In the Indian mutual fund industry, there is often a fascination for star fund managers. Mutual fund distributors and investors believe that going with schemes handled by star fund managers would yield star-studded returns.

Recently, Roshi Jain, a star fund manager, made her exit from HDFC Mutual Fund, one of the top five fund houses in the country. HDFC Mutual Fund manages assets worth Rs 9.52 lakh crore as of November 2025.

Roshi Jain’s key assignment at HDFC was managing the HDFC Flexi Cap Fund (formerly known as HDFC Equity Fund). HDFC Flexicap is a flagship fund of HDFC Mutual Fund and India’s largest flexi-cap fund with an AUM of over Rs 94,000 crore as per the November 2025 fact sheet.

Roshi Jain also managed other schemes such as HDFC Focused Fund (AUM of over Rs 26,200 crore) and HDFC ELSS Tax Saver (AUM of Rs 17,200 crore).

Mutual Fund Schemes Managed by Roshi Jain

| AUM (Rs in Crore) | |

| HDFC Flexi Cap Fund | 94,069 |

| HDFC Focused Fund | 26,230 |

| HDFC ELSS Tax Saver | 17,241 |

| TOTAL | 1,37,539 |

Source: HDFC Mutual Fund’s website

Cumulatively, Roshi Jain managed a prodigious portfolio of over Rs 1,37,000 crore.

Now, before we come to the concern, or lack thereof, of her leaving the fund, a bit about her background and stint at HDFC.

Roshi Jain joined HDFC Mutual Fund in December 2021 and took over from Prashant Jain, another star fund manager and the then CIO of HDFC Mutual Fund (now the co-founder of and CIO at 3P Investment Managers).

Under her watch, over the last 3 years, HDFC Flexi Cap Fund, HDFC Focused Fund, and HDFC ELSS Tax Saver have rewarded investors well, clocking 22.0%, 22.3% and 21.6% (under the direct plan, growth option), respectively, higher than the category average (as of 30 December 2025).

Yes, she has been a star performer during this very volatile phase of the stock market. So, the obvious question on investors’ minds is what to do with their investment in these funds now that their star fund manager is exiting.

For starters, it helps to be invested with a well-managed mutual fund house like HDFC. They have fund management depth. In other words, there is no dearth of talent to take over in case there is an exit.

When Prashant Jain exited HDFC, it was national news. And that left unit holders worried. But to the credit of HDFC and Roshi Jain, the situation was handled well, and those who remained invested did well.

True to form, HDFC Mutual Fund has once again moved swiftly.

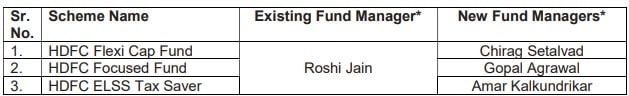

HDFC Mutual Fund, in an addendum, has said that the schemes managed by Roshi Jain will now be managed by the following:

The Chirag Setalvad Factor: What Changes?

HDFC Flexi Cap Fund will now be managed by Chirag Setalvad, another star fund manager and the Head of Equities at HDFC Mutual Fund. Chirag Setalvad is currently managing an AUM of Rs 2,60,000 crore spread across schemes such as HDFC Mid Cap Fund, HDFC Small Cap Fund, HDFC Hybrid Equity Fund, HDFC Children’s Gift Fund, and now the HDFC Flexi Cap Fund.

In this piece, we will evaluate whether Roshi Jain’s exit will have an impact on the HDFC Flexi Cap Fund and how this fund could be expected to perform under Chirag Setalvad.

Beyond the Manager: HDFC’s Safety Net

One cannot undermine the importance of a fund manager in the scheme’s performance.

However, it is also vital to recognise that HDFC Mutual Fund is an asset management company following robust investment processes and systems.

This is one of the crucial aspects of investing in mutual funds, where the fund house outlines the investment mandates, and the fund manager’s role is to function within these defined parameters. It does not leave the performance of the fund to the whims and fancies of the fund manager.

Now coming to fund facts of HDFC Flexi Cap Fund…

Where Your Money is Going: The Strategy

As per the scheme information document (SID), the fund invests 65-100% of its assets in equities across the market cap range – largecaps, midcaps, smallcaps – dynamically, without any upper or lower limit. So, it has a versatile investment mandate, giving manoeuvrability, taking a view of the equity market, and assessing the value and growth opportunities across markets and sectors.

For hedging purposes, it also utilises derivatives up to 50% of its total assets.

It also holds a mandate to invest up to 35% of its total assets in debt securities and money market instruments, and fixed income derivatives for defensive considerations.

Moreover, for diversification, it invests up to 10% each in units of REITs & InvITs and non-convertible preference shares, and up to 20% in units of mutual funds.

Investment Strategy

To achieve its investment objective – which is to generate capital appreciation/income from a portfolio, predominantly invested in equity & equity-related instruments – the fund follows a bottom-up approach.

When approaching equities across the market capitalisation spectrum (largecaps, midcaps, and smallcaps), it looks for companies that are enjoying a distinct competitive advantage, likely to achieve above-average growth, and that have superior financial strength.

These companies are from a cross-section of companies diversified across major industries and economic sectors, offering promising growth opportunities and an acceptable risk-reward balance.

Overall, the approach followed for equities has been growth at a reasonable price (GARP).

Further, when approaching debt and money market instruments, the fund evaluates credit quality, liquidity, interest rates, and debt market outlook.

And as mentioned earlier, the fund approaches REITs and InvITs from a diversification standpoint.

Portfolio Health Check: High Conviction Bets

The fund holds a well-diversified portfolio of around 50-55 stocks. As per the November 2025 portfolio, HDFC Flexi Cap Fund has 50 stocks.

At present, considering valuations, nearly 89.3% of the assets are in largecaps. The rest is in midcaps (6.2%) and smallcaps (4.5%), as per Value Research data.

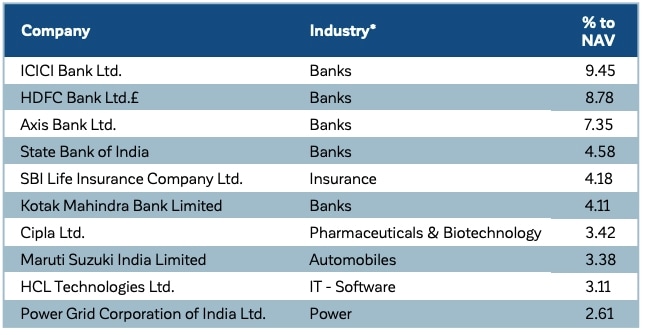

The top 10 stocks comprise 50.5% of the portfolio and include names such as ICICI Bank (9.5%), HDFC Bank (8.8%), Axis Bank (7.4%), etc. It also has exposure to non-banking stocks such as Cipla (3.4%), Maruti (3.4%), and HCL (3.1%), among others.

Top 10 Equity Holdings of HDFC Flexi Cap Fund

Among various sectors, the top 3 are financials (40.0%), auto & auto components (12.6%), and healthcare (7.9%), comprising 60.5% of the portfolio.

The average price-to-book value ratio of the underlying stocks in proportion to their underlying weights is 3.1, while the price-to-equity ratio is 21.8, according to the Value Research data, given the GARP philosophy followed by the fund.

The fund has held its overall portfolio with conviction, as its total portfolio has been 12.5% as of November 2025, as per the fund’s factsheet as of November 2025.

Risk-Return

The approach followed by the fund has yielded a compounded average growth rate (CAGR) of 17.1% (as of 30 December 2025) since its inception on 1 January 2025.

The fund’s longer period returns, over 3 years, 5 years, and 10 years, have been impressive, 22.0%, 24.3%, and 17.4%, respectively, which are higher than the category average and the BSE 500 – TRI (as of 30 December 2025).

Moreover, to clock returns, the fund has exposed investors to low risk (standard deviation of 10.5, as per Value Research data) than the category average and the BSE 500 – TRI.

Thus, on a risk-adjusted basis, over 3 years, the fund has fared well if we were to consider the Sharpe and Sortino ratios of 1.3 and 2.3, which are higher than the category average and the BSE 500 -TRI.

With a qualitative approach to portfolio construction and a buy-and-hold strategy, HDFC Flexi Cap Fund is among the top quartile performers.

Will HDFC Flexi Cap Fund Do Well under Chirag Setalvad?

Chirag is the Head of Equities (CIO for Equities) at HDFC Mutual Fund.

He has 25 years of experience in fund management and equity research.

He is a science graduate with an MBA from the University of North Carolina.

He has also worked closely with veteran Prashant Jain, the erstwhile CIO of HDFC Mutual Fund.

Many of the other schemes, such as HDFC Mid Cap, HDFC Small Cap Fund, HDFC Hybrid Equity Fund, HDFC Children’s Gift Fund, managed by Chirag, have delivered appealing returns over the long term in their respective categories.

With the investment processes and systems followed, it is possible that HDFC Flexi Cap Fund would do well under his watch, with a focus on quality and growth. So perhaps, Roshi Jain’s exit should not be the sole reason for exiting HDFC Flexicap.

That said, don’t just base your investment decision on past returns, which may or may not be repeated in the future.

You need to consider your risk profile, broader investment objective and time horizon before investing. If you are not sure how to go about it, reach out to a SEBI-registered investment adviser.

Happy Investing.

Note: We have relied on data from www.valueresearchonline.com, financial express factsheets, and HDFC Mutual Fund factsheets throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

Disclaimer:

Disclaimer: The above content is for informational purposes only. Mutual Fund investments are subject to market risks. Please consult your financial advisor before investing.

Rounaq Neroy has over 20 years of experience in the financial markets and investments. He is a close observer of the Indian economy and writes deeply on the capital markets, mutual funds, stocks, precious metals, asset allocation, wealth management, and investment strategy. His editorials provide interesting, actionable investment ideas to guide readers in the journey of wealth creation and make wise decisions. Rounaq was the Head of Content at PersonalFN (Quantum Information Services Pvt. Ltd.), which also owns Equitymaster.com – India’s oldest and trusted equity research house