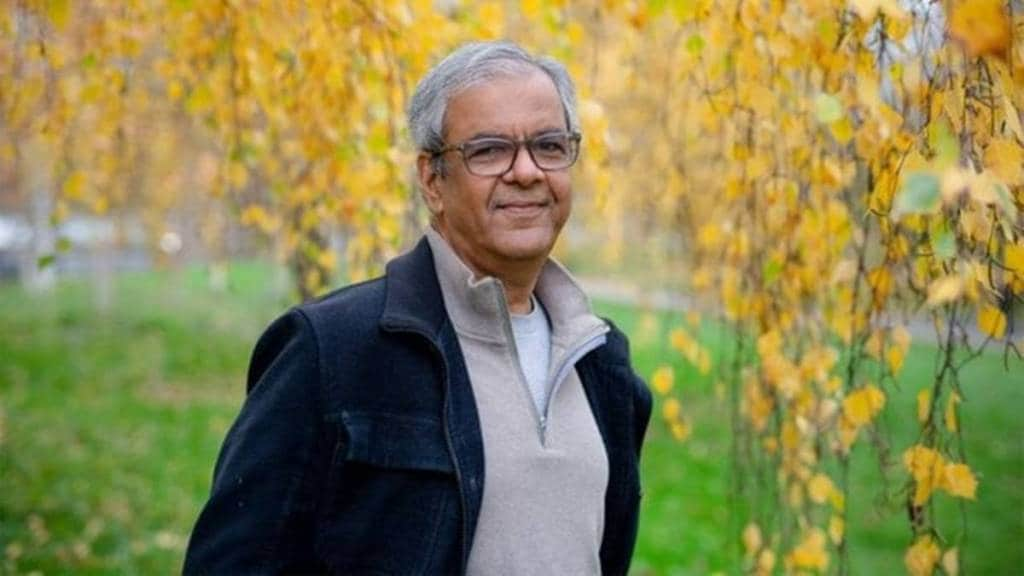

With the regulator lifting restrictions on Kotak Mahindra Bank acquiring customers digitally and via mobile phones, the lender is hoping to onboard customers at a pace of 400,000-500,000 a month once again. Its MD & CEO Ashok Vaswani tells Shobhana Subramanian the rebuilt 811 app has the potential to integrate offerings and deliver them to customers. Excerpts:

How much more, in terms of business, customers and deposits do you think the revamped Kotak 811 app can deliver?

The 811 has always been a great app which offered a fantastic user experience, which is clearly reflected in the amount of customers we have acquired over the years. We were onboarding almost 400,000-500,000 customers a month, reflecting the scale of customer interest and the momentum we generated. Our current objective is to ramp up to that level again over the coming few quarters.

Would you say the new app has the potential for more cross-selling?

The original app had a primary focus around payments convenience. Over the past few months, we’ve rebuilt the app to offer a comprehensive set of products and services that meet the full needs of the core Indian customer. The new app has tremendous potential to integrate product offerings and delivery, regardless of their origin within the group. Through 811, we typically acquire granular, low-cost deposits.

How fast do you believe you can grow the unsecured loan book at a time when the environment is somewhat difficult?

At this point, the entire industry is cautious and taking a measured approach in the unsecured segment, which is understandable. Early in the cycle, we identified this downturn and have managed our portfolio accordingly. However, we have observed that unsecured retail credit typically goes through cycles. At Kotak, we will navigate through this cycle and aim to achieve mid-teen numbers once the macroeconomic conditions are favourable.

The SME business has been doing very well, is this sustainable?

Yes, our SME advances grew by 31% year-on-year in Q3, driven by the acquisition of new customers and the deepening of our existing customer relationships. With the government’s focus on driving growth in this segment and our stable portfolio quality, we have identified the SME segment as a key focus area and will continue to invest in strengthening our customer franchise there.

We also had a strong Q3 in the agri SME sector, benefiting from the busy crop season. Overall, our portfolio remains stable, and we are focused on acquiring new customers in this segment as well.

How soon do you think you can reclaim the share lost in the credit cards space?

In recent months, we have focused on enhancing the value of our existing cards. We have also lined up plans for the credit card space, with new launches scheduled over time. The goal is to regain our rightful market share through these initiatives.

How does a bank like KMB grow at a time when not just businesses but real incomes too are stagnating?

In the past few quarters, two key macro indicators from a BFSI perspective have been the buoyancy in capital markets and stress in some unsecured lending pockets. At Kotak, we identified this stress early on and took necessary measures. Kotak is a financial conglomerate, not just a bank. This helps us manage cyclicity well, especially in environments like this one. If the bank’s granular deposit mobilisation weakens due to outflows to capital markets, we can capture these deposits through our strong relationships in our capital market subsidiaries.

How are you reading the economy?

As we enter 2025, initial macro indicators suggest some correction in the capital market, which may temper the aggressive shift from savers to investors. Additionally, the Budget announcement raising the income tax benefit slab to Rs 12 lakh is a welcome move. I expect this will release liquidity into the system and help banks garner low-cost, granular deposits from this segment. It’s crucial that we all focus on this target segment to seize this opportunity.

You have said you would be keen on an acquisition if it is a good fit and if the valuation makes sense…

As I have mentioned before, we are open to inorganic growth opportunities. This includes portfolio acquisitions that strategically align and create synergies within our diversified financial ecosystem, while also offering a strong financial proposition. These opportunities must enhance our strategic growth path, providing us with a significant advantage and aiding our goal to scale up. In short, every inorganic opportunity must make sense from both a valuation and strategic fit perspective.

What is the bank’s deposits acquisition strategy?

The key question isn’t the quantum of deposits but the cost at which these deposits are coming, especially over the last 12-18 months. We need to look beyond just offering higher rates on deposits and address the fact that the banking industry is facing deposit mobilisation challenges due to customers diversifying their asset allocation preferences, increasingly shifting from savers to investors.

At Kotak, we believe the banking industry needs to respond by adding more value-added services linked to deposits and savings accounts. Our active money product, which delivers deposits at lower costs than term deposits, is working well for us. We are leveraging Kotak 811 to drive granular, low-cost deposits by enhancing our proposition for the core Indian customer. Additionally, we are currently working on an affluent strategy to acquire high-ticket deposits from this segment.