The country?s equities slumped about 1.9% in line with peers in Asia Pacific on global concerns and sustained selling by overseas investors. World indices remained jittery as Greece admitted it would miss its deficit target this year.

The HSBC Markit India Manufacturing PMI fell more than two points to 50.4 from 52.6, indicating that high borrowing costs were crimping India?s manufacturing growth. The gauge had expanded at its slowest pace in 2.5 years.

The HSBC Markit India Manufacturing PMI fell more than two points to 50.4 from 52.6, indicating that high borrowing costs were crimping India?s manufacturing growth. The gauge had expanded at its slowest pace in 2.5 years.

Foreign institutional investors (FIIs) sold shares worth R825 crore on Monday, provisional BSE data shows. They have sold shares worth $2.37 billion since August and remain net sellers of equities worth $0.21 billion in the year to date. Domestic institutions purchased shares worth R295 crore on Monday.

Key indices in Asia Pacific mostly ended in the red on Monday, with the Hang Seng and Jakarta Composite declining the most at 4.3% and 5.6%, respectively. The Kospi index ended marginally in the green. The MSCI Asia Pacific Index fell 2.7% to 110.10 as of 5:38 p.m. in Mumbai. The gauge had slumped 8.6% in August, the most since May 2010.

The Dow Futures was down 34 points at 10807 at 5.20 pm India time. All three major European indices, the FTSE, Dax and the CAC, were trading in the red, having lost about 2%. Yields on 10-year US treasuries were ruling 3 basis points lower at 1.883% compared with the previous day?s closing of 1.916%. Crude oil prices were ruling lower by down $0.42 at $102.32 per barrel.

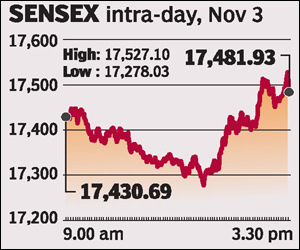

Back home, the Sensex slid 302.31 points or 1.84% to close at 16,151 while the broader 50 share NSE Nifty was down 93 points or 1.9% at 4,849. The benchmark Sensex has fallen 13% in the three-month period ending September 30, its worst quarter since the quarter ended December 2008. The Sensex has shed more than 21% the year to date this year amid negative newsflow from the US and euro zone and local worries about inflation and rising interest rates.

On Monday, 22 of the 30 Sensex stocks declined. In the broader market, breadth was negative with about 66% or 1910 stocks traded on the BSE ending lower compared with 876 advances. All of the BSE sectoral indices ended in the red, with the Realty and Metal indices declining more than 4% each.

The NSE cash turnover on Tuesday was at R8,682 crore, while the six monthly daily average is R11,700 crore. Turnover in derivatives was R81,146 crore and the daily average for the past six months is R1.27 crore. India VIX, a volatility index based on the S&P CNX Nifty index option prices, rose 9.8% to 35.07.