One of India’s widely followed super investors, also called the “Queen of Small Caps,” Dolly Khanna has made a name for herself in the stock markets. With a very disciplined approach, backed by solid research along with a focus on long-term value, her portfolio is a go to place for investors chasing profitable returns.

Known for her knack for picking future multibaggers, she currently holds 10 stocks in her portfolio worth Rs 291 cr. And given her record of picking multibaggers in the making, today we dig into her 2025 picks, which in the last 5 years have delivered gains of over 200%.

Do these companies have it in them to become Khanna’s future multibaggers. Let us try and see if we can find out.

#1 GHCL Ltd: The 9x PE cash machine

Incorporated in 1983, GHCL Ltd (formerly Gujarat Heavy Chemicals Limited) is among one of India’s leading manufacturers of Soda Ash (Anhydrous Sodium Carbonate).

With a market cap of Rs 5,329 cr, GHCL is the 2nd largest manufacturer of soda ash in India with a market share of over 26%. It also has an enviable list of clients which includes Hindustan Unilever, P&G, Borosil Renewable, among others.

The female Warren Buffett of India, Dolly Khanna, bought 1% stake in the company worth Rs 61.5 cr as per the exchange filings for the quarter ending March 2025. And as per the quarter ending September 2025, this holding has gone up to 1.2%, worth Rs 67.3 cr.

Let us look at the financials to try and find out what is it that may have caught Khanna’s attention.

The numbers below show that the company’s sales have seen what we can call a bumpy ride in the last 5-years. And for H1FY26, sales of Rs 1,517 cr have been logged.

| FY | FY20 | FY21 | FY22 | FY23 | FY24 | FY25 |

| Sales (Rs Cr) | 3,305 | 2,491 | 3,052 | 4,551 | 3,447 | 3,183 |

The EBITDA (earnings before interest, taxes, depreciation, and amortization) saw an upwards trend till FY23, post which it slipped.

| FY | FY20 | FY21 | FY22 | FY23 | FY24 | FY25 |

| EBITDA (Rs Cr) | 729 | 605 | 730 | 1,503 | 851 | 877 |

For H1FY26, EBITDA logged was Rs 354 cr.

Looking at the profits, the company has not seen any losses in the last 10 years, but in the last 5 years it witnessed a huge drop.

| FY | FY20 | FY21 | FY22 | FY23 | FY24 | FY25 |

| Net Profit (Rs Cr) | 397 | 326 | 650 | 1,142 | 794 | 624 |

For H1FY26, profits of Rs 251 cr have been recorded already.

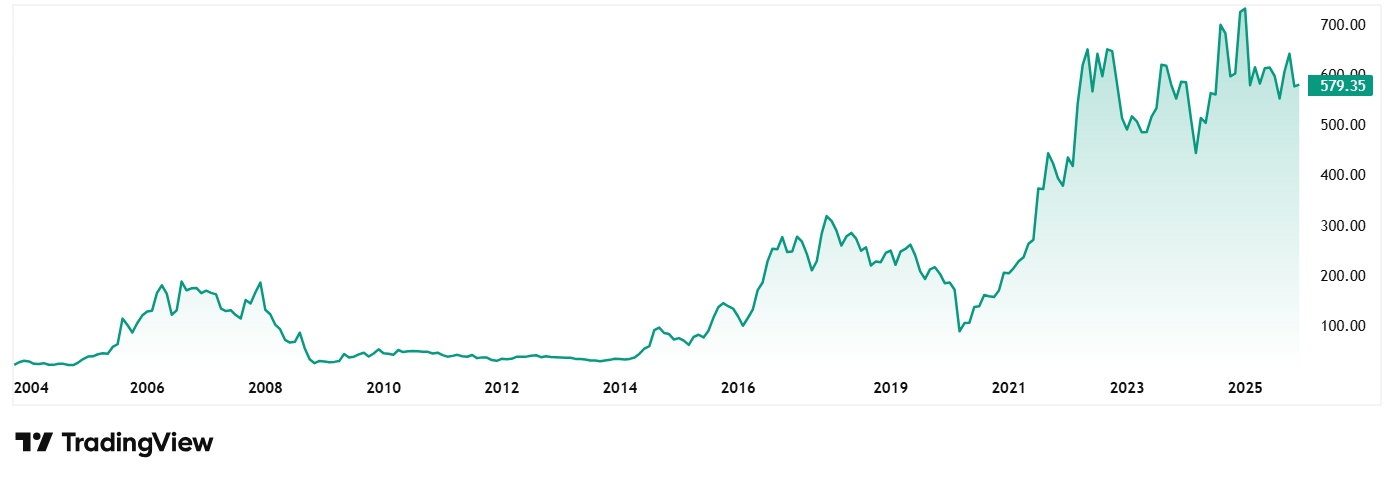

The share price of GHCL Ltd was Rs 180 in December 2020 and as on 15th December 2025, it was Rs 580, which is a jump of over 220%.

The company’s share is trading at a current PE of 9x, and the industry median is 22x. The 10-year median PE for GHCL is 7x while the industry median for the same period is 15x.

The dividend yield of the company is 2% which is amongst the highest when compared to peers in the same industry. Also, the company has reduced its debt from over Rs 1,250 cr five years ago to around Rs 96 cr currently.

GHCL Ltd is also good at maintaining capital efficiency with a current ROCE (Return on Capital Employed) of 24%, which in simple terms means that the company makes Rs 24 in profit for every Rs 100 it spends as capital. The industry median is 9%.

Recently, the company has also announced a share buyback program.

In the latest investor presentation from November 2025, the company’s Managing Director, Mr. R. S. Jalan said, “We have built a solid leadership position. We have announced a shareholder buyback program, which will optimize the capital structure and create value for our shareholders. Our current actions ensure we can navigate today’s challenges while building long-term value.”

#2 SPIC: A fertilizer play with 2.4% yield

Incorporated in 1993, Southern Petrochemicals Industries Corporation Ltd is engaged in manufacturing and selling Urea and Nitrogenous chemical fertilizers.

With a market cap of Rs 1,664 cr, the company’s product offerings include Primary nutrients, Secondary Nutrients, Water Soluble Fertilisers, Organic Fertilisers, Non-edible de-oiled Cake Fertilisers, pesticides, industrial products, etc.

Dolly Khanna bought a 1.7% stake in the company worth Rs 32 cr as per the exchange filings for the quarter ending June 2025. And as of the quarter ending September 2025, this holding is now gone up to nearly 3% with a value of 45.5 cr.

Coming to the financials, sales of the company have grown at a compounded rate of 8% from Rs 2,079 cr in FY20 to Rs 3,086 cr in FY25. For H1Y26, sales of Rs 1,600 cr have been logged already.

EBITDA went from Rs 113 cr to Rs 284 cr in the same period, which is a compounded growth of about 21%. And for H1FY26, the EBITDA figure was Rs 170 cr.

The company recorded a compounded profit growth of 19% from Rs 67 cr in FY20 to Rs 156 cr in FY25. For H1FY26, net profits of Rs 128 cr have been recorded already.

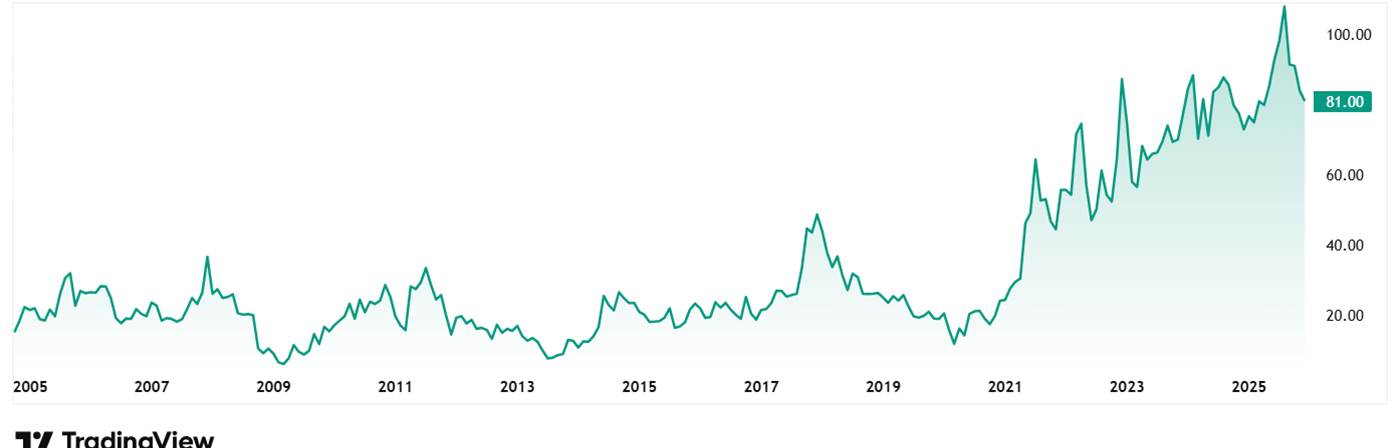

The share price of Southern Petrochemicals Industries Corporation Ltd was around Rs 22 in December 2020 and as on 15th December 2025 it was Rs 82, which is a jump of over 270%.

The company’s stock is trading at a PE of a modest 9x, while the industry median is 22x. The 10-Year median PE for the company is 10x and the industry median for the same period is 15x.

The company has one of the highest dividend yields of 2.42% when compared to peers from the industry. The industry median is 0.1%. In the past 12 months, Southern Petrochem has declared an equity dividend amounting to Rs 2 per share.

Follow dolly’s dividend duo?

Many investors maintain a distance from small cap stocks as a category, given that they have been widely misunderstood as carriers of huge risk. But investors like Dolly Khanna have repeatedly proven that with the right strategy and research, this category could be a goldmine. No wonder she is called the queen of small caps.

The two stocks we saw today, GHCL and Southern Petrochemicals, have financials that speak volumes about how diverse Dolly is in picking stocks. But Khanna is known to pick such stocks and reap significant rewards.

The question is whether she will continue her streak of picking future multibaggers with these 2 stocks, or will these break it? That is something we will all know in time. But if there is an opportunity here or one pops up, it would be good to know about it, right? We suggest you add these stocks to your watchlist 2026 and keep an eye on them.

Note: We have relied on data from www.Screener.in and www.trendlyne.com throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Suhel Khan has been a passionate follower of the markets for over a decade. During this period, He was an integral part of a leading Equity Research organisation based in Mumbai as the Head of Sales & Marketing. Presently, he is spending most of his time dissecting the investments and strategies of the Super Investors of India.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.