Bank Nifty

Bank Nifty, also known as the Nifty Bank, is an index that represents the performance of the banking sector in the National Stock Exchange of India (NSE). It consists of the 12 most liquid and large capitalized banking stocks listed on the NSE. These banks represent both the public and private sectors and are considered major players in the Indian banking industry.

Key Points about Bank Nifty:

- Composition:Bank Nifty comprises 12 banking stocks, which are major players in the Indian banking sector. These banks are selected based on certain criteria, including market capitalization, liquidity, and other factors.

- Weightage:Each stock included in Bank Nifty has a specific weightage based on its market capitalization. Stocks with higher market capitalization contribute more significantly to the movement of the index.

- Sector Representation:Bank Nifty represents the banking and financial services sector, which is a crucial component of the Indian economy. It includes both public sector banks (PSBs) and private sector banks.

- Index Calculation:Bank Nifty is calculated using the free-float market capitalization weighted methodology. The index value is derived from the stock prices of its constituents, adjusted for the proportion of shares that are available for public trading (the free float).

- Performance Benchmark:Bank Nifty serves as a benchmark for investors and traders who want to assess the performance of the banking sector in the Indian stock market. Movements in Bank Nifty are often indicative of investor sentiment and trends within the banking industry.

- Derivative Trading:Bank Nifty is one of the most actively traded derivatives contracts in the Indian stock market. Traders use Bank Nifty futures and options contracts to speculate on the future movements of the index.

- Market Impact:Significant movements in Bank Nifty can influence the broader stock market, especially considering the sector’s importance in the Indian economy. Investors often track Bank Nifty to gauge the overall market sentiment.

- Economic Indicators:Bank Nifty’s performance can reflect broader economic indicators and trends, given the banking sector’s direct connection to economic activities such as lending, investments, and consumer spending.

- Global Impact:Bank Nifty’s movements are sometimes influenced by global economic factors, especially those affecting financial markets and banking stocks worldwide.

It’s important to note that like all stock market indices, Bank Nifty is subject to market volatility and can be influenced by various factors, including economic data releases, geopolitical events, and changes in government policies. Investors and traders often analyze Bank Nifty trends and historical data to make informed decisions in the stock market.

Read More

Related News

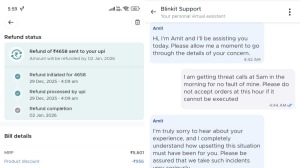

‘Getting threat calls at 5 am’: Blinkit customer alleges harassment over delivery dispute, tags Zomato CEO Deepinder Goyal

‘No job in Canada without…’: NRI who returned to India 1.5 years ago calls it ‘best decision’

Indian Govt urges vehicle owners, DL holders to update mobile number on Vahan, Sarathi portals: Here’s how

Mark Zuckerberg’s Meta Superintelligence Lab goes global: Chief AI Officer Alexandr Wang announces new hiring in Singapore

AI will end work-from-home, says Google DeepMind Co-Founder Shane Legg