In yet another initiative to enable Indian investors trade in global indices in Indian currency, the National Stock Exchange (NSE) launched its futures and options contracts on FTSE 100 on Thursday. The widely tracked index of the UK equity market is the third global index being introduced by NSE after it got the right to list rupee-denominated futures in the S&P 500 and Dow Jones in August.

At the close of trading at 3.30 pm, the traded value of derivative contracts on FTSE 100 was about R510 crore, with more than 18,000 contracts traded in the derivative contracts of the FTSE 100.

The rupee-denominated contracts will be traded during normal Indian market hours and investors will be able to take advantage of the three-hour overlap in market hours between the two countries.

The rupee-denominated contracts will be traded during normal Indian market hours and investors will be able to take advantage of the three-hour overlap in market hours between the two countries.

NSE has waived off transaction fees for the first six months to encourage participation. The exchange has also announced a liquidity enhancement scheme to give incentives to clients and member brokers.

Not everyone, though, is sure if the FTSE 100 listing will attract enough investors. ?The FTSE listing may create some hype initially but volumes may dip once the incentives schemes are withdrawn,? said a senior broker, adding that there was a lack of awareness among retail and HNI investors about the product at present but there might be some interest from proprietary desks of brokers.

Prasanth Prabhakaran, president ? retail broking of IIFL sees it as a futuristic product. ?Volumes will pick up once the retail participation comes back in the market and investors get accustomed to the product,? he said. Market participants also believe that time overlap between the two markets may work in favour of the product.

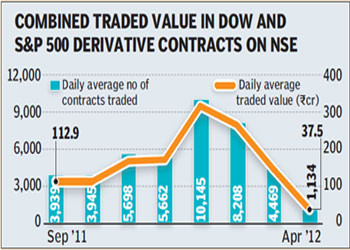

Volumes of the Dow and the S&P 500 derivative contracts on the NSE have not picked up significantly. While the combined daily average traded value of the global indices rose to R320 crore in January this year, the figure dipped to R269 crore in February.