Small-cap stocks have historically produced some of the best companies to buy for long-term wealth creation. In the last 25 years, small-cap stocks were the origin of some of the best stocks to buy. In 1998, Amazon (AMZN) shares traded at $7, while in 2010, Tesla (TSLA) had a market value of just over $1 billion. Anyone who would have bought those shares at that time would have become a multi-millionaire by now.

Companies are classified as small-cap if they have a market valuation of roughly between $300 million and $2 billion. They tend to have significant growth potential, however, not every small-cap company turns out to be a multi-bagger in the long run. Compared to mid- and mega-cap stocks, investing in small-cap stocks carries a larger risk, but there is also a greater potential for gain.

The Russell 2000 Index, which measures the performance of about 2,000 of the smallest cap companies in the U.S., is up by almost 10% YTD. Similarly, another small-cap market index, S&P 600 index is almost up by 7% YTD in 2023.

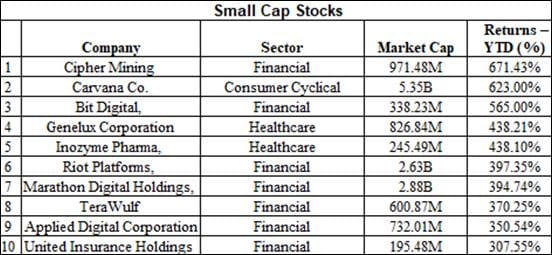

Still, some small-cap stocks have given good positive returns as a group, and the top performers came from an industry that can be considered 2022’s biggest loser – Crypto.

Cipher Mining, a Bitcoin company, topped the chart with 671.43% YTD returns. Another peer, Bit Digital, wasn’t far behind. The top 3 small-cap companies, Cipher Mining, Carvana, and Bit Digital, gave more than 500% YTD returns.

The top rankings charts based on YTD returns included companies majorly from the financial and healthcare sector. The healthcare sector is one of the most sustainable sectors, which has grown significantly, especially after the pandemic.

Small-cap stock prices are more volatile than those of larger corporations over time, and stock values vary more significantly. However, in general, the longer the holding time, the more likely small-cap companies outperform large-cap stocks.

Businesses are often small caps throughout their growth phase, making them more volatile than larger businesses. The small-cap companies grow into mid-cap and later turn large-cap based on their fundamental strength. As we saw during the pandemic, they consequently take a bigger blow during a crisis. In other words, small-cap companies often do better during bull markets than they do during bear markets. Therefore, it’s crucial to conduct the required research before adding small-cap companies to your portfolio.

(By Contributor – Aashima Yadav)