To make financial protection more accessible, the secure plus plan will be available to people where household income is a…

To make financial protection more accessible, the secure plus plan will be available to people where household income is a…

Adjusting tax slabs with the increase in other deductions can help the salaried taxpayer, specifically the below Rs 50 lakhs…

The impact of the pandemic has altered the everyday behaviour of millennials across a variety of topics like health, travel,…

With a plethora of apps available in the market, the most crucial question for a consumer is to decide on…

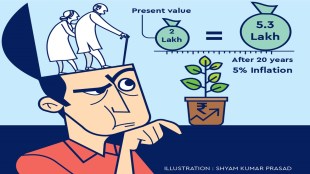

Understanding the purpose of money, life goals and planning for them will keep you energized and motivated during your sunset…

Before taking a loan, check and confirm with your lender on what all expenses are covered under the education loan.

While personal finance has been gaining significance in the last few years; there is still a huge gap in the…

The report reveals what men and women shopped for across the country. While men spent heavily on fashion and lifestyle,…

Even though there is no hard-and-fast rule that pinpoints the right or the best time to redeem a mutual fund…

By choosing the EMI payment facility, a cardholder can repay the debt over a period, managing his finances better.

Considering that an education loan is one of the first big financial decisions that a person makes, which will remain…

With all of your bank accounts connected to the framework, a smart digital financial assistant could help keep track of…

For an emergency fund, the investments should be made only in specific assets which generate safe and stable returns and…

Youngsters can establish their credit history in various ways. One of the best is to opt for a credit card…

While investing in equities, long term investors in equities should ignore temporary market movements and not time the market. That…

Real estate investment acts as a life-saving resource in the face of adversities and unforeseen circumstances.

When opting for an insurance plan, look for averaging your return, balancing it in favour of return-on-investment and safety that…

Along with comparing interest rates, the EMI amount and repayment tenure offered by different lenders should also be taken into…