India’s data centre build-out has quickly moved from a niche infrastructure theme to a structural investment story. Names like Anant Raj and Netweb have already captured investor attention, becoming early beneficiaries of this shift. Other data center names, such as E2E Networks, Blackbox, and Orient Technology, have also gained significant traction. Yet focusing only on the most visible winners risks missing a deeper layer of opportunity quietly taking shape across the electrical supply chain.

Behind every hyperscale facility, cloud expansion, or colocation project lies a web of power infrastructure, where wires and cables form the backbone. This is where the Indian wires and cables industry steps into focus. Valued at roughly ₹90,000 crore in FY25 (per Polycab), the sector has delivered around 12% YoY growth in FY25, even before the data centre cycle has fully played out. This is when the big demand from Adani, Airtel, and Reliance is yet to come.

That said, the Wire and Cable sector, which accounts for nearly 40%-45% of India’s electrical industry, is now a core enabler of India’s infrastructure and digital ambitions. As data centres scale up, rising power density, tighter redundancy norms, and more stringent safety standards significantly increase their reliance on specialised, high-quality cabling systems.

Here is how these three proxy plays are positioning themselves…

#1 R R Kabel: Plans to Grow Domestic Business by 1.6X

R R Kabel is a key player in the Indian consumer electrical industry. The company manufactures a wide range of electrical products, with a primary focus on wires and cables, and is also expanding its presence in the fast-moving electrical goods (FMEG) segment.

The Engine: Why Wires Are 88% of the Bet

Wires and Cables are the cornerstone of the business, contributing 88% of total revenue in FY25. RR Kabel is the fourth-largest Wires and Cables player by value in FY25. It exports W&C to 74 countries and holds over 42 international product certifications. FMEG business contributes the remaining 12% of revenue.

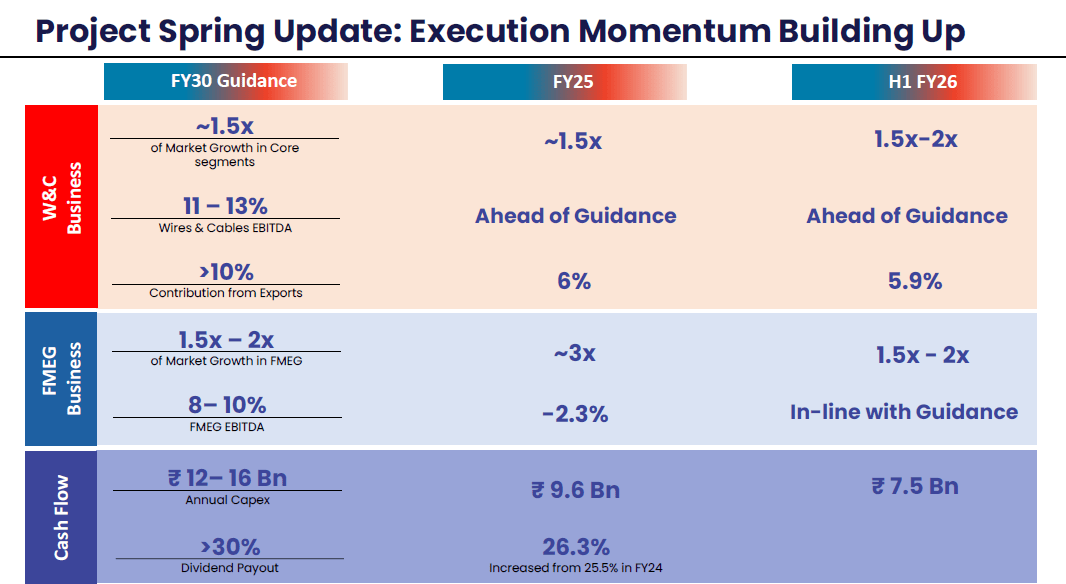

RR Kabel states that investments in data centers are a driver of demand for wires and cables. The domestic Wires and Cables business is poised to grow by 1.6x, supported by strong external demand factors, including increased investments in emerging sectors such as data centers and renewable energy, as well as industrial capex.

To capitalize on the growing demand, it aims to expand its presence in the data center and original equipment manufacturer (OEM) businesses, where the demand for specialized cables is high. RR Kabel offers a range of specialized cable products for data centers, including aluminum and copper flexible cables, fire-survival cables, battery cables, and low-tension power cables.

Project RRise: A ₹1,200 Crore Capex Gamble

For RR Kabel, scaling the cable business is a strategic focus under “Project RRise,” with a total capital expenditure of ₹1,200 crores planned for FY26-28. This will increase manufacturing capacity (at 90% utilization) by about 1.7x. Approximately 80% of this capacity is dedicated to expanding the cable business.

This includes adding roughly 36,000 Metric tons (MT) of cable capacity at Waghodia and 6,000 MT of wire capacity at Silvassa. The expansion plans aim to achieve production capabilities of up to 220 kV in power cables, enhancing the company’s capabilities in higher-voltage segments.

RR Kabel’s ultimate goal is to achieve an 18% CAGR in wires and cables revenue, along with similar volume growth. It plans to increase its domestic business by 1.6x and its export business by 1.8x. EBITDA margin is also expected to expand by 100 basis points (bps) each year, reaching 10.5% by FY28. EBITDA means earnings before interest, tax, depreciation, and amortisation.

R R Kabel Financials

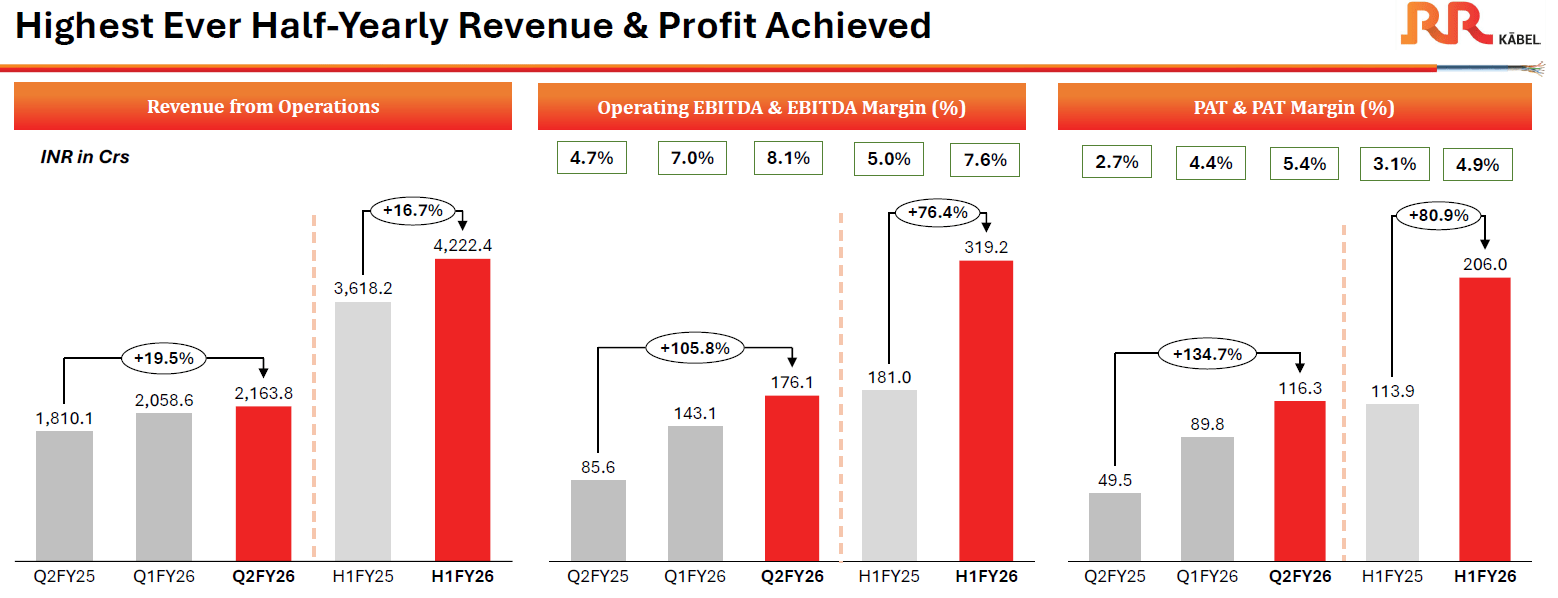

Margins expand on operating leverage

Coming to its financials, RR Kabel revenue increased by 16.7% year-on-year to ₹4,222 crore in the first half of FY26 – marking the highest ever half-yearly revenue in the company’s history. Operating EBITDA increased by 76.4% to ₹319 crore, while margins expanded by 260 bps to 7.6%. As a result, profit after tax (PAT) surged by 80.9% to ₹206 crore.

#2 Polycab India: Aims to Outpace Industry Growth Rate

Polycab India is the largest company by revenue and the most profitable company in the Indian electronics ecosystem. The company manufactures and sells wires and cables, and holds a 26-27% market share in the organized wires and cables industry. Polycab is also present in the FMEG business, which includes products such as fans, LED lighting, luminaires, and switchgear.

Wires and cables drive core growth

In addition, Polycab also operates in Engineering, Procurement, and Construction (EPC). This division specializes in turnkey contracting and promotes the use of Polycab-made Extra High Voltage, Medium Voltage, and Low Voltage cables for power projects. In the revenue mix, Wires and Cables accounted for 84% of sales in FY25, followed by EPC (9%) and FMEG (7%).

The AI Catalyst: From Real Estate to Cloud

Polycab expects strong growth across all its business segments. The wires and cables business, Polycab’s core segment, is expected to grow at about 1.5x the industry rate. This growth is supported by government programs such as metro rail, smart cities, and power projects, as well as by the real estate and emerging sectors, such as data centers.

Polycab Ambitious Growth Plan

Data centers represent a growing opportunity for Polycab. The company states that the rapid adoption of artificial intelligence (AI) and cloud computing is driving significant growth in the data center market, with investments projected to reach US$49 billion (₹4.4 lakh crore) by 2030. And Polycab is actively supplying cables for data center projects.

Polycab products are essential to data center infrastructure, which requires extensive structured cabling and fire-resistant solutions. The company states that growth in digital infrastructure is driving continuous demand for fiber-optic cables, structured cabling systems, and high-speed data transmission solutions, all of which Polycab provides.

Capex supports multi-segment expansion

That said, Polycab also aims to grow the FMEG business at 1.5x to 2x the market rate by focusing on premiumization and channel expansion. It also aims to ramp up its export business, increasing its contribution to over 10% of the company’s top line by FY30. To support these ambitious goals, Polycab has pledged to invest ₹6,000-8,000 crore over the next five years.

In terms of financials, Polycab revenue in H1 of FY26 increased by 21% year-on-year to ₹12,383 crore, led by robust growth in the Wires and Cables business. Operating EBITDA increased by 55% to ₹1,878 crore, while margins expanded by 330 bps to 15.2. Consequently, PAT rose by 53% to ₹1,292.7 crore.

#3 Finolex Cables: New Capacity Targets Emerging Demand

Finolex, with 23.9% market share in the organised wire industry, is one of India’s leading manufacturers of electrical and telecommunication cables. It also has a significant presence in the FMEG segment. Within cables, it is a diversified manufacturer of a range of cables, including extra-high-voltage cables, optical fiber cables (OFC), coaxial cables, and data cables.

The Tech Edge: E-Beam & Solar Cables

The company inaugurated its e-beam facility in Urse, Maharashtra. This technology is used to manufacture solar cables, EV battery cables, and railway instrumentation cables. It also launched Finoultra e-beamed house wires, which have a lifespan of over 50 years, can withstand higher voltages, and offer enhanced safety.

Data centres drive multi-cable demand

Finolex states that the rapidly increasing number of data centers worldwide is a key driver of strong demand for various types of cables. This includes optical fiber cables for high-speed connectivity, data cables essential for network infrastructure, including coaxial cables, and power cables to support these energy-intensive data centers.

This multi-segment demand is expected to create strong synergies across Finolex’s diverse product portfolio, positioning the company as a key enabler of digital transformation. That said, Finolex engages in backward integration by producing compounds, copper rods, glass fibers, and other raw materials in-house.

This strategy ensures better control over raw material availability, pricing, quality, and manufacturing efficiency.

Backward integration supports margin expansion

To meet the growing demand from emerging sectors like data centers, a new preform facility for optical fibers is awaiting production trials. Once operational, this backward integration will make Finolex India’s second self-reliant OFC manufacturer.

This will reduce dependence on imports and improve margins. Capacity expansion is also underway to increase fiber drawing capacity from 4 million km to 6 million km annually.

From a financial perspective, driven by a strong cable business, revenue in the first half of FY26 increased by 9% year-on-year to ₹2,772 crore. The EBITDA margin expanded by 130 basis points to 15.8%. Profit after tax (PAT) grew by 21% to ₹326 crore.

What about Valuation?

Polycab is leading the industry with high return ratios, including Return on Capital Employed (RoCE) and Return on Equity (RoE). This is reflected in its premium valuation, which is in line with its median multiple but above the industry median.

RR Kabel, with decent return ratios, is also trading at a premium compared to the industry, but at a discount to the median multiple. Finolex, however, is trading close to the industry valuation but is at a discount to its own median multiple after the recent correction.

Valuation Assessment (X)

| Company | P/E | 5-Year Median | RoCE (%) | RoE (%) |

| RR Kabel | 40.2 | 52 (3 Year) | 19.8 | 15.2 |

| Polycab | 43.3 | 44.3 | 29.7 | 21.4 |

| Finolex | 19.8 | 24.7 | 16.2 | 12.4 |

| Industry P/E | 20.3 | 19.8 | 15.6 | |

In short, India’s data centre expansion is creating a long runway for wires and cables players embedded in digital infrastructure. RR Kabel, Polycab, and Finolex offer differentiated exposure through capacity expansion, scale, and integration. Beyond visible winners, these companies provide steadier, structurally aligned compounding opportunities.

Disclaimer:

Note: Throughout this article, we have relied on data from http://www.Screener.in and the company’s investor presentation. Only in cases where the data were not available have we used an alternate, widely used, and accepted source of information.

The purpose of this article is only to share interesting charts, data points, and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educational purposes only.

About the Author: Madhvendra has been deeply immersed in the equity markets for over seven years, combining his passion for investing with his expertise in financial writing. With a knack for simplifying complex concepts, he enjoys sharing his honest perspectives on startups, listed Indian companies, and macroeconomic trends.

A dedicated reader and storyteller, Madhvendra thrives on uncovering insights that inspire his audience to deepen their understanding of the financial world.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The articles’ content and data interpretation are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources, and only after consulting such independent advisors as may be necessary.