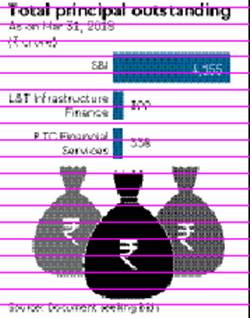

A consortium of lenders led by State Bank of India (SBI) has put on sale a 1,200-megawatt (MW) thermal power plant in Chhattisgarh set up by SKS Power Generation (Chhattisgarh), according to sources. The total principal outstanding, as on March 31, stood at Rs 4,892 crore, of which SBI’s exposure was Rs 4,155 crore. SBI Capital Markets (SBI Caps) has been appointed by SBI on behalf of the consortium to invite proposals through a bidding process and identify an investor for acquisition of at least 51% share in the company.

In addition, SBI had also sanctioned fund-based working capital (FBWC) limit of Rs 414.6 crore, a letter of credit (LC) limit of Rs 42 crore and a bank guarantee limit of Rs 395 crore, according to a document seeking bids. An email seeking a response from SKS Ispat and Power remained unanswered till the time of going to press. Unit I of phase I of the project, comprising a capacity of 300 MW, began commercial operation on October 6, 2017, while unit II of phase I, which consists of another 300 MW, became operational on April 1, 2018.

The company had entered into a power purchase agreement (PPA) with Chhattisgarh State Power Trading Company in 2011, under which the latter would buy 5% of the net energy generated at the plant at energy charges. It had also secured short-term PPAs with discoms of four states and a medium-term PPA with Noida Power Company.

However, in the absence of a long-term PPA, the plant has been unable to source linkage coal. At present, it sources coal through e-auction and from the open market. It is likely to enter into a long-term PPA with the Rajasthan discom, the document said. Stressed assets in the power sector have been a cause for concern for banks after a chunk of troubled assets in the steel sector — the other significant source of stress —took the Insolvency and Bankruptcy (IBC) route to resolution.

A lack of PPAs and other structural issues has led to many power projects defaulting on loan repayment obligations. Banks are currently working on a plan to resolve Rs 70,000 crore worth of non-performing assets (NPAs) in the power sector through operation and maintenance (O&M) contracts.

The mode of resolution for power assets will involve determining the “sustainable debt” levels of completed plants with existing power purchase agreements (PPAs) and coal supply arrangements. On May 5, FE had reported that companies whose power projects may be rated by credit rating agencies include KSK Mahanadi, Indiabulls, GMR, Avantha, Essar and Lanco.