The next big chapter in India’s green transition has begun: the electric vehicle charging build-out. Public charging stations in the country have surged from 1,800 in February 2022 to over 16,000 by March 2024, a ninefold rise in just two years.

However, recent research by Forvis Mazars indicates that even this pace is not enough. In fact, India would see about 50 million EVs on the road by 2030, which would necessitate about 1.32 million charging stations — an addition of almost 400,000 new chargers annually to keep up.

This scale of expansion makes EV-charging infrastructure the next green frontier for investors. As electric mobility shifts from pilot projects to mainstream highways, the companies building, powering, and connecting these chargers could define the next decade of infrastructure growth in India.

We have picked five stocks that are literally wiring India’s EV future: companies at the heart of manufacturing, deployment, and energy integration-those poised to benefit from the country’s massive charging build-out.

Together, they represent the ecosystem India will rely on to keep millions of new EVs powered and moving. From utilities and oil-marketing giants repurposing their networks to homegrown tech firms building chargers and power systems, these players are set to define how fast and how far India’s electric journey goes.

#1 Tata Power Company

Tata Power Company, a Tata group company, is primarily involved in the business of the generation, transmission and distribution of electricity. It aims to produce electricity completely through renewable sources.

It also produces solar roofs and intends to construct 1 lakh EV charging stations by 2025. It is the largest vertically integrated power company in India.

Tata Power’s EV charging business recorded strong momentum in Q1 FY26, driven by higher utilisation and network expansion. The company said performance was significantly better than last year as more public and bus-charging stations became operational.

Growth was also supported by rising demand in home charging, as well as partnerships with major automakers. The firm continued to extend its reach into urban networks and fleet-charging hubs-a segment that is enjoying rapid adoption as electric mobility expands from passenger cars.

Management highlighted steady improvements in capacity use and operational efficiency throughout its charging network. The company intends to continue investing in expansion and reliability upgrades through FY26.

As India’s EV-charging market grows speedily, Tata Power is focused on a larger presence in key cities and highways.

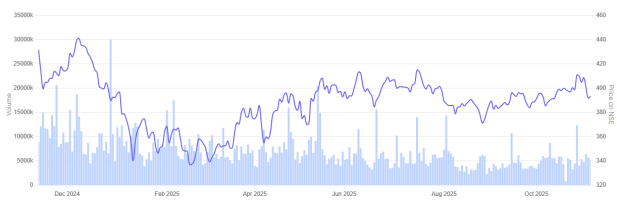

In the past one year, Tata Power Company share price is down 8.7%.

Tata Power Company 1 Year Share Price Chart

(Source: Screener.in)

#2 Bharat Petroleum Corporation (BPCL)

Bharat Petroleum Corporation, a public sector company, which is engaged in the business of refining of crude oil and marketing of petroleum products.

BPCL hastened its electric vehicle charging expansion in Q1 FY26, adding 839 new stations to take its total network to 7,402 across India. In a statement, the company said that it remains focused on building a nationwide charging backbone integrated with its retail outlets, serving the needs of both private and commercial EV users.

Management, however, added that the business is still at a nascent stage and capacity utilisation remains low at 2% with investments of around Rs 300 crore. The financial contribution at present is negligible but BPCL sees the network as a strategic enabler and not a profit centre.

The company is expected to see an improvement in utilisation over the next few years as vehicle penetration increases, eventually making BPCL one of the largest and most widespread EV-charging operators in the country.

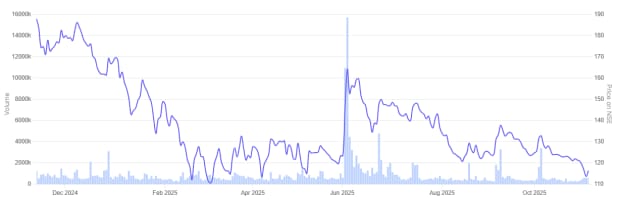

In the past one year, BPCL share price surged 17.4%.

Bharat Petroleum Corporation 1 Year Share Price Chart

(Source: Screener.in)

#3 Servotech Renewable Power Systems

Incorporated in 2004, Servotech Renewable Power System manufactures EV Chargers, Solar Products, and Power & Backup Products.

Servotech Renewable Power Systems showed steady progress in its EV charging business in Q1 FY26, although policy delays had their impact on the execution of projects. EV charging accounted for around 62% of quarterly revenue, with Servotech placing emphasis on scaling up its DC charger production capacity to 12,000 units per annum.

Management mentioned that infrastructure and government-scheme transitions-from FAME II to PM E-Drive-had created near-term pressure on utilization but reaffirmed long-term growth prospects.

It plans a subsidiary in the UAE to serve GCC and African markets and has cost advantages from a free-zone manufacturing base to offset domestic bottlenecks.

It also works on developing on-board chargers for EV OEMs to capture a significant vehicle-integrated charging market. Management expected that FY26 will remain one of its strongest years despite challenges in the near term.

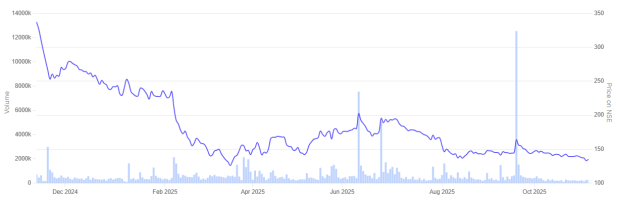

In the past one year, Servotech Renewable Power Systems share price tumbled 38.1%.

Servotech Renewable Power Systems 1 Year Share Price Chart

(Source: Screener.in)

#4 Exicom Tele-Systems

Incorporated in 1994, Exicom Tele-Systems manufactures EV chargers and Critical Power components.

Exicom Tele-Systems reported a strong pipeline in its electric vehicle charging business, even as Q1 FY26 performance was weighed down by delayed project deliveries. The company said its EV charging revenue rose 61% year-on-year to Rs 53 crore, supported by rising passenger EV and electric bus adoption.

Key growth drivers during the period were its entry into electric trucking and a global framework agreement with a Southeast Asian clean energy company for charger supply across Malaysia, Indonesia, and Thailand. Exicom started providing turnkey EPC solutions — covering survey, construction, and commissioning — to Indian automakers.

The company’s Hyderabad manufacturing facility is on track to begin production by October 2025 to scale up output and reduce costs. Management maintained its guidance for FY26 on the back of a record order book and strong policy tailwinds in India’s EV ecosystem.

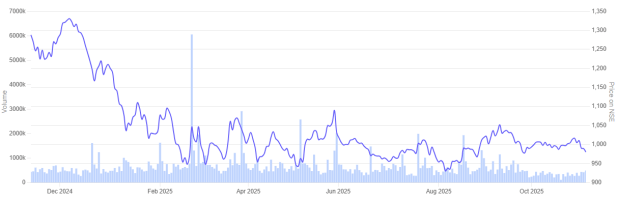

In the past one year, Exicom Tele-Systems share price nose-dived 59.7%.

Exicom Tele-Systems 1 Year Share Price Chart

(Source: Screener.in)

#5 Amara Raja Energy and Mobility

Amara Raja Energy and Mobility, the flagship company of the Amara Raja Group, is the technology leader and is one of the largest manufacturers of lead-acid batteries for both industrial and automotive applications in the Indian storage battery industry.

With its New Energy Business, which comprises EV chargers, lithium battery packs, and storage systems, Amara Raja Energy & Mobility marked an expansion in the Indian EV ecosystem. Localizing the production of portable chargers for two- and three-wheelers, the company is on its way to gaining traction in the off-board DC fast-charger segment.

Construction is in full swing at its Divitipally Giga Cell factory, part of a Rs 9,500 crore investment to build a 16 GWh lithium-cell capacity by FY30; Phase 1 of 4 GWh is expected to come on stream by Q3 FY26. These cells would serve the requirements of both mobility and stationary energy, which it is committed to underpinning with R&D at its E+ Energy Labs in Hyderabad.

With its charger production, battery-pack assembly, and cell manufacturing plans aligned, Amara Raja is positioning itself as a vertically integrated player in India’s EV-charging and energy-storage transition.

In the past one year, Amara Raja Energy and Mobility share price nose-dived 24.1%.

Amara Raja Energy and Mobility 1 Year Share Price Chart

(Source: Screener.in)

Valuations

Let’s now turn to the valuations of the EV charging infrastructure companies in focus, using the Enterprise Value to EBITDA multiple as a yardstick.

Valuations of EV Charging Infrastructure Companies in India

| Sr No | Company | EV/EBITDA | Respective Industry EV/EBITDA Median | ROCE |

| 1 | Tata Power Company | 11.3 | 12.3 | 10.8% |

| 2 | Bharat Petroleum Corporation | 5.0 | 10.0 | 16.2% |

| 3 | Servotech Renewable Power Systems | 44.2 | 18.7 | 19.7% |

| 4 | Exicom Tele-Systems | -34.5 | 29.2 | -5.9% |

| 5 | Amara Raja Energy and Mobility | 11.0 | 13.9 | 16.8% |

Source: Screener.in

As the numbers indicate, the sector is sending out a mixed picture, reflecting the relative maturity of different players in India’s fast-evolving EV ecosystem.

Tata Power and Amara Raja Energy & Mobility are trading close to their respective industry medians. This shows that valuations have already priced in near-term growth and stability. BPCL trades well below its industry median, showing upside if its charging rollout scales materially over the next couple of years.

On the other hand, Servotech Power Systems enjoys a steep premium, with valuations significantly higher than those of its industry peers-a fact indicative of high investor expectations from its rapid expansion in the DC fast-charger segment.

Exicom TeleSystems reports negative earnings before interest, tax, depreciation, and amortisation (EBITDA) and return on capital earnings (ROCE), that indicates early-stage execution challenges despite strong revenue growth.

In short, the valuation of these companies reflect where each company stands in India’s EV-charging industry. The important question for investors is if current prices still offer space for returns once growth assumptions, policy support, and competition are considered.

Conclusion

India’s EV-charging story is at the starting line of a much longer race. The next few years will determine how quickly infrastructure growth can keep pace with the country’s ambitious EV adoption targets.

For now, the sector remains uneven: some players have scale and reliability, while others are betting on innovation and speed. Yet all are tied to one of the most critical themes of India’s energy transition. As utilisation improves, costs are stabilised, and public-private partnerships deepen, the market can start to gradually reward those companies which balance execution with financial discipline.

However, current valuations already reflect a fair amount of optimism. Readers will therefore be well served by doing a comprehensive evaluation before taking any investment call, factoring in policy clarity, capital intensity, competition, and the long-term viability of each business model in India’s evolving EV-charging landscape.

Note: We have relied on data from www.Screener.in throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Ekta Sonecha Desai has a passion for writing and a deep interest in the equity markets. Combined with an analytical approach, she likes to dig deep into the world of companies, studying their performance, and uncovering insights that bring value to her readers.

Disclosure: The writer and her dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.