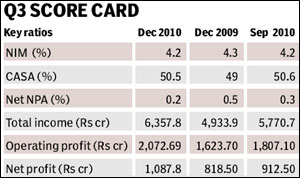

Driven by a 25% year-on year growth in net interest income and fee income HDFC Bank posted a 32.9% growth in net profit to Rs1,087.8 crore for the quarter ended December, 2010.

The bank?s net interest margin (NIM) of 4.2% remained stable on a sequential basis, though it dipped marginally from 4.3% year-on-year. The bank’s operating profit was up 27.65% to Rs 2,072.69 crore thanks to robust credit growth, which rose 32.7% over at Rs 160,619 crore.

Paresh Sukthankar, ED, HDFC Bank, said,? Profits were driven by robust growth in core business, especially retail advances, which outpaced the corporate loan book, following the run down of some one off loans given to the telecom companies in September quarter.”

Other income (non-interest revenue) for the quarter ended December 2010 increased by 25.43% to Rs 1,127.8 crore. This was on the back of a 22.5% increase in fees and commissions to Rs 942.8 crore, up 22.5% year-on-year.

The bank?s provisions and contingencies increased by 4.1% to Rs465.9 crore at the end of December 2010, which includes loan loss provisions of Rs 292.9 crore for the quarter ended December 31, 2010 as against Rs 447.7 crore in the corresponding quarter last year. Loan loss provisions were Rs 437.9 crore in December 2009. The net non performing assets of the bank slipped to 0.2% at the end of December 2010 as against 0.5% in the same period last year. The HDFC scrip ended lower by 1.67% on BSE at Rs 2,052.15.

Bank?s deposits grew to Rs1,92,202 crore, up by 24.2% over December 31, 2009. The Casa mix stood at 50.5% of total deposits at the end of December 2010 on a 30.7% growth in savings deposits to Rs 61,038 crore. The credit deposit ratio at the end of Q3 stood at about 82% against 78% in the corresponding period last year.

Bank?s deposits grew to Rs1,92,202 crore, up by 24.2% over December 31, 2009. The Casa mix stood at 50.5% of total deposits at the end of December 2010 on a 30.7% growth in savings deposits to Rs 61,038 crore. The credit deposit ratio at the end of Q3 stood at about 82% against 78% in the corresponding period last year.