Insiders and promoters have been on a record-selling spree. They have sold shares worth $30 billion in the first half of 2025. As a result, promoter holdings in the listed companies now stand at a seven-quarter low of 50.1% in Q4FY25.

When promoters reduce their stake in a company, it usually draws attention. After all, promoters are seen as the people who know the business best. If they’re selling shares, it raises eyebrows, but not every sale is negative.

The sale can be for a variety of purposes, including raising funds for the business, profit booking by private equity, or to meet shareholding criteria. Similarly, here are three stocks whose promoters sold their stake in the June quarter.

Let’s find out..

#1 Sagility India

Sagility is a pure-play business process management service provider in the healthcare sector. The company offers its services in the US market, with a strong client base including insurance companies and hospitals.

It offers services across the healthcare value chain for payers and providers. The services include diagnostics, case management, member engagement, payment integrity, claim cost control, and revenue cycle management.

Stake Sale for Compliance

The company was listed in November 2024, with a promoter shareholding of 83.4%. However, to meet SEBI minimum public shareholding norms, it sold about 15% by the end of June. But, fundamentally, business remains strong.

In Q1FY26, Sagility’s revenue grew 18% year-on-year (YoY) to ₹15.4 billion. Payer accounted for 88.4% of revenue, while the provider 11.6%. However, its profit after tax (PAT) also rose 18.6% to ₹1.5 billion.

This growth was driven by the expansion from existing clients. The company expects this momentum to strengthen with new client acquisitions as the year progresses. Its active client stood at 77, which has more than doubled from 35 in FY23.

Customer Concentration Risk Remains

However, Sagility faces the risk of customer concentration. Top 3 customers contribute 64.7% of revenue, top 5 (76.3%), and top 10 (89.4%). It has 30 million-dollar client groups contributing over $1 million, while 47 customers contribute less than that.

Looking ahead, the company said its operations remain robust, driven by strong performance across key metrics. It secured $32 million in average annual contract value through new wins and client expansions.

The company added four new clients during the quarter and deepened engagements with 18 existing ones through fresh scope-of-work deals. It also began work on setting up a Global Capability Centre (GCC) for a client under a Build-Operate-Transfer (BOT) model.

The company is also investing in artificial intelligence (AI) use cases. It has implemented 18 artificial intelligence-based use cases for 8 customers. In addition, it is working on more than 15 additional use cases.

But, risks remain from one Big Beautiful Bill, which cuts federal medical spending. Sagility expects minimal impact due to mid-sinple digit exposure to Medicaid. It sees no tangible impact from tariffs, either.

Valuation at Discount

Sagility trades at a price-to-earnings multiple of 45x, which is at a discount to Inventurus Knowledge (51x). It was recently listed and has a limited historical trading history.

#2 Aptus Value Housing Finance India

Aptus Value Housing Finance is a housing finance company. Aptus is considered one of the early private sector entrants in the affordable housing finance space in South India.

Selling by WestBridge Crossover Fund

As of March 31, 2025, the promoter group held a 52.99% stake, of which WestBridge Crossover Fund LLC holds 29%, and 23.9% by founder-promoter M Anandan and his family. Of these, WestBridge sold a 12.4% stake during the June quarter, reducing the total promoter stake to 40.4%.

Focused Lending Model Drives Steady AUM Growth

The company serves self-employed individuals from the informal sector, targeting low–and middle-income customers. The company typically offers home loans in the range of ₹0.5-₹2 million. It operates 300 branches across Tamil Nadu, Karnataka, Telangana, and Andhra Pradesh (AP).

Its non-housing loan portfolio includes small and medium enterprises, as well as loans against property. As of March 31, 2025, the consolidated assets under management (AUM) stood at ₹108.6 billion. Housing loans comprise 60% of the AUM, with the balance from non-housing segments.

Geographically, Andhra Pradesh accounts for 42.3% of AUM, followed by Tamil Nadu (33.4%). AUM is highly concentrated, with the top 3 states accounting for 92% of total AUM. It is also expanding into Odisha and Maharashtra, which have not yet contributed significantly.

The internal rate of return (IRR) for home loans typically ranges between 13 and 15.50%, while non-home loans can offer returns of up to 22%. Its core strength lies in its entirely in-house team that manages all key functions, including business sourcing, recovery, and collections.

Strong Financial Performance

Financially, Aptus’ AUM grew 25% YoY to ₹108.6 billion in FY25. Total income grew 27.6% to ₹17.9 billion, while profit after tax (PAT) also grew 22.7% to ₹7.5 billion. However, due to rising cost of borrowings, its net interest margin (NII) declined 27 basis points to 11.17%.

Pre-provision operating profit also grew 23% to ₹10 billion. Asset quality, however, witnessed a marginal uptick but was strong. Gross non-performing assets (NPAs) rose 12 bps to 1.19%, while net NPAs rose 9 bps to 0.89%. As a result, credit cost increased slightly to 0.28% in FY25 from 0.27% in FY24.

Its asset quality remains strong due to a low loan-to-value (LTV) ratio of up to 50%, which provides a safety margin in case of rising liabilities. 81% of Aptus’ loan portfolio had an LTV of less than 50%. Its return on total assets stood at 7.44%.

Aptus trades at a price-to-book multiple of 3.9x, which is lower than the 3-year median of 4.4x. Its valuation seems full, as peers such as Aadhar (3.4x), Home First (4.3x), and India Shelter (3.6x) are trading at around the same level.

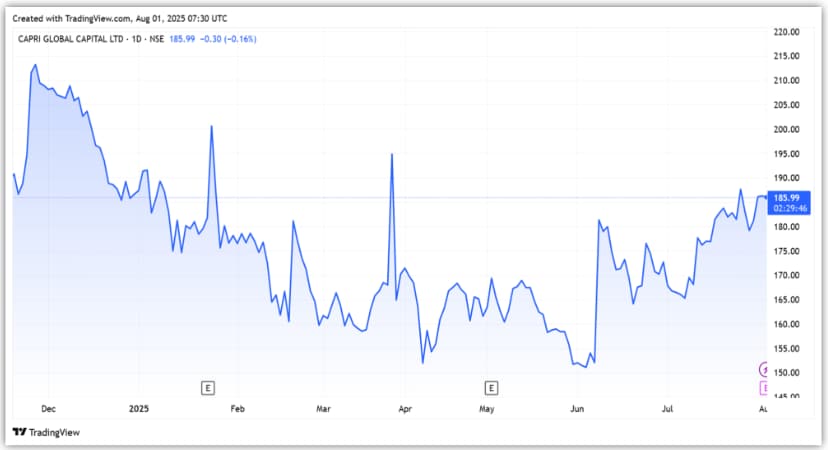

#3 Capri Global Capital

Capri Global is a systemically important NBFC. It operates in sectors such as gold loans, MSME, construction finance, housing finance, and indirect lending. As of March 2025, its total branches stood at 1,111, with 803 gold loan branches and 308 non-gold loan branches.

Promoter Dilution to Fund Expansion Plans

The company raised a total of ₹34.4 billion, including ₹14.4 billion from a rights issue and ₹20 billion from a qualified institutional placement. As a result, the promoter stake, declined to 59.95% in Q1 from 69.87% in Q4FY25. Ace investor Prashant Jain’s firm, 3p India Equity, also bought a 1.06% stake.

Strong and Diversified AUM Growth

As of March 2025, consolidated AUM stood at ₹228.6 billion, up 46% over the previous year. Gold loans contribute 35% to AUM, followed by MSME (23%), housing (22.8%), construction finance (18%), and others (1%). Gold loans led the growth with a 13% rise in AUM, followed closely by housing loans at 12%.

Financials Stay Strong

Net interest income rose 35% to ₹133.2 billion in FY25, with a net interest margin of 8.8%. Total income rose 34% to ₹183.3 billion, while PAT increased 71% to ₹47.8 billion. A gradual decline in the cost-to-income ratio, from 70.5% in Q4FY24 to 54.8% in Q4FY25, also supported the profit growth.

Pre-provision operating profit also rose 61% to ₹73.4 billion. Capri’s asset quality improved, with net NPA and gross NPA improving 17 bps and 40 bps to 0.9% and 1.5%, respectively. As a profitability boost, return on average assets also jumped 55 bps to 2.7%.

Ambitious Growth Outlook

Looking ahead, the company aims for a strong growth trajectory of 27-30% annually over the next few years. It plans to more than double its AUM to ₹500 billion by FY28. All segments will support the growth.

It also expects the cost-to-income ratio to decline as the branch network matures, leading to improved profitability. Capri trades at a price-to-book multiple of 3.4x, which is at a premium to its 10-year median of 2.8x.

Conclusion

The promoter may sell shares for a variety of reasons, which can be positive or negative depending on the use of the funds. For example, the promoter of Sagility sold shares to meet the minimum shareholding criteria.

On the other hand, Capri raised funds to expand its business, which is positive. The stake in Aptus was sold by private equity, who are not known for holding stakes indefinitely. All three companies are performing exceptionally well in the stable healthcare and finance sector.

Disclaimer

Note: We have relied on data from http://www.Screener.in throughout this article. Only in cases where the data was not available have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points, and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educational purposes only.

Madhvendra has been deeply immersed in the equity markets for over seven years, combining his passion for investing with his expertise in financial writing. With a knack for simplifying complex concepts, he enjoys sharing his honest perspectives on startups, listed Indian companies, and macroeconomic trends.

A dedicated reader and storyteller, Madhvendra thrives on uncovering insights that inspire his audience to deepen their understanding of the financial world.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The articles’ content and data interpretation are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.