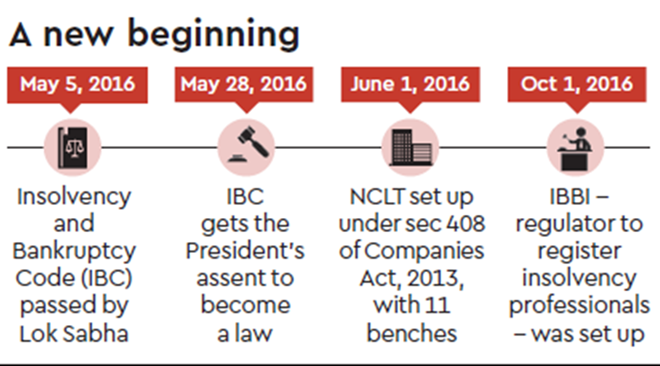

A well-known resort in Assam owed its corporate lenders just around Rs 30 lakh and didn’t bother to repay even the relatively small amount despite several reminders. A few years passed by and just when the exasperated lenders were struggling hard to make the resort pay back came the Insolvency and Bankruptcy Code (IBC) 2016. The law provides for power to creditors to approach the National Company Law Tribunal (NCLT) to trigger insolvency process — which typically involves an immediate suspension of powers of the board of directors or the promoters, among other things — to recover dues. The creditors asked the resort to repay the dues at the earliest, else the insolvency proceedings under the new law would be triggered. Within days the dues were cleared. In another case, a company based out of Chhattisgarh paid as much as Rs 28 crore of dues (Rs 17-18 crore to financial creditors and another Rs 10 crore to operational creditors) within just three weeks, after evading creditors’ plea for a long time.

The IBC, which is yet to complete a year, has prompted dozens of debtors so far to clear their dues as they fear the resolution process could otherwise be triggered by creditors, said insolvency professionals registered with the Insolvency and Bankruptcy Board of India (IBBI). Such professionals take on the important roles of resolution professionals or liquidators or bankruptcy trustees in insolvency resolution processes. So far, over a hundred applications have been made before NCLTs, seeking the resolution process, of which 40-odd have been admitted by the adjudicating authority.

Mamta Binani, former president of the Institute of Company Secretaries of India and the country’s first insolvency professional to be registered with the IBBI, said: “The law is really working well because it has given a lot of teeth to creditors. Now, the debtors who used to think that they could just gobble up the money know that they will be pulled up by NCLT through this law. There are many such cases (where debtors settle dues to avoid insolvency proceedings) that have come to the notice, although most of them are not reported as many settlements are happening off the record.”

Sanjay Grover, managing partner at company secretary firm, Sanjay Grover & Associates (SGA), said: “The law is working. Also, professionals are required to spend a lot of time on it.” He added that insolvency professionals are visiting the plant against all odds (Workers some time protest assuming that production will be stopped and the company will be liquidated, posing risks to lives of insolvency professionals) to fulfil the important role they are mandated to assume. He said in some cases, debtors paid money even before the NCLT admitted a case for the resolution process to start.

Also Watch:

https://youtu.be/j4_tyEl84IQ

Noted insolvency lawyer Sumant Batra, however, said forcing debtors to repay by NCLT is undesirable. “Insolvency law is not a recovery proceeding. The judges are not supposed to act as recovery agents of banks and use their power to force a debtor to repay. The debtor has a right to seek restructuring opportunity under IBC without being threatened. The fundamental concept of the insolvency law is that it’s a collective proceeding where everybody pulls in their assets, and the concept of preferential payment (to any particular creditor) is illegal.”

The IBC subsumed many existing laws, including the Sick Industrial Companies Act, and become the overarching law to address corporate insolvency. It provided for requisite institution building (the NCLT in the main) and creation of a pool of insolvency professionals and insolvency professional agencies, which are regulated by the IBBI. The IBBI is also supposed to make model bye laws to regulate such professionals. The NCLT’s mandate includes hearing cases that were dealt earlier by the Company Law Board (CLB) under the Companies Act 2013, in addition to cases under the IBC.