Bosch Global Software Technologies (BGSW) is a key partner to the global automotive industry. In an exclusive chat with Financial Express, Dattatri Salagame, CEO, President, and MD, BGSW, shares his views on leading the company, the talent war, role of software in the automotive industry and much more. Edited excerpts.

What have been the key learnings since you took charge as the Head of Bosch Global Software Technologies three years ago?

I took over in the middle of the pandemic, then we jumped into getting used to shifting more than 25,000 people to their homes. We are an engineering company with a lot of work on hardware; we had to move the hardware to the homes to keep our engineering services going. The good part is that we never had a disruption and every project was delivered around the world.

In 2022 when there was a lot of pent-up demand, and a change of attitude towards work brought in a lot of stress on employee retention. The industry was running at more than 20-29% attrition. We had to quickly jump in to manage this situation because our projects were growing very big. We had over 20% growth in 2022 and had to manage growth on one side and attrition on the other side eventually we did it.

Just to give you some numbers in 2022 we hired 9,000 people, that’s a lot of action in one year. We also opened more centers, like Hyderabad and Pune centers came alive and they scaled up to 1,400 to 1,500 associates in a matter of about 15 months.

I think the learning would be to never imagine that you hit the steady state as I mentioned. During the pandemic, we faced the post-Covid supply chain crisis, the shortage of talent followed by the war, and its impact on the supply chain.

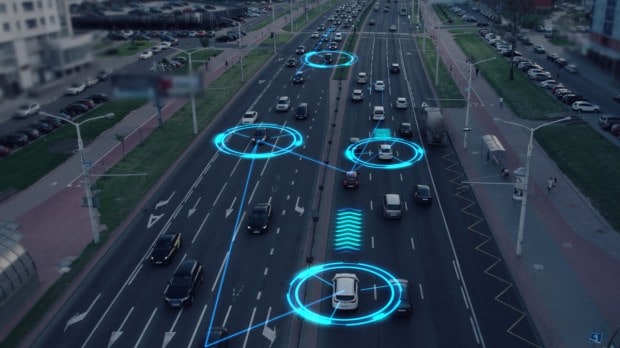

Now we are in the era of mobility disruptions, where we are looking at software-defined vehicles, software being the higher-order valuing vehicles, and that space being contested by various people and different kinds of companies. That’s the kind of attention that we are focusing on now.

How are you addressing the talent crisis, especially with some companies ready to offer lucrative packages?

We cannot directly compete with many of them, because our life span is much different and our scope is very different. People who passionately work with us are the ones who love the domain. They are very passionate about automotive complex systems and are solving challenging problems. If there is an opportunity to work for an e-commerce startup versus solving the autonomous driving technology, there are people who will choose autonomous driving, no matter how much they are paid.

That’s the crowd that we aim to foster. We focus on passionate domain-oriented people who are married to solving deep tech problems. We really go all out for that and have our own incentive models for people who are in this zone. It is linked to the kind of projects they work on, own up and they do in this field. We have been very successful in that.

As software takes centrestage in mobility, what role do you see for companies like BGSW?

Bosch was always a software-rich company, the only thing was our software was embedded deep in electronics – in the hardware. BGSW would complete the value stream and we will have components, systems, software at the edge, software on the cloud, the middleware, and the full stack. We will have the complete value stream and depending on the context of how this is being played out by different OEs, we will occupy a different role in it. In some areas, for example, we are complete stack providers or we are at the edge, in some areas, we are on the cloud, but you would see BGSW playing these roles in different parts of the value stream.

Can you elaborate on the evolution, growing importance and acceptance of software in the automotive industry?

It is evolving as we speak. If you see the customer or the mobility-consumer experience in the car is largely created through software – be it infotainment and connected vehicles, the internet connected vehicles (car), as they call it. This is largely created through a software-rich experience. But a four-wheeler is a much more complex system. At times people say, a vehicle is a smartphone on wheels.

But as we go forward three to five years – I won’t associate the timeline as quickly as that, but the software-defined experience for mobility consumers is going to exponentially increase as we go forward because of upgrades on the car, in-cabin experience, add-on features, lifetime value of the car, and serviceability of the car. Additionally, the safety aspect, the autonomous, ADAS Level 1, 2, 3. All of these will be driven largely by the software content.

The megatrend of electrification is seen as a huge opportunity as software can play a big differentiator in terms of range, charging and the BMS?

Electrification also brings out the fact of vehicle-to-infrastructure connectivity (V2X). You will see a lot more players coming in there, the charging stations and vehicles interacting with each other, the search for the right charging stations, or the green energy-based charging stations. Many of these will come into play more and more. For instance, the parking infrastructure and the car communicate with each other.

You will also see more personalisation of the vehicle to the car to the passenger and the driver in the car.

Is BGSW also helping automakers in their quest for alternate fuel vehicles?

We are also working on topics of hydrogen-based IC engines. For instance – we are working on systems of fuel cells complete with hydrogen and electrolysis-based vehicles. We also have a demonstrator of a hydrogen-based truck here in India, If you look at the ethanol-based IC engine project, it was done by BGSW for India.

When the Government of India introduced ethanol blends for vehicles, the calibration of engines to be able to work with ethanol blend was an engineering project, done in close collaboration between Bosch India and Bosch Global Software Technologies.

What about the two-wheeler and commercial vehicle space?

We work a lot in the two-wheelers segment and have been closely working with the government on the policy framework to enhance the safety of two-wheelers. For example, ABS and ECU for two-wheelers. We work with Royal Enfield on their connectivity platform for two-wheelers.

In commercial vehicles, we work on several systems on trucks, light commercial vehicles, and different tonnages of commercial vehicles.

What is your future focus areas and plans for new investments?

In Vietnam, we opened our centre in Hanoi up north last year. That is where we will continue to develop that further and there will also be thrust on Pune and Hyderabad centres to develop further. We will continue to increase our workforce across BGSW.

At present in India, we’re about 31,000 people. By the end of next year, we will easily add about 1,000 to 1,500 people. This will be a net addition and not a replacement of attrition. We will be adding about 600 people in Vietnam. Mexico is in a very early stage, so their percentage will grow much higher.

We are perhaps looking at even opening a boutique front-ending center somewhere in the US.