Valuation helps companies ascertain the present value of their expected future cash flows that would be generated by them. This, in turn, enables them to get benefits in two situations: One, in selling or buying the businesses at justifiable price and, secondly, to arrive at an appropriate price during stake sale or buyback or going public. In this context, can we value individuals using the traditional discounted cash flow (DCF) model?

DCF valuation for companies: DCF valuation arrives at the value of an entity by discounting the free cash flow (FCF) of the entity by its weighted average cost of capital (WACC). The value generated by a business under the DCF method is the sum of the present value of the expected cash flow generated by a business from its predicable future and the present value of its expected cash flow from its unpredictable future known as terminal value. So, the inputs for DCF calculation are FCF, WACC and growth rate.

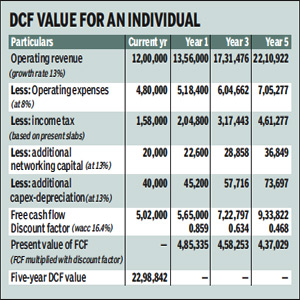

DCF valuation for an individual: The DCF calculation for an individual (say, Manogana Sayanti Sanjana, a management trainee at a bank) is quite different as people have finite life. There is no ?terminal value? for an individual. So, DCF value is simply the present value of the expected cash flow from the predictable future. Here, the inputs are FCF and WACC.

DCF valuation for an individual: The DCF calculation for an individual (say, Manogana Sayanti Sanjana, a management trainee at a bank) is quite different as people have finite life. There is no ?terminal value? for an individual. So, DCF value is simply the present value of the expected cash flow from the predictable future. Here, the inputs are FCF and WACC.

Free cash flow: FCF is arrived by deducting the sum of additional net working capital and additional net capital expenditure from the after-tax operating profit of a firm. Additional net working capital is the difference between the working capital of the two years. Working capital is the excess of current assets over current liabilities. Net capital expenditure is computed by subtracting depreciation of the year from the additional capital expenditure. If the additional net working capital and additional net capital expenditure amount is positive, then it uses the cash available for the investors of a business. Hence, it is subtracted from the after-tax operating profit. Here, we are using the operating profit i.e., the earnings before interest and tax, instead of the net profit as we are valuing the entire business [both owners and lenders] instead of the owners? claims alone.

FCF for an individual: It is possible to value individuals for 5-10 years as their finances can be predicted. For instance, the next year?s operating revenue of Manogana can be calculated using the expected average pay hike in the banking industry. Let us assume the figure to be 13%. Similarly, the operating expenses can increase year after year at the last five-year average CPI inflation figure of, say, 8%.

Discount rate: Manogana has a total capital of R50 lakh, comprising 14% loan of R10 lakh and equity capital of R40 lakh. This translates into 80% equity and 20% debt in terms of her capital invested. She doesn?t gain anything by borrowing as interest on loan (unless housing loan) is not tax deductible for an individual. Hence, her after-tax cost of debt is the same 14%. Assuming that she would like to earn 10% in addition to the last five-year inflation rate of 6.72%, her required rate of return comes to 17%. This number can be approximated to be his cost of equity. Calculations show that the five-year DCF value of Manogana is R23 lakh. Note that the value is based on the projected data of next five years, which does not include her value from existing assets in place. Assuming that she would earn for next 40 years, we can arrive at the DCF value based on the projected data for her for the next 40 years.

The author teaches accounting and finance courses at IIM Ranchi