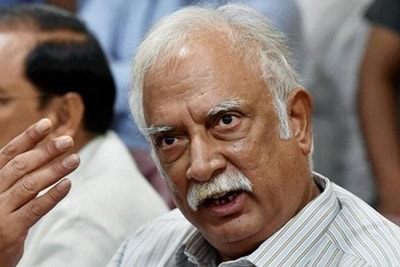

Aviation Minister Ashok Gajapathi Raju has sent a proposal to the Finance Ministry on service tax according to government sources. These sources told ET Now that he wants service tax on tickets to be sub-12% in Goods and Services Tax (GST). He has also proposed that ATF should be kept under GST, the sources said. ” With ATF out of GST, Aviation Minister fears that ticket prices will rise under GST. The Finance Minister is unlikely to consider ATF demand, since petroleum is out of GST,” the sources added.

Currently, the Centre and states levy taxes on ATF including excise duty and value added tax. A service tax of 6 per cent is levied by airlines for economy air travel and 9 per cent for non-economy air travel. Ticketing systems under the proposed GST regime will also need to be realigned as every journey across states or countries will be treated as a separate journey and GST will be levied at the point of embarkation. This is in variance with the present tax arrangement where a return journey is treated as one journey irrespective of stopovers. Also, if the point of embarkation for a return journey is outside India, then it does not attract service tax.

You may also like to watch:

[jwplayer SR8smtOf]

The GST Council had agreed on a higher tax rate of 18 per cent for services under the indirect tax regime, while some essential services are proposed to be taxed at 6 per cent or 12 per cent, though the complete structure is yet to be finalised. This is likely to lead to an increase in the ticket cost and there won’t be any set-off available in form of input tax credit as ATF will be out of GST ambit. “The implementation of GST could possibly also result in higher upfront costs for aircraft and leases, spares and parts, and distribution costs, increasing cash flow requirements, although airlines may receive input tax credits later,” Centre for Asia Pacific Aviation said in its India Aviation Outlook for 2017-18.