Housing demand in India, which is a key driver of allied sectors like paints, is showing signs of moderation. According to recent reports, both demand and price growth are expected to ease in FY26 as housing inventory levels rise and affordability pressures play out. This softer backdrop raises a critical question for investors: what does it mean for India’s leading paint companies?

Indian paint firms are not only consumer brands but also among the most widely held stocks among investors. Their relevance transcends walls and colours, and it is thus imperative to assess if these holdings are still worth holding in portfolios as demand for housing slows.

In this article, we are focusing on three paint companies where decorative paints lead the business, housing and renovation cycles have a direct impact on growth, and investor significance is the maximum.

Sector leaders and disruptors qualify, while companies like Kansai Nerolac (more industrial and automobile-centric), Shalimar Paints (not scaled up), and newer players like Indigo Paints or Birla Opus (still too early) are reserved. The end result is a clearer view of the companies that most fairly represent India’s housing-linked paints narrative to investors.

#1 Asian Paints

Asian Paints is India’s largest home decor paint company. The 80+yr old firm has prominent brands such as Asian Paints and Apco under its umbrella. The firm operates in the business of wall paints, wall coverings, waterproofing, texture paint, wall stickers, mechanized equipment, adhesives, modular kitchens, sanitaryware, lightings, soft furnishings, and uPVC windows.

Asian Paints is focusing its premium play with offerings such as All Protek, a Lotus Effect emulsion sold as walls that won’t stain, and Nilaya Arc, a super-luxury lime-based paint with 10-year guarantee. Although these products have beefed up its premium mix, the luxury segment has witnessed some pressure of down-trading in recent quarters.

Asian Paints’ business is backed by a huge 1.7 lakh dealer network as well as by a Net Promoter Score (NPS) of 70, indicating wide reach and customer loyalty. NPS is a benchmark that measures how likely customers are to recommend a brand to others.

In recent months, the company has been in the news for trying to ward of competition from new players like Birla Opus. How has that really impacted the performance of the company?

Let’s look at the longer term trend first.

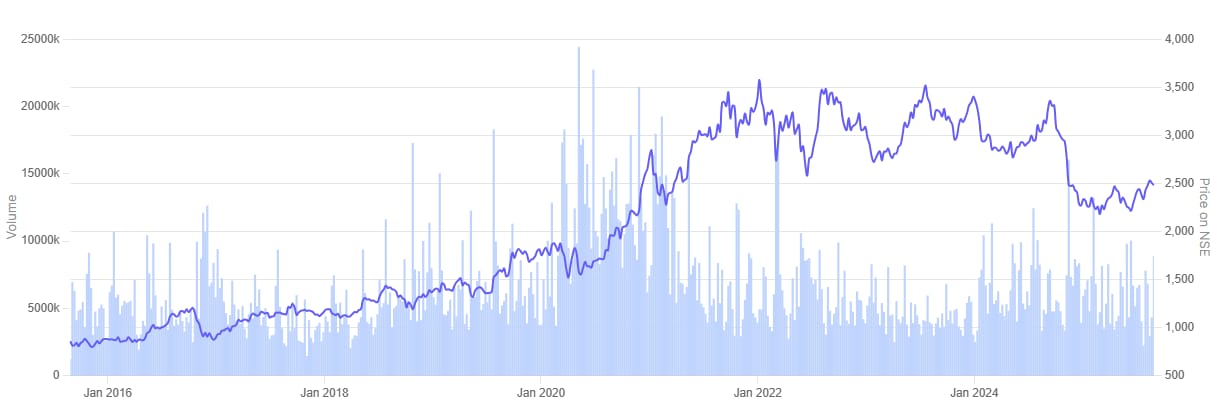

Asian Paints is a consistent compounder. Over the past 10 years, it has grown from Rs 838.8 to Rs 2,504.2, giving almost an absolute return of 199%; or a CAGR of 11%. Over 5 years however, this drops to just 5%. A lot of this has to do with the increasing competitive intensity in the sector.

Coming to fundamentals, revenue jumped significantly from Rs 12,220 crore in FY14 to Rs 33,906 crore in FY25. Again, over a 10-year period, sales growth has been 10% CAGR. But over 3 yrs this has moderated to just 5% CAGR. The numbers for net profit are only slightly better, with 10 year and 3 year CAGRs at 11% and 8% respectively.

The company’s Return on Capital Employed (ROCE) which hit 42% in FY15, has declined to 26% in FY25. In fact, there was a sharp dip YoY as well, with the ROCE declining from 38% in FY24 to just 26% in FY25.

Over the last 10 years, dividends have also scaled up from Rs 6.1 to Rs 24.8 per share, with FY25 maintaining a healthy 60% payout ratio. On this count the company has not disappointed.

Nor surprisingly, the company’s stock has been an underperformer over the last one year. The Asian Paints stock is down 20% over a year, as compared to Berger Paints (down 7.9%) and Akzo Nobel India (up 6.5%)

On the valuation front though, the company still trades at a premium. The current price to earnings (P/E) ratio of the stock at 62.4 is just about on par with its 10-year median of 61.1. The 1 yr industry median PE is 47x.

Asian Paints 10 Year Share Price Chart

As per Geojit BNP Paribas brokerage report, on forward estimates, Asian Paints is trading at approximately 54x FY26 earnings and 50x FY27, which are levels that are still pricey compared to peers. It shows the market still places premium on its leadership and earnings predictability, but without leaving much space for re-rating.

In the short term, Q1 FY26 volume growth was modest at 3.9%. Premium paints remained resilient, but luxury paints were impacted by soft discretionary spending.

Overall, however, sales have declined in 6 consecutive quarters. The operating margins too have seen a YOY decline from 19% to 18%.

The company’s management expects that the earnings before interest, tax, depreciation and amortisation (EBITDA) margins at Asian Paints will likely remain in the 18–20% zone. Geojit in its recent note pegs the stock at 55x FY27 EPS and has a HOLD recommendation with a target of Rs 2,777, suggesting limited near-term upside from current levels.

#2 Berger Paints India

Berger Paints India is into production and sale of paints. It is expanding in premium segments through offerings such as Roof Kool & Seal, Tank Kool, and WeatherCoat Anti Dustt Kool, which are for heat and dust resistance, and Easy Clean Silky Touch for high-end interiors. These are evidence of its emphasis on science-driven, higher-value products.

Its distribution too has spread fast. Berger now has more than 1,300 retail outlets (added 550 in FY25 and 300 in Q1 FY26), almost 59,000 touchpoints, and 57,000 colour bank machines, and thus one of the most distributed brands in India.

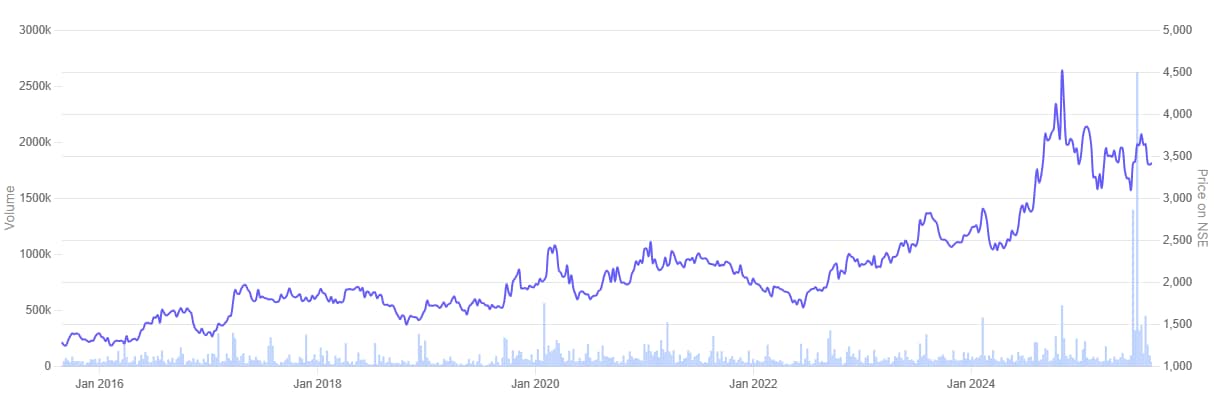

For shareholders too, this stock has been a good compounder—going up from Rs 200 in 2015 to Rs 527 in 2025, an absolute increase of around 163%. Over the last 10-years, the return has been 16% CAGR. However, the momentum has slowed in recent years, with just 3% CAGR over 5 years and even a slight negative CAGR of –1% over 3 years.

On the fundamentals side, the performance is steadier. Over the last 10 years, revenues grew 11% CAGR. Net profits rose at a CAGR of 16% over 10 years.

The company’s ROCE peaked at 31% in FY17 and has fluctuated since, standing at 25% in FY25 after touching a low of 24% in FY23.

Dividends have also increased consecutively from less than Rs 1 a share in FY15 to Rs 3.8 in FY25, showing regular cash returns to shareholders.

At a P/E of 53.1, Berger trades near its 10-year median of 62, indicating that it is still priced as a growth stock.

Berger Paints India 10 Year Share Price Chart

The performance of the company in recent times has been volatile.

During Q1 FY26, volume improved 5.6% whereas value growth trailed at 2%, indicating lower realisations. Exterior paints and luxury interiors were hit due to heavy rains, yet the margin remained stable at approximately 17.4% owing to cost management. Competition is fierce in the economy segment, although Berger is still picking up market share, currently standing at 21.2%, a jump from 18.9% three years ago.

Looking forward, management is expecting demand to pick up in the post-monsoon period with volumes coming at 7–9%. Geojit Paribas has estimated a 9–10% revenue compounded annual growth rate (CAGR) over FY25–27 and retains a HOLD view. It has a target of Rs 635, approximately 18.8% higher from Rs 534.4 on 25 August 2025.

#3 Akzo Nobel India

Incorporated in 1954, Akzo Noble India is engaged in manufacturing, trading, and selling of paints and allied products. It also offers research and development services to its holding company and other group companies.

The firm is in the news now for its planned merger with JSW Paints, a move that sets it up as a possible disruptor in India’s paint market. The merger brings together JSW’s vigorous expansion and distribution heft with Akzo’s high-end Dulux brand portfolio, forming a strong third force against Asian Paints and Berger.

Akzo Nobel India has established a leadership position in premium decorative paints with the Dulux brand. New launches such as Velvet Touch Eterna in the uber-luxury interior space and improvements to WeatherShield Protect reflect its drive to premiumisation, while other ventures such as Dulux experiential stores and the Maestro network of architects and designers are enhancing customer connection.

The stock has risen from Rs 1,236 in 2015 to Rs 3,396 in 2025, giving around 175% absolute returns. The 10-year CAGR stands at 10%. Interestingly, the near-term performance is stronger, with stock CAGR of 21% over 3 years, though the last one year has been relatively muted at 6%.

Its revenue for the last decade has risen to Rs 4,091 crore in FY25 from Rs 2,442 crore in FY15, translating into a 10-year CAGR of 5%. Over the last 5 and 3 years, sales growth has been better at 9% CAGR each. Its net profit on the other hand grew at a CAGR of 11% over 10 years, 13% over 5 years, and 14% over 3 years.

The company’s Return on Capital Employed (ROCE) improved significantly from 16% in FY14 to 42% in FY25, with sharp jumps in recent years. Sustaining ROCE above 40% over FY24 and FY25 reflects strong profitability and efficient use of capital, making Akzo Nobel one of the more capital-efficient players in the paints sector.

Dividends, too, have risen steeply, with FY25 payouts of Rs 100 per share, much above the single-digit levels of the early 2000s.

At a current P/E of 38.5, nearly its 10-year median of 35.1, valuations indicate the stock still trades at a quality premium but with no exuberances.

Akzo Nobel India 10-Year Share Price Chart

The recent performance of the company emphasizes its strength, with 3% revenue growth in FY25 over peers’ decline, led by pricing power and cost discipline, even as margins were dented by increasing discounts and marketing expenses.

Akzo is strategically also in the limelight due to its portfolio restructuring, including possible business transfers with its parent group.

Asit C Mehta, a broker, sees this as a potential harbinger of a merger or JV, which can make it a disruptor in the paints space. Nevertheless, the brokerage is cautious—placing a valuation of 33x on forward earnings and taking a conservative approach, assigning a SELL rating. It has set a target price of Rs 3,440 for the stock, which is close to the present market price as on 25 August 2025.

Conclusion

Even as India’s housing demand moderates, the paint sector continues to demonstrate resilience through premiumisation, innovation, and expanding distribution networks. Over the last decade, Asian Paints, Berger Paints, and Akzo Nobel have created substantial shareholder wealth, consistently scaled revenues and profits, and rewarded investors with growing dividends. Their widespread presence in homes and portfolios alike underscores their importance as more than just consumer brands.

Valuations now indicate these firms continue to command a premium for leadership and brand power, but the upside is limited by competitive pressure, discretionary demand pressure, and raw material price risk. Brokerage reports confirm the sentiment.

Meanwhile, the larger industry is undergoing change. According to a tweet by Rahul Mathur—a founder-turned-venture capitalist (VC)—the Rs 70,000 crore paints sector has contracted for the first time, with Asian Paints being legally challenged by Birla Opus, and the JSW–AkzoNobel deal coming in as a third robust competitor.

Birla Opus has already picked up more than 8% market share in less than two years, instigating aggressive pricing and distribution wars. Mathur adds that this competitive churn may keep the industry in transition until at least 2027, rendering paints a space, investors need to keep an eye on.

For investors, the message is to beware: paint stocks are still quality holdings but near-term payback could be limited. The industry’s long-term attraction still hinges on its premiumisation cycle and India’s structural housing and refurbishment demand, even if the current cycle is one that will require waiting rather than frenzied buying.

Disclaimer

Note: We have relied on data from www.Screener.in throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Ekta Sonecha Desai has a passion for writing and a deep interest in the equity markets. Combined with an analytical approach, she likes to dig deep into the world of companies, studying their performance, and uncovering insights that bring value to her readers.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.