021-2022

The Next Bitcoin Cycle

If history is any guide, the next cycle could play out between 2025 and 2027. We’ve already seen the rise from $20,000 to $120,000. If that pattern holds, the peak might be between $180,000 and $250,000 possibly by November 2025 or maybe even 120K is the peak and then followed by another correction. If this were true and I was a short term trader, I would buy now and sell by October -November time frame and buy put options for June 2026. If Bitcoin prices keeps going up, you capture the upside with your buy, if it goes down your put options are in the money and if it goes up till November and then goes down, you get double benefits.

The reasons why it should go down wish I knew.

In 2013 it was the collapse of Mt.Gox, In 2018 it was the ICO bust and in 2021 it was the Terra-Luna collapse. Nobody knew this earlier but somehow it happened. Same way, something will happen is my gut feeling, it could be perhaps trade wars, geopolitical conflict, or drastic Fed rate hikes. Whatever it is, it is always good to study history and patterns. Hitler could have learned from Napolean’s loss to Russia and need not have committed the same blunder in war strategy if he was a good student of history. A trader should also study history, learn about macroeconomics, geopolitics, sociology and above all listen to the market, the wisdom of the crowds.

Now just because a pattern happened in the past does not mean it will happen again today or in the future. Buyers and sellers beware of any predictions; they are all guesses, specially the ones from academics and journalists. But when a high profile investor bets his own money, I consider that a stronger signal and it shows he is willing to put money where his mouth is. If the doomsayer is also willing to short bitcoin when he is saying so, now that becomes a better signal. It need not be correct but at least we know if we follow his advice and lose money he loses money too. And most people would be careful to bet their money but they will not have a problem in giving any financial advice.

We should be listening to people who are playing in the same game. When you follow advice, specially financially advice, from people who don’t have stake in the game, I would suggest never trust such advice or do not play such a game. They make money on subscription or because of viewership on their podcast.

Nithin Eapen is a technologist and entrepreneur with a deep passion for finance, cryptocurrencies, prediction markets and technology. You can write to him at neapen@gmail.com

Disclaimer – The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.