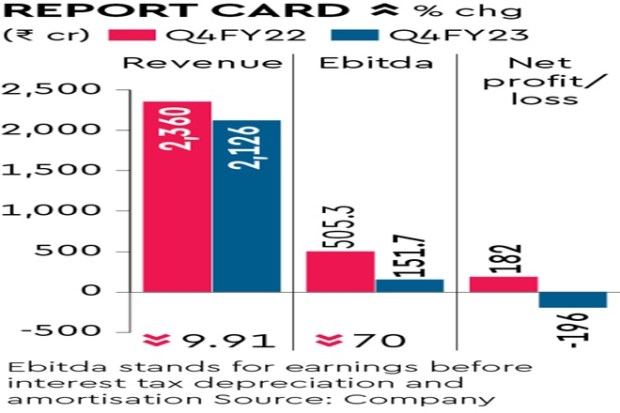

Zee Entertainment Enterprises (Zee) on Thursday posted a consolidated net loss of Rs 196 crore for the quarter ended on March 31, 2023 (Q4), on the back of an advertising slowdown, missing street estimates by a wide margin. Bloomberg consensus estimates had pegged Q4 profit at Rs 113 crore. The media company had posted a net profit of Rs 182 crore in the year-ago period.

Revenue fell nearly 10% year-on-year (y-o-y) to Rs 2,126 crore from Rs 2,360 crore in the same period last year. Advertising revenue fell 11% to Rs 1,006 crore from Rs 1,119.7 crore reported last year. Bloomberg consensus estimate had pegged revenue at Rs 2,064 crore.

Zee’s earnings before interest, taxes, depreciation and amortization (Ebitda) plunged 70% y-o-y to Rs 151.7 crore due to elevated strategic investments across the business, the company said. It had reported a `505.3 crore Ebitda last year. Bloomberg consensus estimates had pegged Ebitda at Rs 267 crore for Q4.

Further, operating margins contracted to 7.2% from 21.8% reported last year, analysts said, after being impacted by an increase in costs across Zee5, movies and sports.

Zee also said it was discontinuing its funding to tech startup SugarBox, as it reins in expenses. Zee would, however, continue to invest in its digital and sports businesses, it said.

The company is looking to merge with Culver Max Entertainment (formerly Sony Pictures Networks India).

While Zee has been settling its disputes with creditors in recent months and received approval from the bourses, shareholders and the Competition Commission of India, it faced a setback last week when the National Company Law Tribunal (NCLT), directed the BSE and NSE to reconsider initial approvals to the Zee-Sony merger.

The order came after markets regulator Sebi issued an adverse interim ruling against an Essel group entity.

Zee has since challenged the NCLT order in the National Company Law Appellate Tribunal, with the case to be heard on Friday after being deferred on Thursday.

Shares of Zee settled at Rs 178.25 apiece on the BSE on Thursday, down 1.22% versus the previous day’s close. In the last one year, the Zee stock has shed nearly 22% of its value as the merger process progresses slowly.

In an earnings’ call last week, Sony CEO Kenichiro Yoshida said the company was looking to complete the merger with Zee by the end of the first half of the current financial year.

The proposed deal would see Sony indirectly hold a 50.86% in the combined company, while Zee’s founders would own 3.99% and the remaining 45.15% would belong to other shareholders, including the public.