They say that every revolution begins from the ground up. The transition to clean energy is demonstrating that quite literally. The batteries powering the future are being constructed on the backbone of what we extract beneath the earth’s surface.

Mining is where it all starts. Miners in effect dig up metals — lithium, nickel, cobalt, and graphite — that are the basis of each electric vehicle and energy-storage cell. Refining provides those raw ores with their true identity. It transforms dispersed mineral wealth into pure battery chemicals that manufacturers can finally utilize.

Together, mining and refining build the unseen foundation of the battery economy. Each lithium-ion cell, each cathode and anode, each gigafactory exists because of this chain. Without domestic capacity in the two, a nation’s battery dreams remain unfulfilled, regardless of how sophisticated its manufacturing arrangement may become.

India has depended for decades on imports for battery-grade materials. But that is changing at last. The government has made critical minerals a strategic focus. Exploration for lithium and nickel is speeding up. Private sector players are making investments in refining and processing units. And the quick takeup of EVs and renewable energy is driving demand ever higher with each successive year.

This momentum is building a new opportunity — one that is more than the battery manufacturers themselves. The firms that extract, process, and refine these critical materials may become the largest beneficiaries of India’s transition to green almost unnoticed.

These are five Indian mining and processing stocks that could surf the battery-chemical wave ahead.

#1 Vedanta

Vedanta is a diversified natural resource group engaged in exploring, extracting and processing minerals and oil & gas. The group engages in the exploration, production and sale of zinc, lead, silver, copper, aluminium, iron ore and oil & gas.

Vedanta is expanding its mining footprint to meet India’s increasing battery-chemical aspirations. As part of its Vedanta 2.0 strategy, the company has won two additional blocks of critical minerals, bringing its tally to ten, for nickel, cobalt, vanadium, manganese and rare earths. These assets position Vedanta at the upstream end of India’s critical minerals drive to cut import dependence.

For this growth, the Vedanta group has hiked its total capital investment proposal to US $11 billion, of which US $5.9 billion has already been invested. A significant portion is focused on Hindustan Zinc, whose board has approved the first phase of enlargement to increase production towards two million tonnes, supported by a US $1.4 billion investment.

Coming to aluminium, Vedanta clocked record alumina production at Lanjigarh and is scheduled to commission Train II during the current fiscal. The new Sijimali bauxite mine, scheduled to commence by end-FY26, will contribute 1–1.5 million tonnes of captive ore, while coal from Kuraloi will enhance fuel security for refining operations.

Outside of India, the group is developing a US $2 billion copper smelter and refinery project in Saudi Arabia, with land and EPC partners having already been decided.

With years of experience in the mines, Vedanta is now reaching out into metals that are needed for electric vehicles and energy storage. The opportunity is huge, but it will rest on stable commodity prices, swift clearances, and timely project completion.

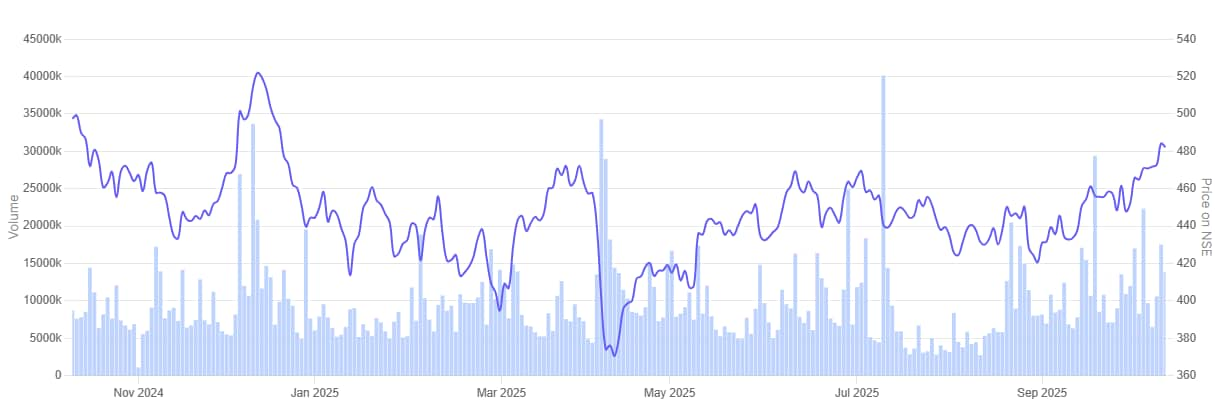

In the past one year Vedanta share price is down 3.4%.

Vedanta 1 Year Share Price Chart

#2 Hindalco Industries

Incorporated in 1958, Hindalco Industries is a flagship company of the Aditya Birla Group. The company and its subsidiaries are primarily engaged in the production of Aluminium and Copper. It is also engaged in the manufacturing of aluminium sheet, extrusion and light gauge products for use in packaging markets like beverage and food, can and foil products, etc.

Hindalco Industries is increasing its upstream businesses to better position itself in battery material and energy-transition business. The company posted industry-high aluminium upstream EBITDA per tonne during Q1 FY26, aided by a record alumina production and reduced input costs. Strategic projects such as the Aditya Alumina Refinery, Aditya Aluminium Smelter, and copper recycling and smelter expansions are moving according to plan.

Hindalco also purchased U.S.-based AluChem for US $ 125 million to gain access to high-purity alumina technologies utilized in specialty and battery applications. The acquisition is a part of a strategy to double its specialty-alumina portfolio in the next three to four years. Captive coal mines—Chakla, Bandha and Meenakshi—are expected to initiate phased production from FY27, aiming at up to 20 million tonnes annually once operational at full capacity.

The project to recycle copper by Hindalco, expected in FY27, will contribute 50 kt a year initially, rising to 200 kt to negate poor smelting margins.

Though Hindalco’s integrated model and long mining track record provide a competitive advantage, success rests on clearances, timely project execution, and fluctuating global prices.

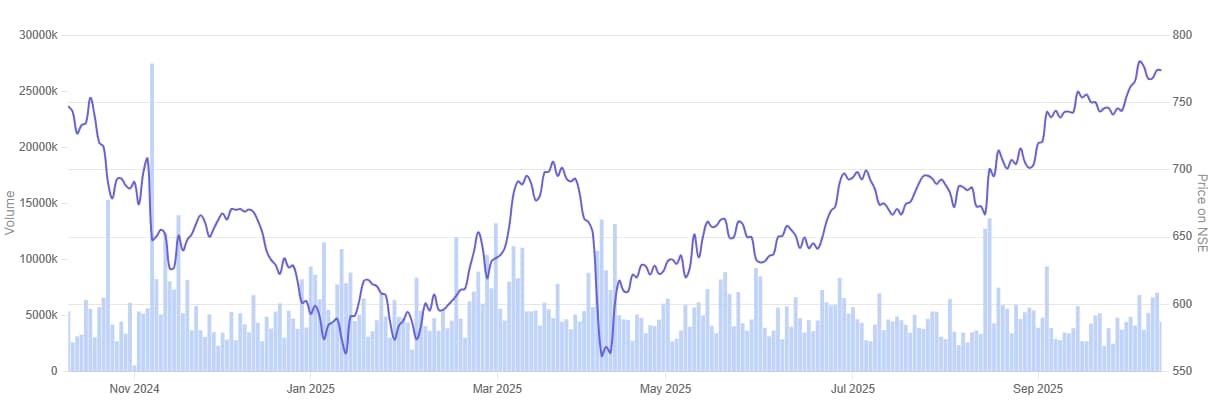

In the past one year Hindalco Industries share price is up 3.1%.

Hindalco Industries 1 Year Share Price Chart

#3 Adani Enterprises

Adani Enterprises has business interests in various economic areas such as mining, integrated resources management (IRM), infrastructure such as airports, roads, rail/ metro, water, data centres, solar manufacturing, agro and defence.

Adani Enterprises, a part of the Adani Group is coming to a critical juncture as it nears commercial production at its Kutch Copper refinery project that reinforces India’s leadership in the battery-metal and clean-energy supply chain. The refinery, which has been commissioned this year, should be commencing its impact in financial numbers towards the closing of this year and contributing substantially in the first quarter of the following year.

Copper is a fundamental metal for electric-vehicle wiring, battery charging and charging infrastructure connectors. Full-scale operations will see AEL expand into tubes and cables produced from refined copper in conjunction with industry partners through joint ventures.

In mining, the firm saw a 30 % increase in dispatch volumes of its mine-developer-operator business to 12.1 million tonnes, which pushed EBITDA up to Rs 484 crore. The Australia-based Carmichael mine saw steady shipments of around 2.3 million tonnes.

Management stated that fluctuating commodity prices continue to pose a near-term threat, but AEL’s integrated business model—from mining, to logistics and metals refining—leaves it well-positioned to take advantage of long-term growth in battery and electrification demand.

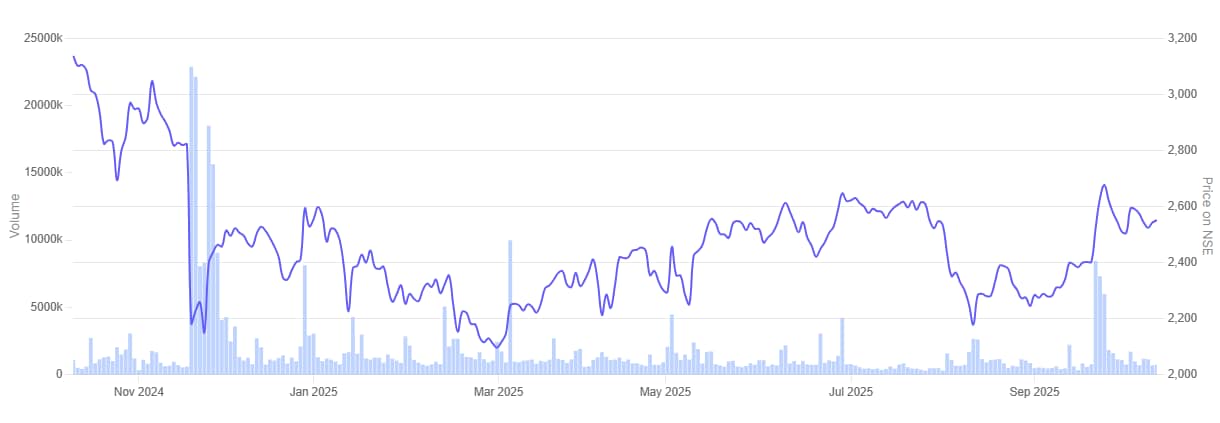

In the past one year Adani Enterprises share price tumbled 19%.

Adani Enterprises 1 Year Share Price Chart

#4 Hindustan Copper

Incorporated in the year 1967, Hindustan Copper was formed to take over from National Mineral Development Corporation. It is the first Indian PSU and only vertically integrated copper producing company. HCL is engaged in various processes right from copper mining to the final stage of converting copper into saleable products.

Hindustan Copper is expanding its mining business to meet growing demand for metals used in batteries and clean-energy infrastructure. The company plans to increase ore production to 12 million tonnes by FY31, driven by capacity growth in Rajasthan, Madhya Pradesh and Jharkhand. Rakha and Kendadih mine clearances have been obtained, and both mines are expected to resume production in the near future.

Copper is at the core of the battery-chemical supply chain, energizing EV wiring, charging infrastructure and grid transmission. For securing supply, HCL is joining hands with JSW-owned South West Mining under a 30-year revenue-sharing agreement to develop Rakha mine (investment of Rs 2,700 crore). Internationally, through Khanij Bidesh (KABIL), the company has finalized exploration in five lithium blocks in Argentina as a precursor to future battery-metal integration.

Management indicated that progress would be based on clearances, equipment availability and even commodity prices that are stable, but government priority on critical minerals is likely to speed up timelines.

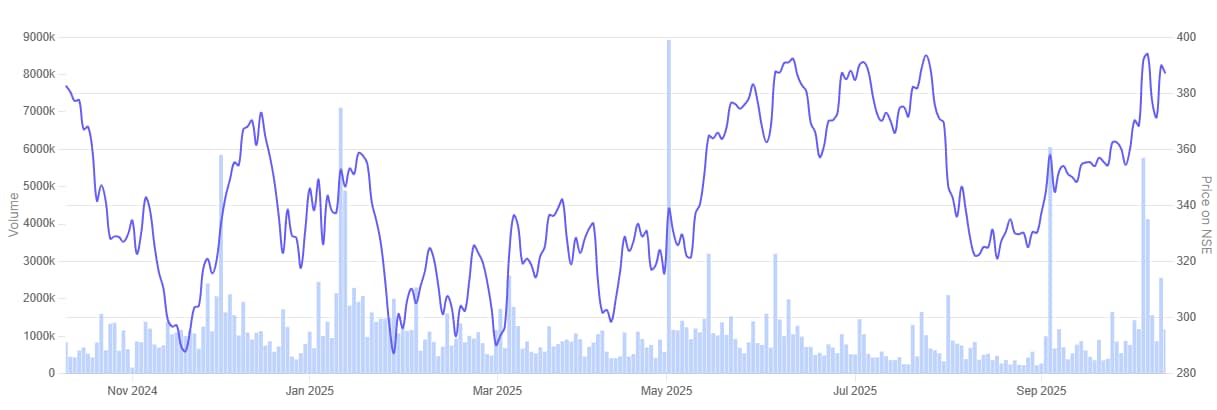

In the past one year Hindustan Copper share price is up 8.9%.

Hindustan Copper 1 Year Share Price Chart

#5 MOIL

MOIL is primarily engaged in mining of manganese ore and is the largest manganese ore producer in the country. It is a miniratna state-owned company owned by the government of India.

MOIL, India’s top manganese ore producer, is scaling up capacity and R&D to keep pace with increasing demand for battery-grade manganese in cathodes for electric vehicles and energy storage systems. The company recorded its all-time high production of 1.8 million tonnes in FY25 and is targeting an increase in capacity to 3.5 million tonnes by 2030 through new shafts, clearances, and joint ventures.

Ecological sanctions for Sitapatore and Kandri blocks will contribute 1.9 lakh tpa, while deep-shaft ventures at Balaghat, Gumgaon, and Dongri Buzurg will unlock deeper-level minerals. In Madhya Pradesh and Gujarat, MOIL is concluding joint ventures with GMDC and MPSMCL to develop more than 1,300 sq km of prospective reserves, in addition to considering overseas asset acquisition.

The group’s Electrolytic Manganese Dioxide (EMD) unit—India’s sole one—achieved 1,350 tonnes production in FY25 notwithstanding muted world battery demand. Research and Development partnerships with CSIR-CIMFR, IIT-BHU, and VNIT are centered on beneficiation, trace-element research, and recovery of rare-earth and battery-metal streams.

Management warned that implementation is dependent on clearances, import of equipment, and commodity prices despite its debt-free balance sheet favouring expansion.

In the past one year MOIL share price is up 0.9%.

MOIL 1 Year Share Price Chart

Valuations

Let’s now take a look at the valuations of these mining and refining companies using the Enterprise Value to EBITDA metric.

Valuations of Mining and Refining Companies

| Sr No | Company | EV/EBITDA | 10-year EV/EBITDA | ROCE |

| 1 | Vedanta | 5.8 | 4.6 | 25.3% |

| 2 | Hindalco | 6.4 | 7.1 | 14.8% |

| 3 | Adani Enterprise | 23.7 | 20.8 | 9.4% |

| 4 | Hindustan Cooper | 39.6 | 24.1 | 23.8% |

| 5 | MOIL | 14.0 | 4.4 | 18.8% |

Unlike cyclical peaks of the past, most of these stocks are now trading above their 10-year average multiples, reflecting the market’s renewed focus on battery-linked metals and energy-transition materials. Vedanta and Hindalco, with EV/EBITDA ratios of 5.8 and 6.4, trade moderately above their long-term averages, supported by strong operating cash flows and healthy ROCEs of 25.3% and 14.8% respectively.

MOIL’s multiple of 14.0, against a 10-year average of just 4.4, highlights how investors are pricing in its growing exposure to battery-grade manganese. Hindustan Copper shows the sharpest rerating — an EV/EBITDA of 39.6 versus 24.1 — as expectations rise around domestic copper demand and its role in India’s critical-minerals chain.

Adani Enterprises, at 23.7 times, continues to command a premium owing to its new copper-refining vertical and integrated resource model.

Overall, the sector’s rerating suggests optimism around long-term demand from the battery and electrification ecosystem, but investors may need to weigh how much of this growth is already factored into current valuations.

Conclusion

India’s battery-chemical story is still being written, and mining and refining are its first chapters. The companies that are fuelling this change do not merely dig into the dirt to pull out ores, they are changing the way India approaches to building out the pillars of its ambitions for clean energy.

Policy support, accelerating EV adoption, and a burgeoning global interest in critical minerals have created a rare moment of alignment in opportunity. But opportunity for investors must be dealt with in overall perspective as valuations are already elevated.

Investors have to think about the fundamentals – operating efficiencies, leverage, and capitalizing on capex into returns – beyond the visibility of electric vehicle expansion plans or new projects (to use the term broadly).

In a sector driven by both geology and global trends, prudence and patience may prove as valuable as the minerals themselves.

Disclaimer:

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Ekta Sonecha Desai has a passion for writing and a deep interest in the equity markets. Combined with an analytical approach, she likes to deep deep into the world of companies, studying their performance, and uncovering insights that bring value to her readers.