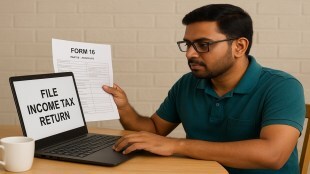

Page 3 of Income tax return filing

This extension will provide more time due to significant revisions in ITR forms, system development needs, and TDS credit reflections.…

ITR Filing 2025: Not everyone needs to file an Income Tax Return (ITR) in India. Filing is mandatory only if…

The applicability of ITR forms depends on factors such as the assessee’s sources of income, total earnings and also the…

Before filing your ITR, it’s crucial to cross-check Form 26AS and AIS to ensure accurate income reporting and avoid missing…

Taxpayers in India can choose between two different regimes while filing their income tax returns — each with a corresponding…

Form 16, a key document for salaried taxpayers, must be issued by employers by June 15; here’s what it includes…

As of May 20, 2025, there is no update on the e-filing portal of the tax department, while forms from…

The electronic version of Form 16 is generated directly from the TRACES portal by employers — guaranteeing consistent and accurate…

Confused between ITR-1 (Sahaj) and ITR-4 (Sugam)? Here’s a simple guide to help you choose the right income tax return…

This year, the tax department was a bit slow in notifying all ITR forms, and that is understandable as there…

The income tax department has notified all seven income tax return forms for assessment year 2025-26.

ITR-1 is a simple single-page form. It is specially designed for salaried, pensioners or people with limited income like interest.…

Despite the increase in average refund size, the IRS issued fewer refunds overall. The number of refunds dropped by 1.3%,…

Taxpayers will soon be able to file their income tax returns for the recently concluded financial year.

It is mandatory to choose between the old and new tax regime while filing the online form — with specific…

Taxpayers will soon be able to file their returns for FY25 via the official Income Tax Department website.

It is not necessary to attach any documents while filing your returns. However the details given in various documents will…

Related News