Page 14 of ITR filing

The proviso to Section 276CC provides some relief to genuine assesses/ taxpayers.

Revised ITR filing rules 2023: Section 139(5) of the Income Tax Act, 1961 allows taxpayers to file a revised return…

Form No. 10B/ 10BB is the audit report required to be furnished in case a taxpayer is a fund or…

How to report income from sale of undervalued property: It is advisable to report entire amount of sale consideration, says…

If the amount of taxes paid exceeds the actual tax liability of the assessee, then the taxpayer can claim such…

Income Tax Return Last Date AY 2023-24: Filing ITR is a responsible financial practice that contributes to the smooth functioning…

Even if you have missed the ITR filing deadline of July 31, you can still file your income tax return.…

ITR filing AY 2023-24: Before the last date to file ITR without any penalty, more than 53 lakh new taxpayers…

Belated Income Tax Return Filing AY 2023-24: If you have failed to file your ITR for AY 2023-24 by July…

Income Tax Return Filing AY 2023-24 Due Date news: As the deadline for ITR filing is ending today, taxpayers are…

ITR Filing Due Date AY 2023-24 News: Even though there has been a record of ITR filing this year, several…

Income tax Return filing on www.incometax.gov.in, ITR Due Date AY 2023-24 Latest News Updates on July 31: Today is the…

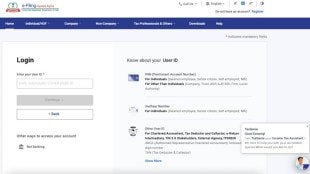

ITR Filing for AY 2023-24 News: Several taxpayers on social media today claimed that e-filing portal was not working properly.…

Income Tax Return Due Date 2023: With just two days left before the end of the deadline for ITR filing,…

ITR Filing Last Date 2023 Latest Updates on July 30: Only two days are left before the end of July…

Income Tax Refund Failure Reasons AY 2023-24: ITR filers become eligible for Income Tax Refund if they have paid excess…

Income Tax Return e-Filing on www.incometax.gov.in, ITR Due Date for AY 2023-24 News Updates on July 29: There are only…

Related News